Beef market update: stable market despite bumper January imports

Friday, 22 March 2024

Key points

- Sharp increase in Irish beef import volumes recorded in January, against competitive Irish beef and robust domestic demand.

- The marketplace appeared to remain stable despite this, with farmgate prices on an upward trajectory through January

- UK beef exports remained robust, with particular growth in shipments to non-EU destinations.

- Price differentials of GB and Irish cattle remain historically wide, the influence of this on import levels will be a key watchpoint.

Beef imports saw a sharp increase in January

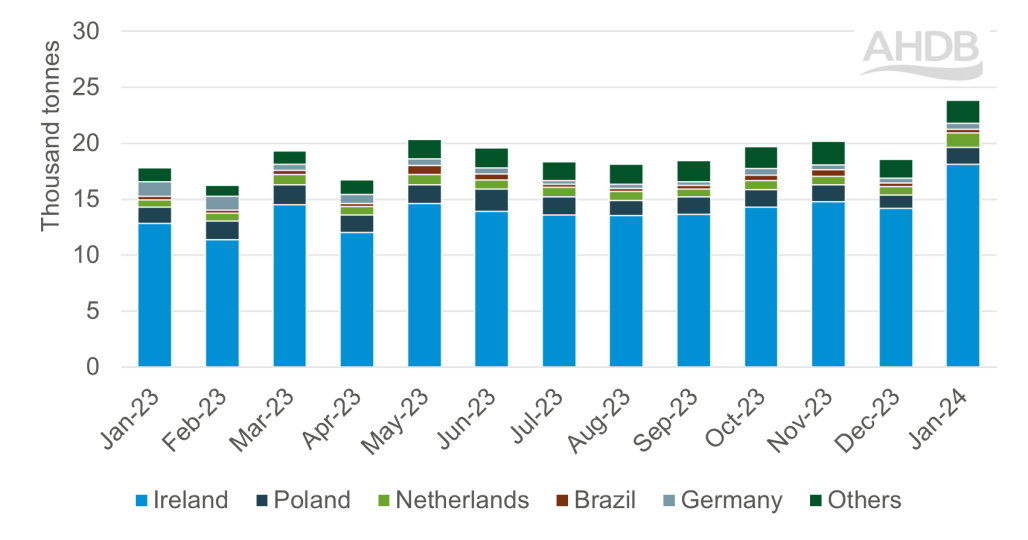

During the first month of 2024, the UK imported 23,900 tonnes (product weight) of fresh and frozen beef. This was 29% (5,300 tonnes) more than was imported during December and 34% (6,000 tonnes) more compared to January 2023.

This is the highest level of beef imports for the month of January in at least the last decade.

