Arable Market Report − 29 August 2023

Tuesday, 29 August 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

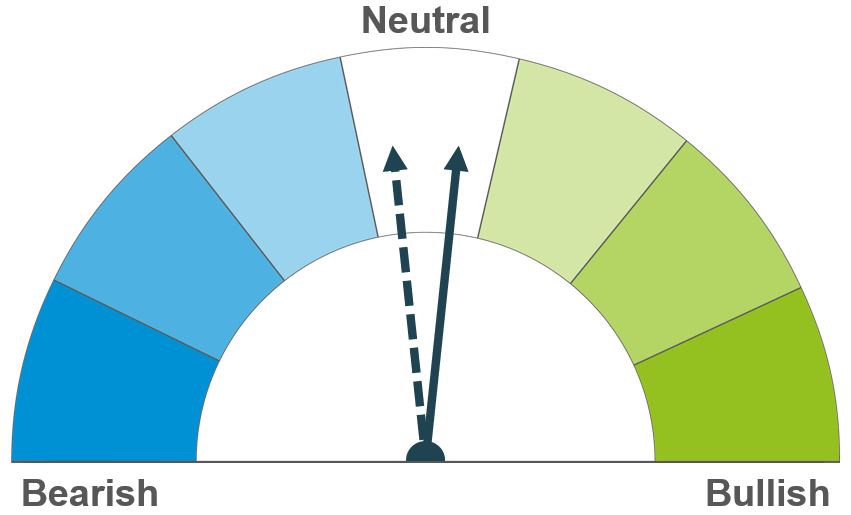

Grains

Wheat

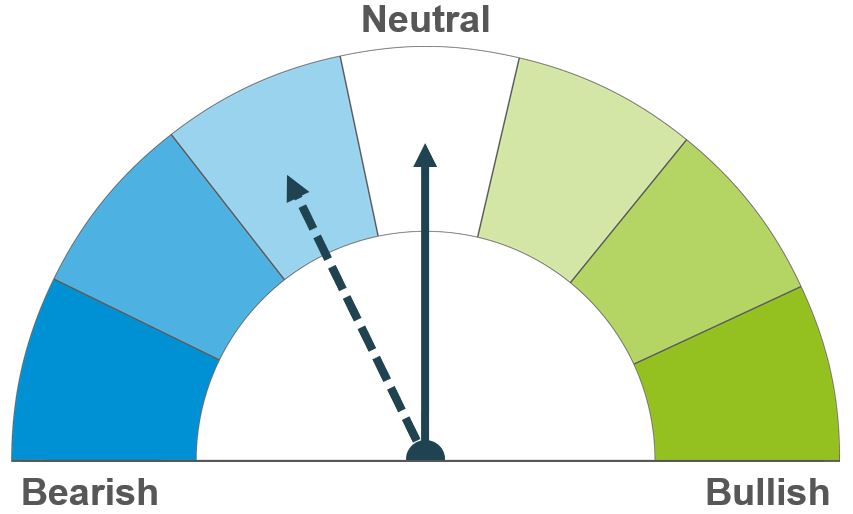

Maize

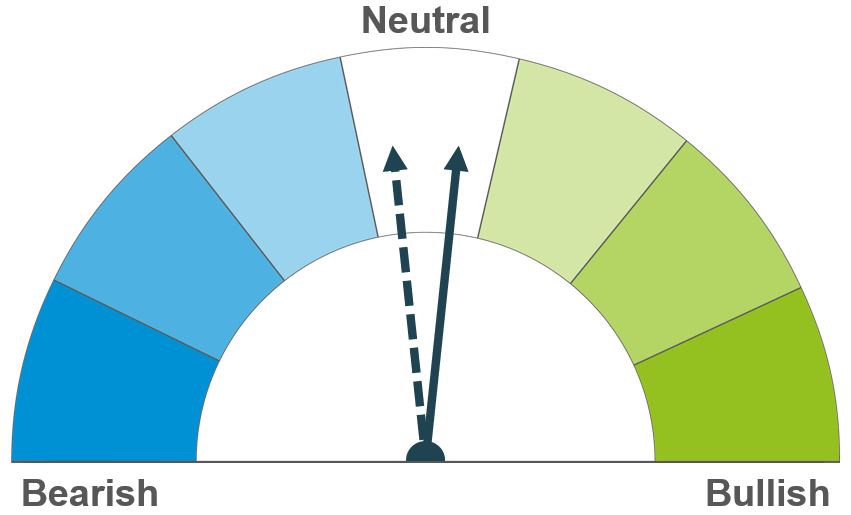

Barley

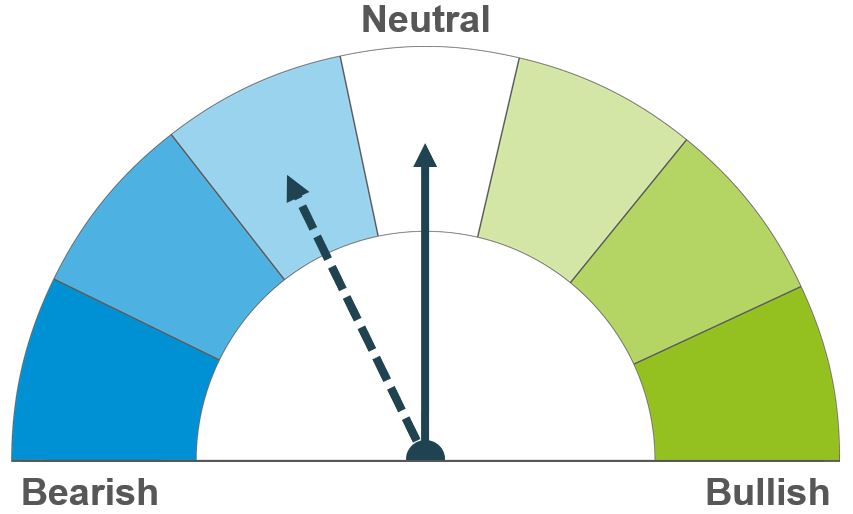

The war in Ukraine keeps uncertainty in the market. But, if large maize crops are confirmed, feed wheat prices are likely to come under additional pressure. The outlook for milling prices will depend on quality results.

Large US and Brazilian crops are forecast; if confirmed this will mean high global feed grain supplies. Uncertainty over US yields keeps support in the market short term.

The global feed grain market seems well supplied, partly due to maize. Last Thursday, feed barley for September delivery (Avon) was at a £19.00/t discount to feed wheat. Conversely, malting premiums globally are up in response to lower quality.

Global grain markets

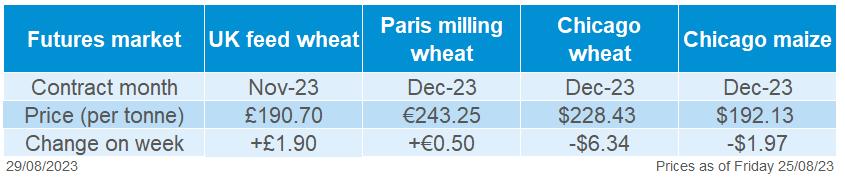

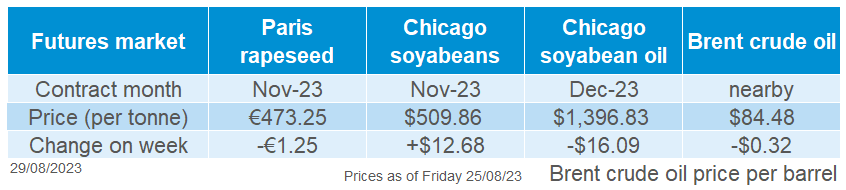

Global grain futures

Global wheat and maize futures had mixed movements last week (18–25 August). Chicago maize and wheat fell but Paris wheat futures gained marginally.

Arguably the main supportive factor was the hot, dry weather in the US. The annual Pro Farmer crop tour highlighted that most crops are still immature, so the weather could stop crops’ full potential being realised. Following the tour, Pro Farmer estimated the US maize yield to be 2% below the USDA.

With more dry weather expected this week, Chicago maize prices rose yesterday (Monday 28 August). After the market closed, the USDA reported that 56% of the crop was in a good/excellent condition as of 27 August. This is down from 58% a week earlier but towards the top end of market expectations (Refinitiv). Any reaction will be seen today (29 August).

There were further attacks on Ukrainian port infrastructure last week, but the market impact was short lived. Ukraine’s Minister of Agrarian Policy and Food expects the country to export similar wheat volumes to last season.

Meanwhile, strong Russian exports weighed on prices, especially for wheat. SovEcon also upped its Russian wheat crop estimate from 87.1 Mt to 92.1 Mt, which would be the second largest on record.

