August 2023 dairy market review

Thursday, 14 September 2023

Milk production

GB milk deliveries continued to see growth year-on-year through August, with estimated volumes for the month up 0.8% on the previous year at 997 million litres.

Grass growth rates have been exceptional for the time of year due to an unseasonably and consistently wet July and August, following the dry June. Despite falling milk prices, high levels of forage availability have kept milk production at high levels, particularly when compared to the drought seen in the summer of 2022.

Agricultural deflation on fuel, feed and fertiliser may have continued, but many input costs remain at high levels and generalised inflation on many other smaller inputs remains problematic. The increased cost of borrowing is especially difficult for many farms. Ongoing declines in milk prices are impacting on farmers' decision making, with little appetite to push yields beyond current levels.

Overall herd size has remained stable. Dairy calf registrations have remained fairly steady according to BCMS data. In the second quarter of 2023 (April–June), calf registrations to dairy dams were recorded at 304,823 head, according to the latest BCMS data.

This is a reduction of 0.2% (646 head) compared with the same period last year and is the lowest figure for Q2 in a decade. Compared with the five-year average, registration numbers in the second quarter are down by 1.5% (4,558 head). This marginal decline predominantly reflects the continued trend towards block calving. In the year to date (January–June), births to dairy dams totalled 707,981 head, almost on par (an increase of 0.01%) with the same period in the previous year.

Global milk production in June flattened off, increasing by only 0.1% year-on-year, averaging 782 million litres per day. Only minimal growth in production was seen across US, EU and Australia with modest declines from New Zealand and Argentina, year-on-year.

The global forecast is now estimated to continue in the same vein with annual growth of only 0.1% expected, revised downwards from earlier expectations of 0.2% growth. Falling prices and difficult weather conditions across many regions could suppress performance in the second half of the year; this is reflected in final estimates.

The US (0.8%), UK (0.3%) and New Zealand (2.0%) are estimated to register some growth. Despite growth of EU milk deliveries in spring, predictions indicate a drop off in the second half of the year; this is due to increased slaughtering driven by falling milk prices and high input costs, with a predicted reduction of -0.2%. Both Australia and Argentina estimate falls in milk production of 3.0%.

Lower growth in production globally may not be enough to support prices given the expected continued decline in global demand.

Wholesale markets

Overall price movements on UK wholesale markets continued on a downwards trajectory in August. UK dairy wholesale markets continued to run quiet in August as the summer holiday season rumbled on. Cream prices moved down by £21/t, SMP fell by £50/t, butter fell by £110/t with mild cheddar falling the most by £140/t.

Prices on global dairy wholesale markets faltered in July with the exception of butter in the US. EU milk supplies have increased with cooler temperatures and rain. Too much rain has been recorded in parts of Oceania, inhibiting grazing utilisation. Demand is still reported as being weak with lackluster demand from China, one of the major global buyers of dairy products. High stocks of whole milk powder (WMP), higher international prices and government support for domestic self-sufficiency impacted Chinese dairy imports in 2022. The trend has continued in 2023, with lower imports recorded in the first half of the year compared to the previous year. Demand for dairy has declined amidst a heat wave across the country and a slowdown in economic growth. There is a strong correlation between China’s economic growth and dairy imports. In the first half of the year (January–June), China’s total imports of dairy products stood at 1.39 Mt, a decrease of 15.2% year-on-year.

EU product prices were anywhere from 12% to 41% lower year on year.

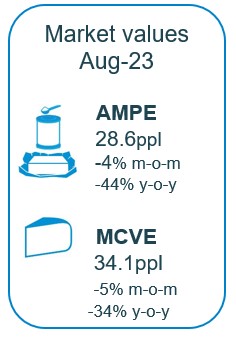

As of August, milk market values (which is a general estimate on market returns and the current market value of milk based on UK wholesale price movements) continued to nudge down: in the UK are now 18ppl lower than a year earlier, with AMPE and MCVE down by 44% and 34% respectively.

Farmgate milk prices

The latest published farmgate price was for July, with a UK average of 36.1ppl. Since then however, market-related farmgate prices have continued to decline in response to the reduced market returns and higher milk availability. The most change to milk prices for the month came from aligned liquid contracts. Tesco and Waitrose held their prices for the month while other retailers made further declines. M&S made the largest announcement of the month, dropping their price by -1.41ppl. Non-aligned liquid contracts were steadier. Cheese contracts followed the same trend as those seen in liquid contracts. The majority of processors on the AHDB league table made no changes to their prices in September.

Product availability and trade

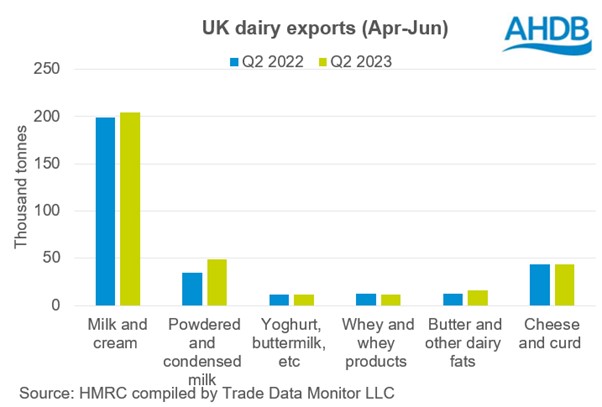

As domestic returns wane, traders turn to exports to gain more value. Export volumes of dairy products from the UK have increased in the second quarter of 2023 year-on-year. Total export volume for Q2 2023 was 336,000 t, an increase of 22,300 t from Q2 2022. The level of EU exports increased by 10,900 t while that to non-EU destinations increased by 11,400 t.

Powdered and condensed milk products saw the largest year-on-year increase, up by 14,400 t (42.0%). This was driven by exports to both EU and non-EU nations. Exports of butter and other dairy fats increased by 27% to 16,400 t. Milk and cream and cheese and curd exports noticed a marginal increase of 2.6% and 0.2% respectively during the period. Whey and whey products and yoghurt bucked the trend recording lower exports of 11,700 t (-6.3%) and 11,400 t (-0.5%) respectively.

In the export basket, EU nations still constitute nearly 90% of total exports.

At the same time dairy imports declined by 14.2%.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.