More wheat and barley, but lower oat stocks at end-June: Grain market daily

Thursday, 24 August 2023

Market commentary

- UK feed wheat futures (Nov-23) rose £2.35/t yesterday to close at £190.25/t, while Paris rapeseed futures (Nov-23) gained €6.75/t to close at €472.00/t.

- Grain and oilseed prices both rose yesterday due to concerns about the impact of extreme temperatures from a ‘heat dome’ on US maize and soyabean crops. The worry is current temperatures could reduce final grain and bean weights and therefore yields.

- The Pro Farmer crop tour, which ends tonight, has so far found higher potential than last year for both maize and soyabeans. But results were below the three-year average in Indiana and Nebraska.

- Buying by speculative traders and the latest Russian strikes against the Ukrainian port of Izmail may also have been factors. The Danube Rivers ports are increasingly important to Ukrainian exports. Ukraine’s deputy prime minister confirmed the loss of 13 Kt of grain and 15% of the port’s capacity due to the latest strike.

- French wheat harvested before rain delays has above-average protein content and Hagberg Falling Numbers according to FranceAgriMer. Fewer samples met specific weight requirements than on average over the past five seasons. The quality is likely to decrease in the final report as this will include samples from areas where rain delayed harvesting.

More wheat and barley, but lower oat stocks at end-June

Data out this morning from Defra and AHDB gives some insight into UK stocks of wheat, barley, and oats at the end of the 2022/23 marketing season.

Defra surveyed farmers in England and Wales to estimate the volume of own-grown wheat, barley, and oats held at the end of June 2023.

AHDB’s survey estimates the volumes of both imported and home-grown grain held by merchants, ports, and co-ops (MPC) across the UK.

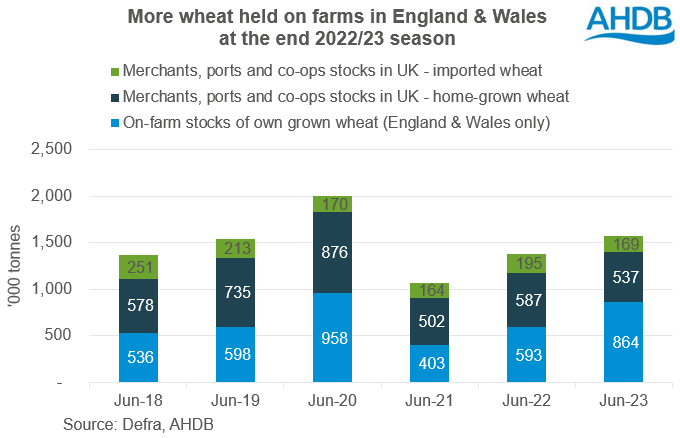

Wheat

There was 864 Kt of wheat on farms in England and Wales (own-grown only) at the end of June 2023; this is the largest amount for three years. MPC held 9% less home-grown and 13% less imported wheat in the UK than a year ago.

Previously released data showed smaller stocks of home-grown wheat year-on-year held by UK flour millers (including for starch and bioethanol production), but higher stocks of imported wheat. Brewers, maltsters, and distillers (BMD) also held larger stocks of wheat, though the volume is small in comparison.

While this is not a complete picture, it still points to UK wheat carry-over potentially being the largest since the end of 2019/20.

In May, AHDB forecasted total UK end-of-season wheat stocks at 2.44 Mt, broadly in line with the end of 2019/20. If larger stocks are confirmed in AHDB’s end-of-season balance sheets, it could boost total availability in 2023/24.

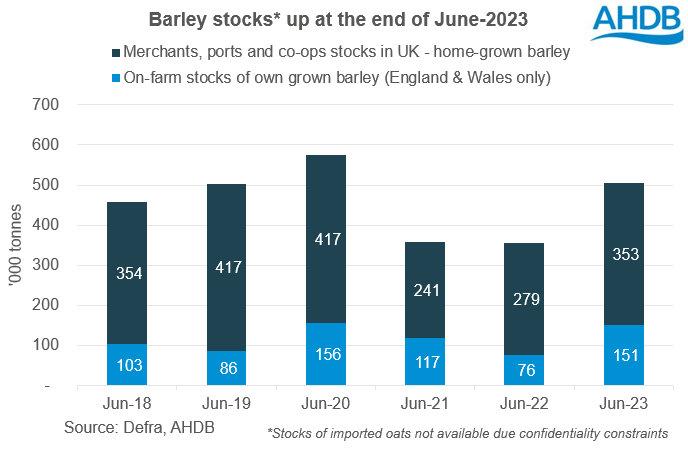

Barley

At the end of June 2023, farmers in England and Wales held nearly double the volume of own-grown barley as a year earlier. UK stocks of home-grown barley held by MPC were also up 26% year-on-year.

Data released earlier showed BMD also held larger stocks at the end of June 2023 than at the end of June 2022. Again, while not a complete picture it does suggest that the UK carried more barley into the 2023/24 season.

In May, AHDB forecasted end-of-season stocks at 1.08 Mt, up 12% from last season and the largest since 2019/20. Depending on final stocks and the 2023 crop size, total barley availability could be higher in 2023/24.

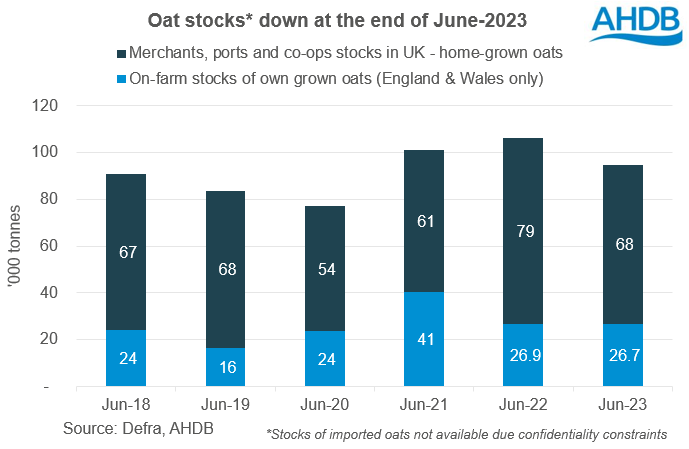

Oats

In contrast to wheat and barley, oat stocks on farms in England and Wales (own-grown grain) were down 1% year-on-year at 26.7 Kt.

Meanwhile, MPC held 14% less home-grown oats in stock across the UK at the end of June 2023 than at the end of June 2022. Data from a few weeks ago also showed UK oat millers held 9% less stock at end of June than a year earlier. This supports AHDB’s May forecast for smaller carry-over stocks after high exports last season.

With the oat area down for harvest 2023 and early GB yield results sitting slightly below the five-year average, the UK is likely to harvest a smaller crop in 2023. If lower carry-over stocks are confirmed as well, UK oat availability is likely to be tighter in 2023/24.

Maize

MPC held an estimated 111.5 Kt of maize (both imported and home-grown) in stores at the end of June 2023. This is 44% lower than June 2022 and the lowest since the end of the 2015/16 season.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.