Currency also played a role in the difference price movements. A stronger US dollar (and weaker exports) weighed on US futures, while the weaker euro boosted Paris wheat futures last week.

The European Commission cut its estimates for wheat, barley, and maize output in the EU-27, with the largest cuts for maize but export forecasts were little changed. Quality remains the main issue. Provisional French wheat results look good, but early German results highlight lower yields and protein contents for wheat, plus the expectation of lower Hagbergs.

UK focus

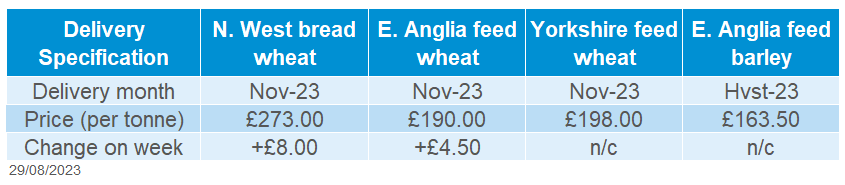

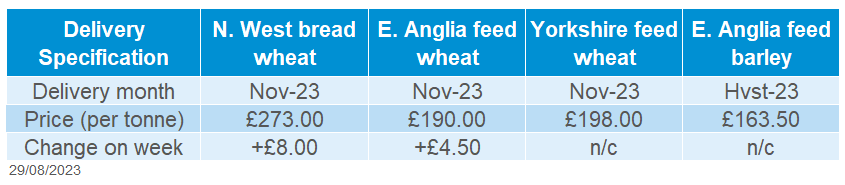

Delivered cereals

Weaker sterling meant UK feed wheat futures rose more than Paris wheat futures. The Nov-23 futures contract gained £1.90/t last week to close on Friday at £190.70/t. On Friday, sterling fell against the US dollar to its lowest level since mid-June, as speculation grows that UK interest rates may peak below earlier forecasts (Refinitiv).

Delivered feed wheat prices rose by similar amounts to UK wheat futures Thursday to Thursday. For example, feed wheat delivered to East Anglia in November gained £4.50/t to £190.00/t. But bread wheat prices rose on expectations of tighter availability across Europe. Over the same period bread wheat delivered to the North West in November rose £8.00/t to £273.00/t.

Look out for highlights of the next GB harvest progress report in next week’s Market Report.

Data out last week gave more insight into UK grain stocks at the end of June, and so the end of the last (2022/23) marketing season. Defra estimated the volume of own-grown wheat, barley, and oats on farmers in England and Wales, while AHDB surveyed merchants, ports, and co-ops (MPC) across the UK.

Oilseeds

Rapeseed

Soyabeans

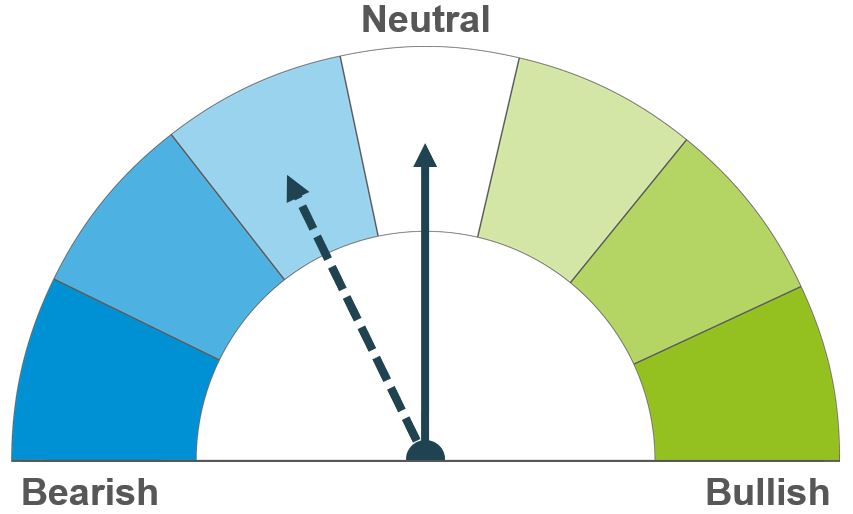

US weather will be a key watchpoint this week as movements in US soyabean futures filter into rapeseed markets. Longer-term, global and EU rapeseed supply still looks ample.

Focus remains on the US crop condition with hot and dry weather forecast for the week ahead. Longer term, plentiful South American supply is expected to weigh on the market.

