Arable Market Report – 29 January 2024

Monday, 29 January 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Short term, continued competition with Black Sea grain pressures European markets, though maize concerns could limit the extent. Early forecasts show potential for tighter global wheat stocks in 2024/25, which could support wheat prices relative to maize longer-term.

Maize

Concern over growing conditions in Brazil offers some short-term support to maize. However, improved weather conditions in Argentina offers an improved supply outlook for the continent overall.

Barley

Barley will continue to follow the direction of the wider grains market, though domestically, the price relationship to wheat is key to animal feed demand. Longer-term, new season barley supply prospects will be key to the price relationship to the grain market.

Global grain markets

Global grain futures

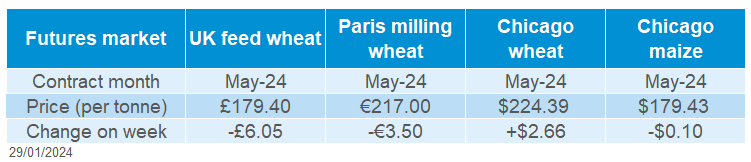

Last week, there was a moderate disconnect between US and European markets. While Chicago wheat reported small gains on the week (Friday to Friday) supported by short covering, both UK and Paris wheat markets were down. European markets have been pressured by intense competition from the Black Sea region, only partly offset as the euro continued to weaken against the US dollar.

Conflict in the Red Sea has increased the competition for grain sales in North Africa and Europe. Access to the Asian markets, which usually import Russian and Ukrainian grain, has been compromised, bolstering Black Sea supplies and weighing on European grain markets. Furthermore, Ukraine’s export capabilities have been improved since the country established an alternate Black Sea corridor. Since 01 July 2023 to 19 January 2024, EU soft wheat exports are down 7.6% from this period last season at 17.4 Mt, while barley exports report a modest 0.4% increase at 3.3 Mt.

Argentina, a major exporter of wheat, is now able to export wheat to China following approval from Chinese custom authorities. This could further increase current competition for French wheat as China has been a key export destination in recent years.

Recent rains in east and south Australia have improved the crop production outlook, which had been pressured by hot and dry conditions caused by the El Niño weather event. Wheat production could reach 30 Mt according to some forecasters, 20 - 25% above latest official estimate (LSEG).

Uncertainty persists over Brazil’s second corn crop due to prior adverse weather due to the El Niño weather event, with planting underway. Meanwhile, Argentina’s corn production has benefitted from improved rains this season as production is forecasted to reach 56.5 Mt, up 1.5 Mt from the previous estimate and up 66% from last year (Buenos Aires Grain Exchange).

UK focus

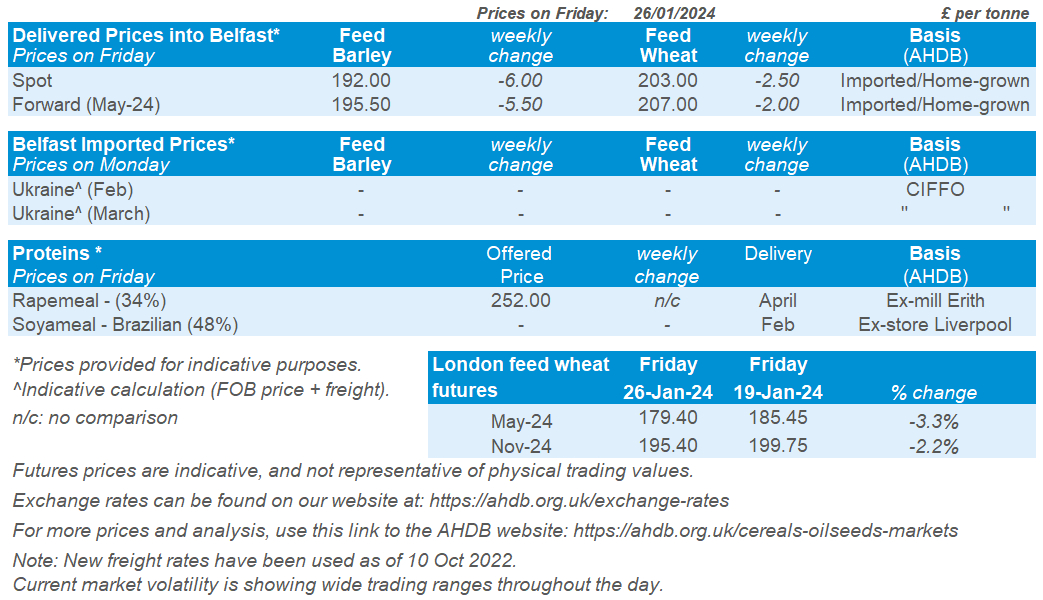

Delivered cereals

UK feed wheat futures’ bearish direction continues as the May-24 contract lost £6.05/t over the week (Friday – Friday), closing at £179.40/t. The Nov-24 contract was down £4.35/t over the same period, to close at £195.40/t on Friday. With a stronger pound against the euro, a build-up of domestic supply, and continued pressure on the continent, both contracts reported losses every day last week.