UK import volumes of fresh & frozen beef by supplier

Source: HMRC, compiled by Trade Data Monitor LLC

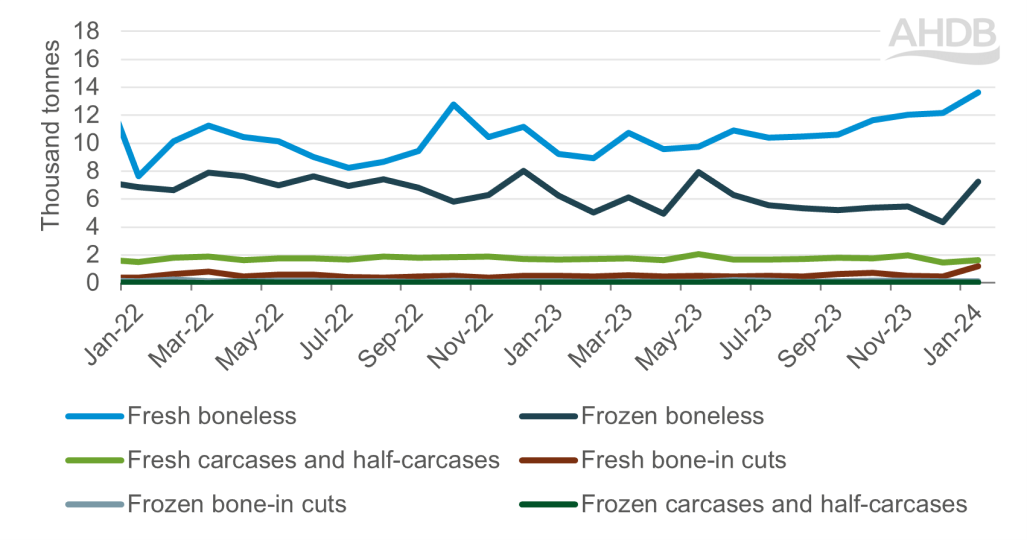

Growth in imports both on the month and the year were driven by Irish product. Versus December, the uplift was driven by a steep increase in frozen boneless product (Dutch and Polish volumes also grew but to a lesser extent). Fresh boneless Irish beef also saw a notable increase, continuing the trend seen throughout 2023. Fresh bone-in beef ticked up significantly but from a lower base, also driven by Irish.

When comparing to January 2023, the quantity of fresh boneless beef imported was significantly higher.

Monthly UK fresh and frozen beef import volumes by product

Source: HMRC, compiled by Trade Data Monitor LLC

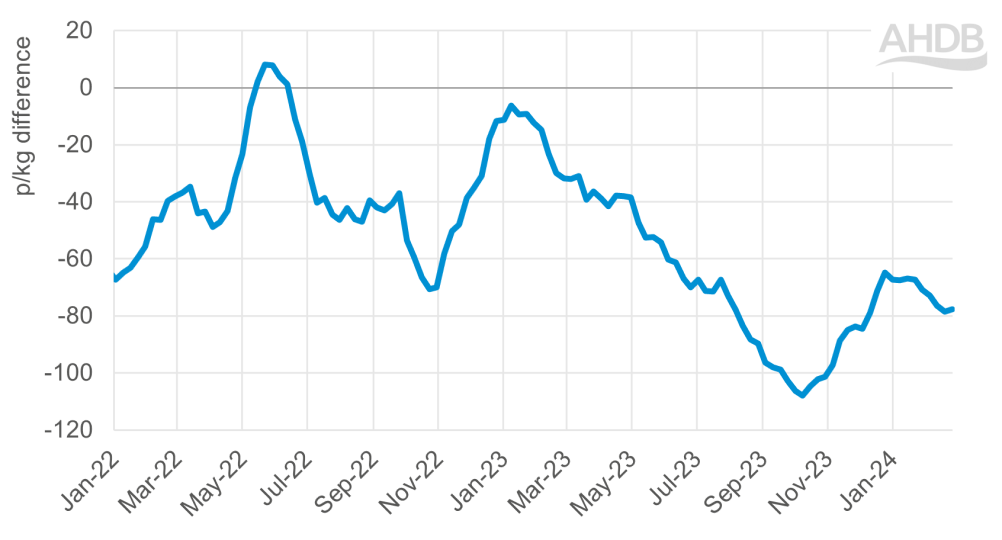

The price difference between GB and Irish cattle remains historically wide. The R3 steer differential peaked in October but import levels did not see much movement at the time. The price gap narrowed into January but remained notably large: Irish steers averaged around 60p lower than GB equivalents during the month. Since January, the price gap has begun to widen again.

Difference between GB and Irish average R3 steer price

Source: European Commission, AHDB

Despite the growth in imports during January, the GB marketplace appeared to remain stable. GB farmgate cattle prices continued an upwards trajectory, as weekly kill rates remained fairly stable and close to 2023 levels. Indeed, a culmination of strong demand from the key events of Christmas and Valentines Day have no doubt added strength to the market.

Elsewhere in the import market, Australian product remained a small proportion of total import volumes (0.9%), with 214 tonnes shipped in during January. This was considerably more than was imported in January 2023, but down notably from a peak of 344 tonnes in September.

Exports firm to non-EU destinations

The UK exported 8,900 tonnes of fresh and frozen beef during January, up 9% from December and up 5% year-on-year. Shipments to the EU increased against December, but remained slightly below January 2023 volumes, at 7,600 tonnes. Monthly growth was driven mostly by shipments to the Netherlands. Meanwhile, while a small proportion of total trade, exports to non-EU destinations performed strongly, with notable growth in shipments to Canada, Japan, the US and the Philippines.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.