Beef market update: How much beef does the UK import from South America?

Friday, 27 June 2025

As strong global demand for beef persists, we look at the production forecast for key regions in South America and their role in exports to serve the global market.

Key points

- Strong exports from Brazil are set to continue throughout 2025, as they look to fulfil firm global demand for beef

- Challenges with profitability and long-term herd declines have weighed on Argentina’s production forecast for 2025, also limiting their ability to export

- China and the USA remain the key markets for South American beef exports, taking the majority of export product volumes

- UK beef imports from South America continue to make up a small proportion of total imports, with products varying by supplier

What is the production forecast in key beef-producing South American countries?

Brazil

As the world’s largest exporter of beef, Brazil is a key player on the global beef market.

Strong demand for product globally coupled with a devalued Brazilian real means that Brazil is well placed to fulfil this global demand, with exports forecast to be very high again as we move through 2025.

Forecasts for Brazilian beef output for the year ahead are more mixed. However, the consensus seems to be that production peaked in 2024, with future declines expected.

Some forecasts suggest that Brazil will enter the retention phase of their cattle cycle in the latter half of 2025, leading to a year on year easing of total production volume. However, robust market signals and poor pasture conditions domestically appear to be delaying retention currently.

Nevertheless, it is expected that exports will grow again in 2025, driven by strong global demand delivering high value, with any reductions in production likely affecting availability for the domestic market in Brazil.

Argentina

Total cattle slaughter in Argentina is forecast to be down by 4% in 2025, according to the USDA. This is expected to lead to a 3% year on year drop in production to 3.1 million tonnes.

Consistent export demand and dry conditions in the second half of 2024 increased slaughter beyond expectations, reducing supplies for 2025.

This, coupled with challenges with profitability and longer-term herd declines, have contributed to the forecasted contractions for 2025.

Uruguay

Beef production in Uruguay is forecast at 595,000 tonnes in 2025, flat on the year previous. The USDA expect that this will lead to exports at a similar level to 2024, with the US and China remaining the two largest customers.

Where are the key export markets for South American beef?

As the two largest global importers of beef, it is not surprising that China and the USA are the key customers for all South American beef exports.

For the year to date (Jan-Apr), Brazil has exported 875,000 tonnes of beef (incl. fresh/frozen, processed and offal), with 44% of this destined for China and a further 15% to the USA.

Exports have grown strongly to nearly all destinations (particularly the USA), reflecting the strong global demand for beef and Brazil’s ability to supply this.

If we look at Argentina, Jan-Apr exports totalled 217,600 tonnes, with 60% of this product allocated to China, their largest market by a significant margin.

While the volumes sent to China have fallen on the year, for this period, we have seen significant increases in product destined for the US.

Uruguay has also increased exports to the USA significantly in the year to date, totalling 48,000 tonnes. Volumes to China have also fallen on the same period of last year.

How much beef does the UK import from South America?

Looking at UK imports of South American beef, both the volumes and product mixes vary by supplier country.