Global oilseed markets

Global oilseed futures

Last week, Chicago soyabean futures (Nov-23) rose 2.6%, closing on Friday at $509.86/t. Gains across the week were largely a result of hot and dry weather in key producing states of the US, leading to concerns over global supply.

Soyabean markets monitored the outcome of the annual US Pro Farmer Crop Tour closely last week. The tour results were relatively in-line with yield estimations made by the USDA in its World Agricultural Supply and Demand Estimates (WASDE) earlier this month. However, this could change if adverse weather persists.

With 38% of the US soyabean area still affected by drought (as of 22 Aug), and the crop being in its crucial stages of development, rain is needed over the next couple of weeks. Analyst expectations for this week’s USDA soyabean crop ratings came in at 54−57% in good/excellent condition (Refinitiv). However, despite the hot and dry weather last week, the crop was rated at 58% in good/excellent as of 27 August. This is down from 59% the previous week. Looking ahead, US weather will remain a key driver in oilseed markets over the coming days. Little to no rain is forecast over the next seven days in relevant states, and more hot weather is on the way.

Malaysian palm oil futures saw a second weekly gain on Friday, as support from rival vegetable oils filtered through. The November contract was up 2.4% on the week. While palm oil markets slipped yesterday, partly on the back of weaker Malaysian exports, this morning prices firmed again, as concerns of tighter Indian supply are rising due to a poor monsoon forecast.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed at €473.25/t on Friday, relatively unchanged (-0.3%) Friday to Friday. Prices fell at the beginning of the week, before support from rises in the US soyabean market filtered through towards the end of the week. The Nov-24 contract recorded similar movements, down 0.2% over the week.

Rapeseed delivered into Erith (November delivery) was quoted at £390.50/t on Friday, up £5.50/t week-on-week.

On Thursday, the EU Commission updated its cereal and oilseed production estimates for the 2023/24 season. Total EU-27 rapeseed production is currently pegged at 19.1 Mt. If realised, this would be down slightly on the year, but up 10.2% on the five-year average.

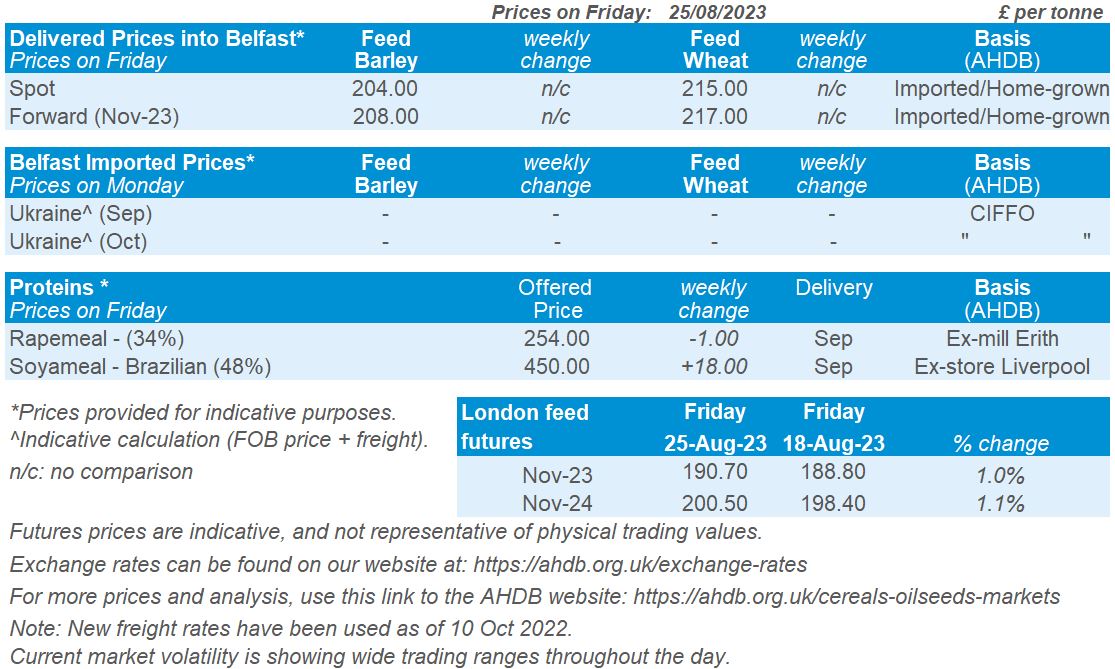

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.