Focused expenditure is key for optimal performance: Grain market daily

Wednesday, 24 January 2024

Market commentary

- UK feed wheat futures (May-24) closed at £183.30/t yesterday, down £1.05/t from Monday’s close, extending the contract’s all-time low. While new crop futures (Nov-24) lost £0.95/t over the same period to close at £198.30/t yesterday, a 14-week low.

- As the EU looks to extend the liberalised trade agreement with Ukraine to June 2025, Ukraine’s grain exports to the EU continues to weigh on prices on the continent, spilling over to UK feed wheat futures.

- Paris rapeseed futures (May-24) closed at €437.50/t yesterday, up €6.00/t from Monday’s close. The new crop futures contract (Nov-24) closed at €435.25/t yesterday, up €3.50/t over the same period.

- Gains in Malaysian palm oil futures due to production concerns and continued Chinese demand buoyed the vegetable oils market. Additionally, increased freight rates due to tension in the Middle East have lifted sunflower oil prices which are no longer at a discount to crude soyabean oil or crude palm oil, supporting the vegetable oils complex.

- The euro weakening has helped to support Paris milling wheat and rapeseed futures, however the sustained strengthening of sterling applied further pressure for UK feed wheat futures.

Focused expenditure is key for optimal performance

The importance of cost management is one of the key take-aways from ‘The Characteristics of Top Performing Cereals and Oilseeds Farms in the UK’ report, in particular ensuring that expenditure is focused on achieving optimum margin and output.

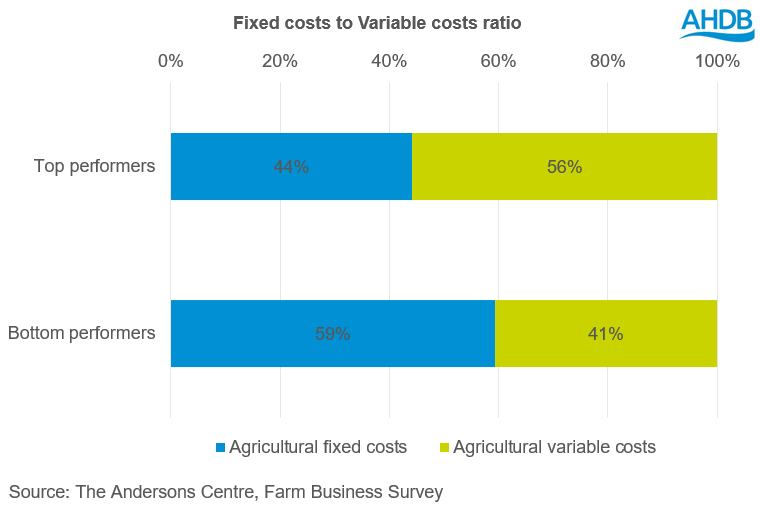

As margins are inherently tight within a commodity business, top performers carefully manage and optimise costs in order to maximise profit from turnover, striving to improve their business efficiency. The report highlights that total costs are much lower per hectare for top performing farms, which seems obvious. But an important distinction was that high performers spend more on variable costs that directly impact yield and turnover and less on overheads. Poorer performing businesses have been found to spend more than one-third extra on overheads for every £1 spent.

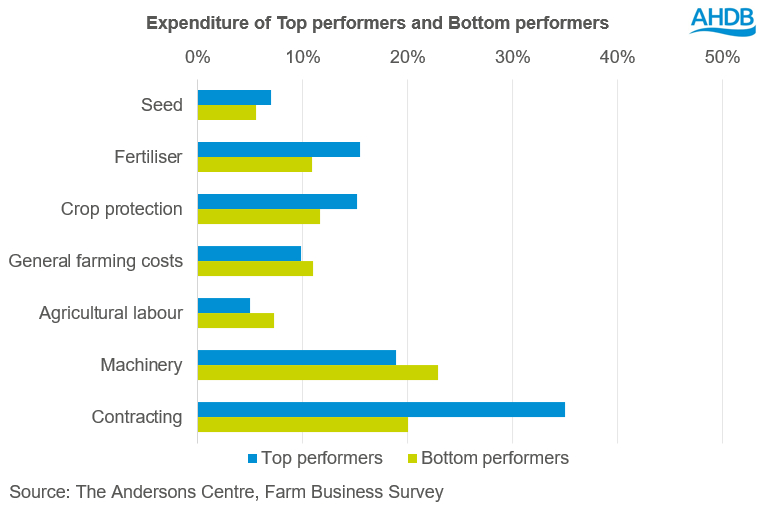

The report showed that spending on variable costs that improve the output per hectare and output per £ spent, such as seed, fertiliser, crop protection, and contracting was significantly higher for top performers. Additionally, the report highlighted that top performing farms have lower fixed costs, notably for power and machinery. This demonstrates that although shrewd expenditure is key, spending more in targeted areas of the farm business makes good financial sense should the forecasted return be greater than the expenditure. For example, contracting is a significantly greater expense for top performers but there are several tangible and intangible gains that can result in greater efficiency for the business overall, such as reduced depreciation costs or access to better machinery for the task at hand.

As emphasised in the report, higher performing farms have lower overheads and this was the same conclusion for the previous report in 2018. Although overheads are necessary for a farm to operate, fixed costs can rise quickly, so careful and watchful management is of the utmost importance. While there is no silver bullet, the report suggests improving farm business performance through marginal gains. Make a list of 50 ways to trim costs which once actioned will collectively improve the farm business notably.

Find out more about characteristics of top-performing farms 2024

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.