Brazil

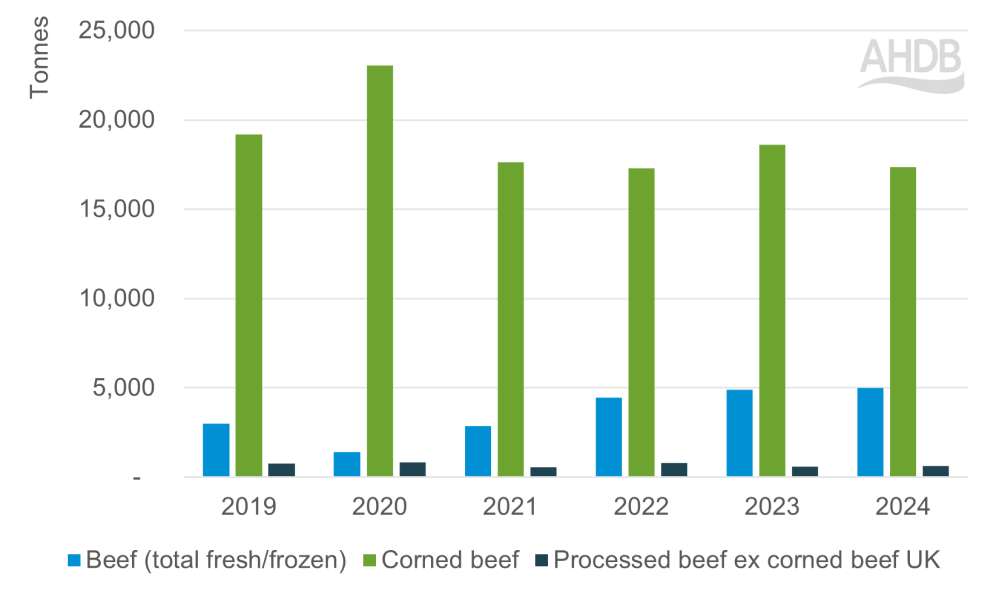

The vast majority of UK beef import volumes from Brazil are corned beef, totalling 17,400 tonnes in 2024.

In 2024, we imported almost 5,000 tonnes of fresh/frozen beef from Brazil, accounting for only 2% of the UK’s total fresh/frozen beef imports, despite being our fifth largest supplier.

UK beef imports from Brazil by product

Source: HMRC via Trade Data Monitor LLC

For the year to date (Jan-April) beef imports from Brazil totalled 6,000 tonnes. Whilst the majority of this remains corned beef, we have seen a marked increase in frozen beef, up 240% on the same period of last year.

However, this only accounts for a volume of 1,500 tonnes imported in that four-month period.

Uruguay

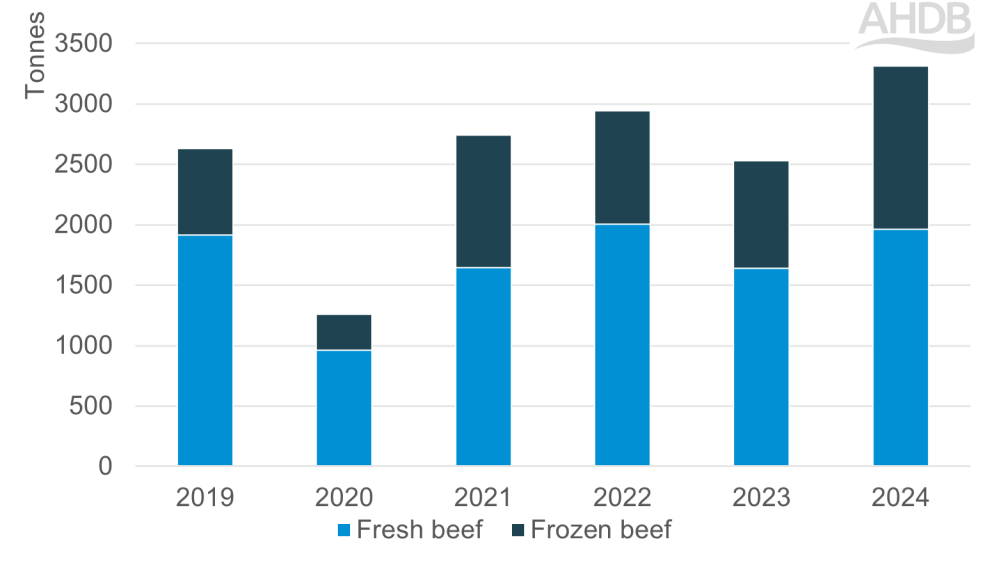

In contrast, the only beef imported into the UK from Uruguay is fresh and frozen, with almost three quarters of volumes made up of fresh product.

Total volumes increased year on year in 2024, to total 15,000 tonnes of product for the full year.

UK imports of beef from Uruguay by product

Source: HMRC via Trade Data Monitor LLC

Looking into 2025, for the year to date (Jan-Apr), we have seen volumes ease back 30% on the year to sit at only 750 tonnes. Three quarters of this product was fresh beef, with the remainder frozen.

Argentina

The UK imports a small amount of beef from Argentina.

In 2024 this totalled 924 tonnes, the vast majority of which was fresh beef. For 2025 to date (Jan-Apr) import volumes were back 7% on the same period of the year previous, likely limited by lower production for the year so far and less competitive prices on the global market.

Conclusion

South America continues to be one of the largest suppliers to the global beef market.

Tightness in supply and firm demand across the Northern Hemisphere is emphasizing the region’s importance as a crucial exporter.

Focus continues to be on the largest import markets, China and the USA, with relatively small volumes moving into the UK.

Moving forward, it will be important to monitor changing trading relationships and flows and their potential impacts on these dynamics in the global beef market.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.