UK wheat stocks to rise despite smaller crop: Analyst Insight

Thursday, 25 January 2024

Market commentary

- May-24 UK feed wheat futures closed at £183.00/t, £0.30/t lower than Wednesday’s close. The Nov-24 contract was almost unchanged (down £0.05/t) at £198.25/t. Stronger sterling against the US dollar and continued worries in the European market about competition from Black Sea wheat, offset a rise in Chicago wheat and maize futures.

- Chicago wheat and maize futures rose due to short covering by speculative traders and a weaker dollar as the market focused on South American maize crops. Planting of the Brazilian Safrinha maize crop is underway, and higher-than-usual temperatures are forecast for Argentina, which is currently forecast to harvest a bumper crop.

- Russian wheat production in 2024 could reach 92.2 Mt according to SovEcon, up 0.9Mt from its December forecast and now only 0.6 Mt below the 2023 harvest.

- Paris rapeseed futures lost some of Wednesday’s gains yesterday, partly as the euro lifted against the US dollar. The May-24 contract closed at €433.50/t, a drop of €4.00/t on the day while Nov-24 prices lost €5.25/t to close at €430.00/t. The oilseeds markets also focused on South American soyabean output with the Brazilian harvest underway.

UK wheat stocks to rise despite smaller crop

AHDB released updated estimates of UK cereal supply and demand this morning, including the first estimates of 2023/24 exports and end of season stocks for wheat and barley.

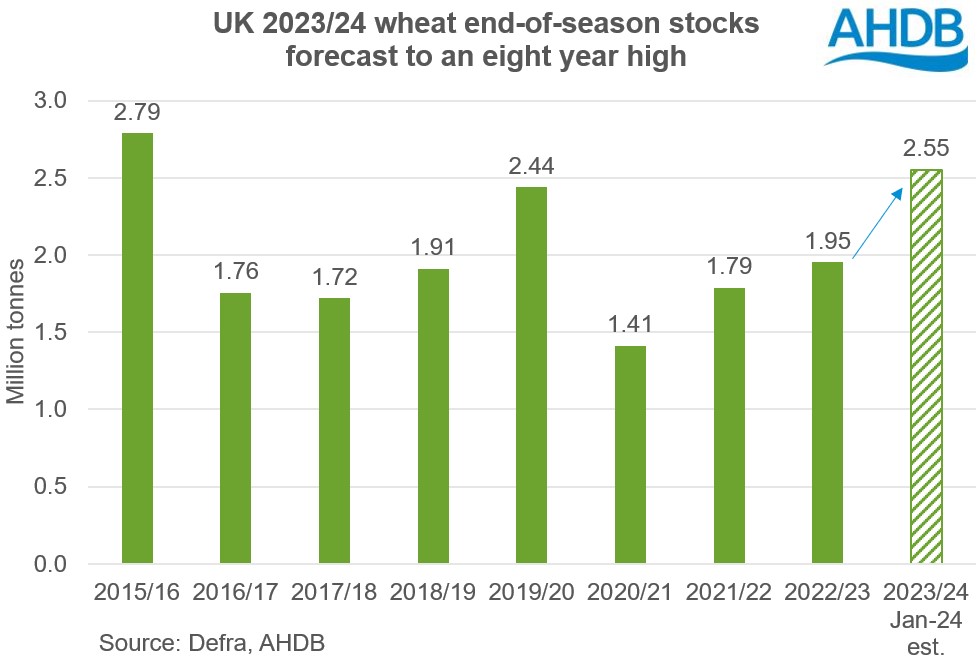

For wheat, a lack of export competitiveness means the UK is looking at the unusual situation of larger end of season stocks, despite a smaller crop. UK wheat end of season stocks are estimated at 2.552 Mt, up from 1.953 Mt at the end of 2022/23.

The smaller 2023 crop does indeed lead to a tighter availability in 2023/24 than last season (2022/23). That said, total wheat availability is not as tight as estimated in November, due to wheat imports increasing. Wheat imports are now pegged at 1.725 Mt in 2023/24, up 300 Kt from November’s estimate.

