Beef market outlook: production forecast update May-25

Friday, 30 May 2025

Key points

- The UK prime cattle slaughter forecast for 2025 has been revised upwards to 2.03 million head (-4% year-on-year). This partly reflects revisions to cattle inventory data from Northern Ireland, but also higher-than-forecast kill through the first quarter of the year

- Cow slaughter has been largely in line with forecasts through the first quarter. The UK cow kill forecast for 2025 remains largely unchanged at 607,000 head (-2.5% versus 2024), on lower supply

- Total beef production for 2025 is forecast at 897,000 tonnes, 4% lower than 2024

- The UK cow population stood at 3.14 million head on 1 December 2024, 1.5% smaller than the year before. Further contraction in the national suckler herd outweighed expansion in the dairy herd. This continues to point to long-term reductions in domestic prime cattle supply.

Overview

Beef markets have certainly experienced a dynamic start to 2025. A combination of constrained supply and sustained consumer demand have driven cattle prices to historic highs, with values well above previous years. More widely, global beef markets have generally held firm, supported by a combination of tight supply in the northern hemisphere (namely the US) and subsequent strong exports from large suppliers below the equator.

Cattle populations

Northern Ireland cattle data revisions

Please note that DAERA (Northern Irish Department of Agriculture, Environment and Rural Affairs) revised the Northern Irish cattle population figures for 1 December 2023 upwards following an error. This meant the addition of an extra 83K cattle (including cows) at that point in time. This adjusts the forecasts and changes year-on-year comparisons. Annual comparisons must therefore be made with caution. The below forecasts have been updated with the revised figures.

Breeding herd

According to Defra figures (factoring in Northern Irish revisions), the UK cow population stood at just under 3.14 million head at 1 December 2024, 48K head (-1.5%) smaller than the year before. While the overall herd was smaller, differing trends were noted between the suckler and dairy herd.

The national suckler herd contracted by 66K head (-5%) on the year. Meanwhile, the dairy herd showed slight expansion, up 17K head (1%) and ahead of forecast. More granular data has shown expansion in the Northern Irish dairy herd, which has added to a stable herd in Great Britain.

Forward cattle supply

The same census figures showed an annual reduction in the number of cattle aged 0–1 and 1– 2 years old, while there was an increase in the number of non-breeding cattle aged 2 years and over. However, there were more cattle alive aged 1 year+ on 1 December than we had previously forecast.

Cattle slaughter and beef production forecasts

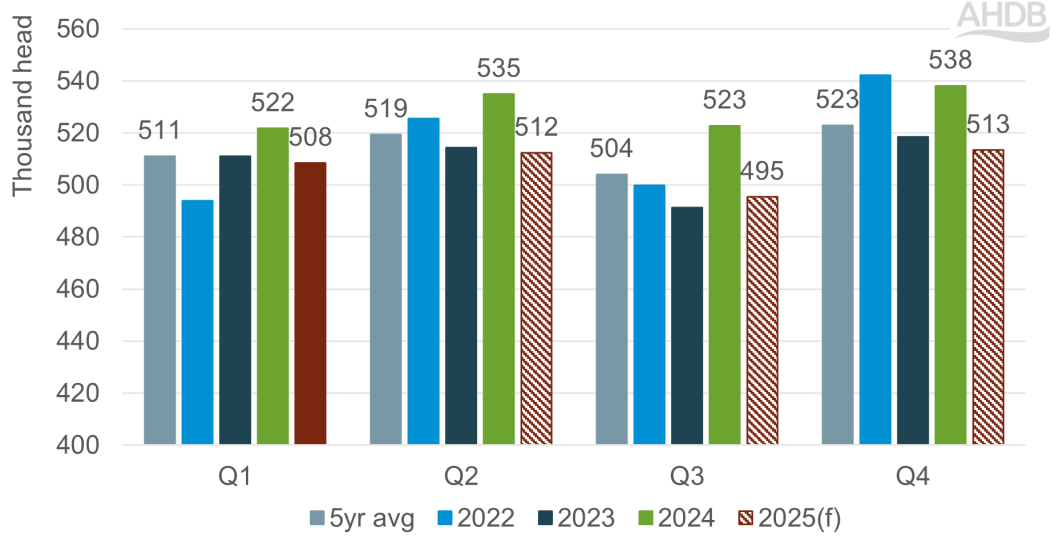

UK production data for the first quarter of the year showed a higher rate of prime cattle slaughter than forecast, with throughput for the quarter totalling 508,000 head. However, numbers were 3% lower compared to the same period a year ago. Cow slaughter for the quarter was in line with forecasts at 150,000 head, 4% lower year-on-year.

Looking forward, factoring together cattle inventory data with year-to-date slaughter had led to a revised 2025 prime cattle forecast of 2.03 million head, down 4% versus 2024. Cow slaughter has been revised marginally downwards to 607,000 head (-2.5% year-on-year).

Actual and forecast quarterly UK prime cattle slaughter

Source: Defra, AHDB forecasts in hashed bars

Average prime cattle carcase weights have been largely in line with expectations. Combining this with slaughter rates has led to a revised 2025 beef production forecast of 897,000 tonnes (-4% versus 2024).

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.