Will the pressure on wheat stop? Grain market daily

Friday, 26 January 2024

Market commentary

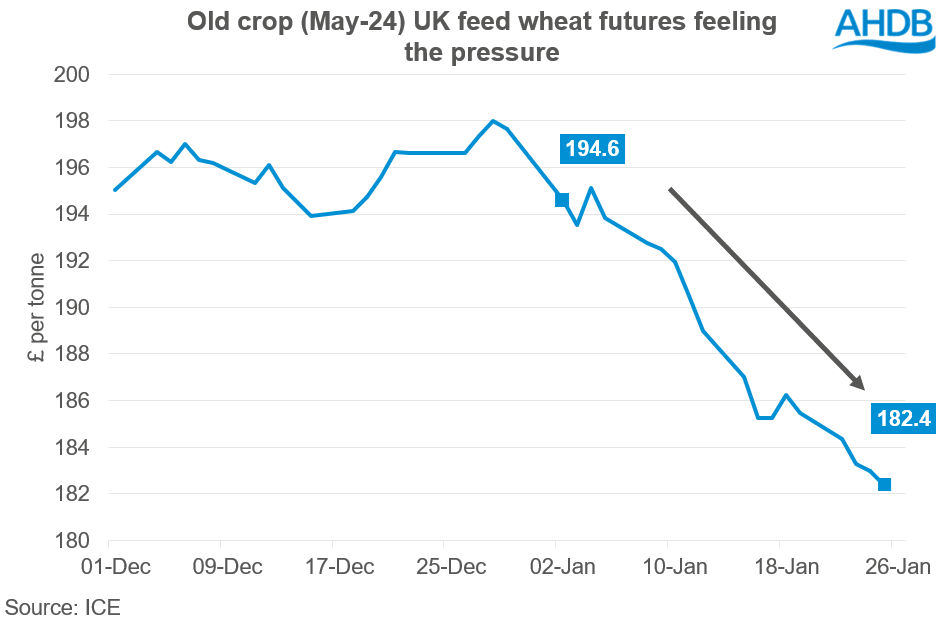

- UK feed wheat futures (May-24) closed yesterday at a new contract low of £182.40/t, down £0.60/t on Wednesday’s close. New crop futures (Nov-24) closed at £198.05, down £0.20/t over the same period.

- The domestic market fell yesterday despite gains in Paris wheat futures due to sterling strengthening against the euro. Trading closed yesterday at £1 = €1.1712 (LSEG). The Paris market slightly gained as the euro weakened against the US dollar, but gains were capped due to the need to maintain export competitiveness.

- Paris rapeseed futures (May-24) closed yesterday at €428.75 /t, down €4.75/t on Wednesday’s close. Rapeseed markets followed the pressure in Chicago soyabeans, which were pressured by weak export demand given strong competition from the Brazilian crop as it starts to come to market.

Will the pressure on wheat stop?

The month of January has seen significant pressure for global grain markets, with both wheat and maize prices tumbling down. So far, in January, UK feed wheat futures (May-24) have dropped 6.3%, closing yesterday at £182.40 /t – a new contract low. Even today the contract is trading even lower, around £180.00/t as at 13:00, as sterling is trading stronger against both the euro and US dollar.

There is an array of things that have been pressuring the global grain markets. These include very competitive Black Sea grain supplies, fairly benign global weather and a strong euro against the US dollar, which was dampening EU export competitiveness until recently. Over the last two weeks, the euro has weakened 1.1% against the US dollar, closing yesterday at €1 = $1.0846 (LSEG). A weaker euro will help EU competitiveness on the global export market, which in turn could lend some support to European grain prices.

What now for markets?

The latest USDA World Agricultural Supply and Demand Estimates confirmed a bearish sentiment for maize markets. The report showed that global maize stocks at the end of this season (2023/24) are expected to reach a six-year high of 325.2 Mt. Between now and harvest-24, the main market driver is going to be the second (Safrinha) maize crop from Brazil.

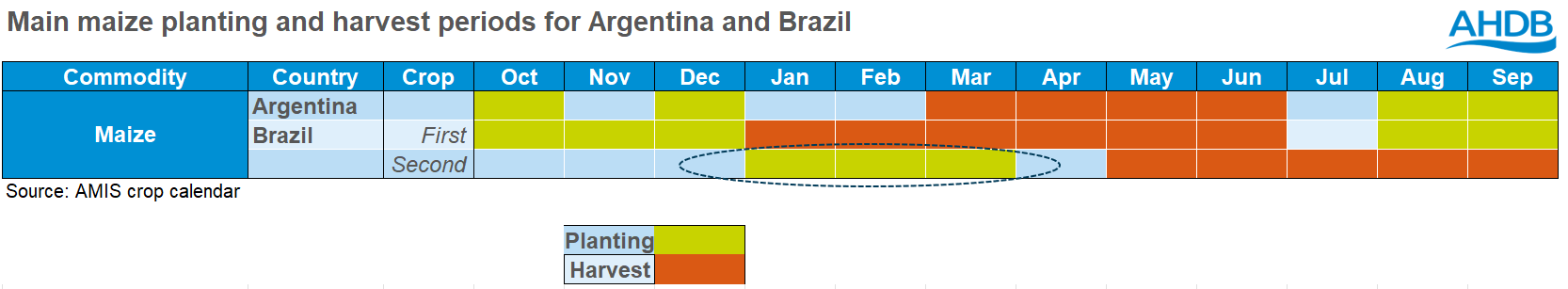

As the soyabean harvest progresses in Brazil, the second maize crop will be planted between January and March. As at 20 January, 5.0% of the crop was planted – up from 0.9% at the same point last year. The faster progression reflects the early start to the soyabean harvest from the hot weather in recent months. This maize crop is currently forecast to be 91.2 Mt – the second highest ever (Conab).

Global markets are relying on this maize to plug the supply gap between now and the autumn of 2024. Issues with this crop could relieve the downward pressure on wheat. But, if this crop goes into the ground without any weather issues, high global maize supplies could continue to bring pressure on global wheat markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.