The majority of imports this season are expected to be high protein milling wheat due to the lack of high-quality wheat available domestically. Doubts over the 2024 crop following the wet autumn are also a factor.

Due to concerns over the size of the 2024 crop, prices for harvest 2024 rose relative to global markets. This also pulled up prices for the 2023 crop relative to global markets, taking UK wheat prices above export market levels. For example, at one point earlier this month, May-24 UK feed wheat futures (2023 crop) even rose above May-24 Paris milling wheat futures. These kinds of price relationships could have made imported grain look attractive for old season delivery too.

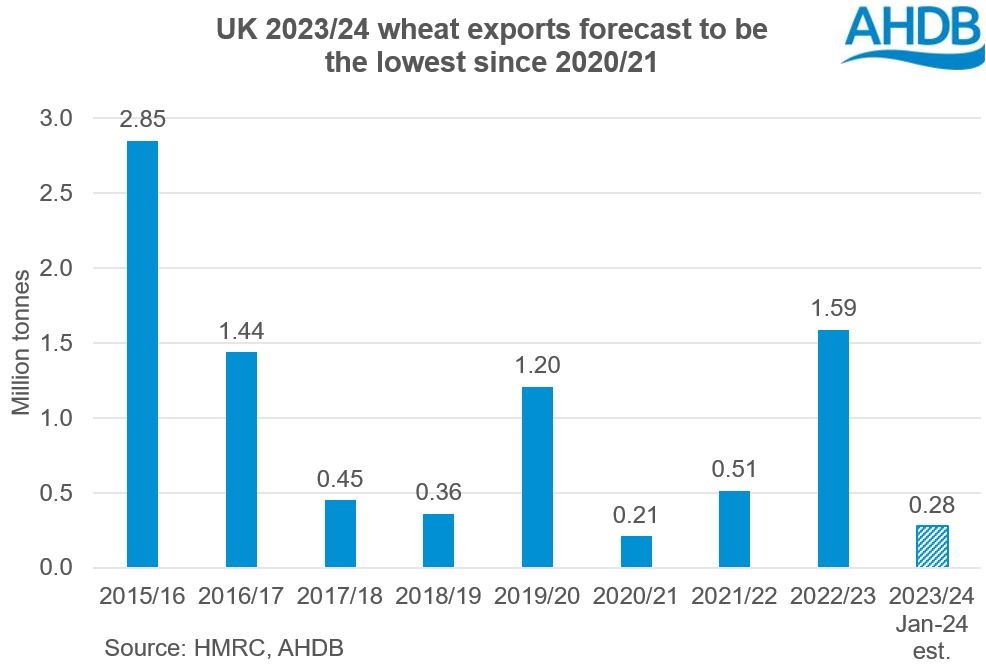

While old crop prices have softened in the past couple of weeks, they remain relatively high compared to European levels. Yesterday, nearby UK feed wheat futures were at an £8.66/t discount to nearby Paris milling wheat futures. However, this is still a far smaller discount than the almost £30/t discount recorded at this point a year ago. Last season the UK exported 1.59 Mt.

The current pricing relationship to European (and global markets) severely limits UK wheat export potential this season. So far this season (Jul – Nov), the UK has exported just 127 Kt of wheat, 71% less than the same period in 2022/23. AHDB forecast 2023/24 exports at just 275 Kt, the lowest since 2020/21 (209 Kt). Limited exports mean carry-out stocks are forecast to rise year-on-year.

Domestic usage of wheat is forecast to rise year-on-year, though by less than previously predicted. This is because of lower-than-forecast actual data in recent months, plus some caution for the remainder of the season surrounding current lower ethanol prices.

This supply picture is being reflected in prices, with May-24 UK feed wheat futures softening more than other origins over recent weeks. The growing price gap between old and new season prices gives incentive to carry wheat into the new season.

Read the full UK supply and demand forecasts here, including updated forecasts for barley, oats and maize.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.