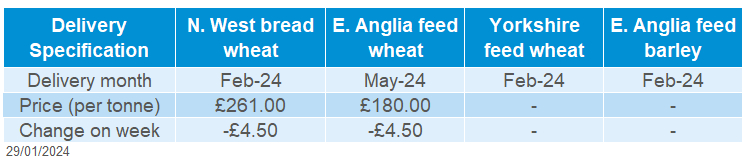

Delivered prices followed futures down last week (Thursday to Thursday). Feed wheat delivered into East Anglia for May delivery was quoted at £180.00/t, down £4.50/t on the week. Bread wheat delivered into the North West for February delivery was quoted at £261.00/t on Thursday, down £4.50/t across the week. For May-24 delivery, North West bread wheat is priced at a £83.00/t premium over May-24 UK feed wheat futures.

AHDB’s latest UK cereal supply and demand balance sheet was published last week. Reduced availability of wheat, combined with increased domestic consumption leads to a tighter wheat balance year-on-year at 2,827 Kt. However, minimal exports and concerns over next season’s crop lead to the heaviest wheat ending stocks since 2015/16.

In partnership with The Andersons Centre, AHDB has published an updated report regarding ‘The Characteristics of Top Performing Farms in the UK’. The report includes case study analysis, which offers a perspective of two farms of varying performance, delving into the importance of focused spending.

Oilseeds

Rapeseed

Short-term, price movement focuses on EU export demand, as well as following movement in the wider oilseeds market. Expected reductions in EU rapeseed plantings for 2024/25 supports the longer-term outlook.

Soyabeans

Short-term, focus is on South American production as well as US export demand, though more rain is needed for South American supplies to be as expected. Longer-term, it’s likely that Brazilian supplies will weigh on the global market.

Global oilseed markets

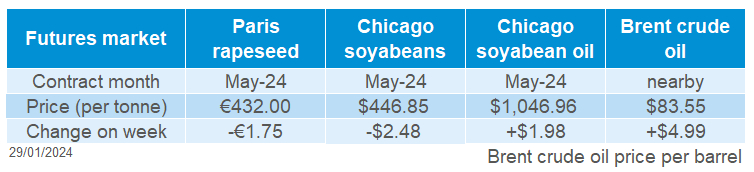

Global oilseed futures

Chicago soyabean futures were pressured last week (Friday-Friday), as the May-24 contract fell $2.48/t, to close on Friday at $446.85/t. The Nov-24 contract ended Friday’s session at $435.37/t, down $2.30/t across the week. Much of this pressure came as the Brazilian harvest progresses and Brazilian soyabeans start to come to the market, contributing to weak US export demand. Rains in South America are also supporting firm estimates of soyabean supplies.

In the week ending 18 January, the USDA reported export sales of 593 Kt of US soyabeans, below the range of trade estimates of 700 Kt to 1.2 Mt. Abundant supplies from South America combined with lacklustre global demand is to blame for weak US exports. A shrinking pig herd in China, the world’s top importer, is contributing to weak demand. At the end of 2023, China’s pig herd had fallen 4.1% from a year earlier (LSEG).

Any concerns over South American supplies were suppressed last week after more rains across key producing regions in Brazil and Argentina, with more rain forecast in Brazil over the next seven days too. Last week the Buenos Aires Grain Exchange increased their soyabean production estimate, with Argentina’s crop now expected to reach 52.2 Mt. This is up 1% from the previous estimate, though it was made clear that more rain would be needed to reach this estimate.

There was some support in Malaysian palm oil markets last week, with ongoing concerns over production and more unsettled weather forecast in Indonesia (the top producer of palm). However, with weaker rival oils, specifically crude oil, palm becomes less attractive for biodiesel and prices have been pressured so far today. This is something to watch over the next week.

Rapeseed focus

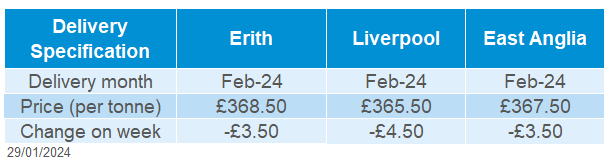

UK delivered oilseed prices

Despite some weakening of the euro against the US dollar last week, and some support filtering through from Malaysian palm oil markets, Paris rapeseed futures were pressured overall last week with soyabeans.

Old crop (May-24) futures ended the week at €432.00/t, down €1.75/t from the previous Friday. The Nov-24 contract saw greater losses, down €4.50/t on the week, ending Friday’s session at €429.00/t.

Domestic delivered prices followed futures movement last week. Rapeseed delivered into Erith for February delivery was quoted at £368.50/t on Friday, down £3.50/t on the week.

The euro weakened slightly against the US dollar last week, down 0.1% Friday to Friday, driven by uncertainty surrounding European monetary policy. On Friday in particular, the euro ended the session down 0.2%, supporting Paris rapeseed futures with improved competitiveness on global markets.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.