What’s driving markets this week? Grain market daily

Friday, 25 August 2023

Market commentary

- UK feed wheat futures (Nov-23) gained £0.60/t yesterday, ending the session at £190.85/t. The Nov-24 contract closed at £200.10/t, up £1.25/t over the same period.

- Hot and dry weather in the US remains in focus, as well as cuts to EU cereal crop forecasts.

- Paris rapeseed futures (Nov-23) fell €0.50/t yesterday, ending the session at €471.50/t. The Nov-24 contract closed at €481.25/t, down €2.25/t from Wednesday’s close.

- Falls in Paris rapeseed futures followed pressure in the wider vegetable oils market, with Chicago soyabean oil futures (Dec-23) down 1.3% yesterday.

What’s driving markets this week?

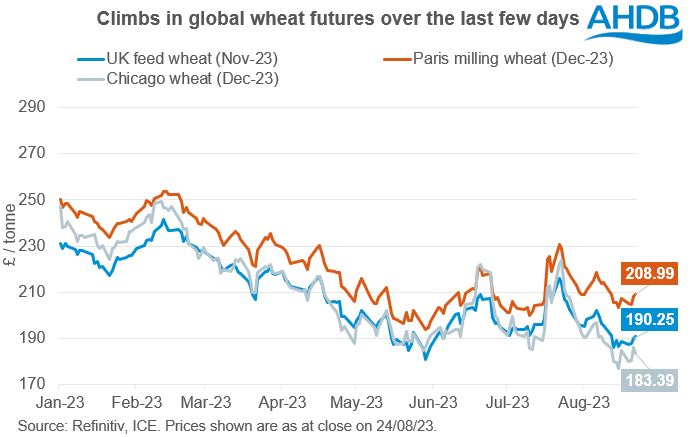

So far this week (Mon–Thurs), UK feed wheat futures (Nov-23) have climbed 1.9%. This rise has followed both Chicago wheat (Dec-23) and Paris milling wheat (Dec-23) futures, up 1.0% and 1.6% respectively. While the support at the beginning of the week was largely due to escalations in the Black Sea region, the focus has very much turned to US weather and the potential impact on global supply.

Hot and dry weather in focus

Over the next seven days, unseasonably hot weather is expected to continue over the key spring wheat producing states (Montana and North Dakota), with little to no rain due either. While a portion of the crop has now been harvested, there could still be some yield impact on later-sown crops. In the USDA’s crop progress report released on Monday, the spring wheat crop was revised down from 42% to 38% in excellent/good condition, compared to 64% the previous year. Updates on this condition score will be something to watch out for on Monday.

The US soyabean crop is currently in its crucial stages of development, making it susceptible to extreme temperatures and moisture stress. The key soyabean producing states are also due little rain over the next seven days, which could lead to some support in the oilseeds complex.

Cuts to EU production

The European Commission made further cuts to major grain and oilseed crops this season in its updated figures, released yesterday. Maize output saw the biggest reduction, now pegged at 61.9 Mt, the second smallest crop (after 2022) since 2015. Europe’s maize crop has suffered from drought and heatwaves in southern parts of the continent this summer. However, it’s important to remember that a bumper US maize crop is expected to make up for losses in EU production.

The Commission also lowered its soft wheat production estimate, now at just over 127 Mt, though this remains almost 2% higher than the five-year average.

Ukraine exports

Global grain and oilseed markets remain reactive to any news on escalations in the Black Sea region. At the beginning of the week, overnight drone attacks on ports on the Danube River and the Odesa region, led to some support in prices. Having said this, Ukraine are finding new ways to get grain and oilseeds out of the country.

This morning, the Minister of Agrarian Policy and Food in Ukraine said that the tonnage of Ukrainian wheat exports will not be any less than last season. Despite a 20% reduction in total crop area due to Russian occupation, favourable weather conditions have led to significantly higher yields.

With a more optimistic outlook, Ukrainian exports have had less of an impact on global markets over the last couple of days. However, any further attacks on infrastructure or ports and disruption to Black Sea supplies will remain something to watch.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.