Australian wheat export could be at a high level: Grain market daily

Wednesday, 20 November 2024

Market commentary

- UK feed wheat futures (Nov-24) ended yesterday’s session at £179.50/t, slightly down £0.05/t from Monday’s close. The May-25 contract also down £0.05/t over the same period, to close at £192.40/t.

- Domestic wheat futures closed mixed yesterday. Global wheat futures prices fluctuated between support from unpredictable geopolitical risks and pressure from more favourable weather for the winter crop. As of 17 November, 49% of US winter wheat crop 2025 was rated in good or excellent condition, the highest rating in five years. In Ukraine, the wheat area for the 2025 crop could reach 5 million hectares, up 8.7% from 4.6 million hectares in 2024.

- The May-25 Paris rapeseed futures contract closed at €533.00/t yesterday, down €2.75/t from Monday’s close.

- European rapeseed prices followed falling Winnipeg canola and Chicago soyabean futures. Winnipeg canola futures (Jan-25) were down 2.84% during yesterday’s trading session. However, Paris rapeseed futures are showing some resilience due to the high import demand in the EU (+16 % compared to the same data last year). The largest exporters of rapeseed to the EU in this season are Ukraine and Australia.

Australian wheat export could be at a high level

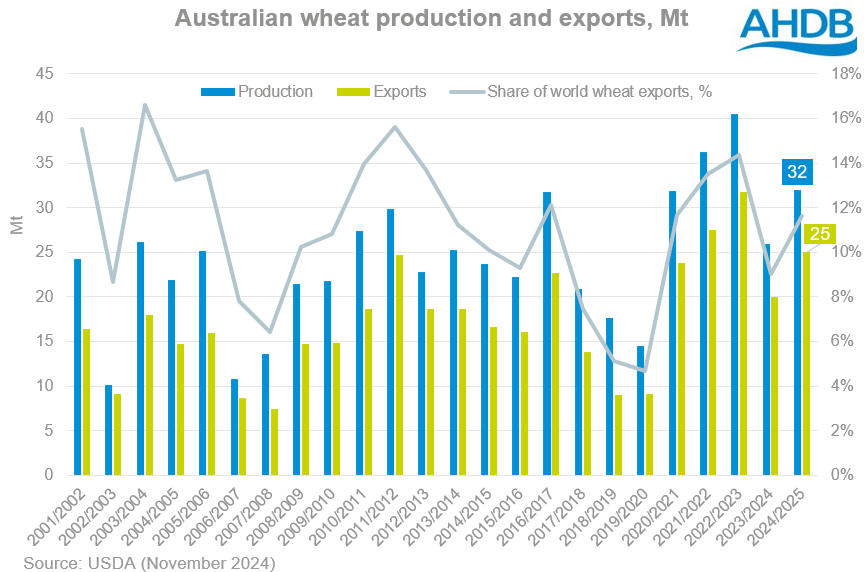

The Australian wheat harvest campaign is underway, and the export supplies will soon be arriving on the market. Australia harvests wheat from October to February, depending on the region. Last marketing year Australia produced 25.9 Mt of wheat and an average of 29.8 Mt a year over the last five years. The USDA’s latest November forecast for Australian wheat production is 32 Mt (exports 25 Mt) for the 2024/25 season, which is significantly higher than last year. The most optimistic figures to show that Australian wheat production in the 2024/25 season could be more than 34 Mt.

More wheat production could mean more Australian exports. According to the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), the top wheat export destinations in the 2023/24 season, were China, Indonesia, the Philippines, Vietnam, the Republic of Korea, Yemen and Japan. Competition among major exporters to sell wheat in these countries is increasing.

The main driver for higher wheat production in Australia in the current marketing year is higher yields due to favourable weather during the season. What about the quality of the higher yielding wheat? Its too early to make any conclusions as the harvest campaign is in progress, but in a scenario where protein content is lower prices for high protein wheat (above 13 %) will be supported, but under pressure for 11-12 % protein.

Looking ahead

Wheat exports from Australia will be a very important influence on the world grain market in the coming months. For exports, competition for higher protein quality will intensify between the US, the Black Sea region, Kazakhstan and Australia.

Additional supplies of high protein wheat from Australia and a firm maize market will put pressure on the price spread between milling wheat and feed grains. On 14 November, for example, the difference between Paris milling and maize futures Mar-25 was €12.5/t one of the lowest levels since July 2024.

The global trend is reflected in the UK domestic market. Milling wheat premiums continue to ease, despite the Cereal Quality Survey confirming lower protein in the current marketing year.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.