Arable Market Report – 25 March 2024

Monday, 25 March 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

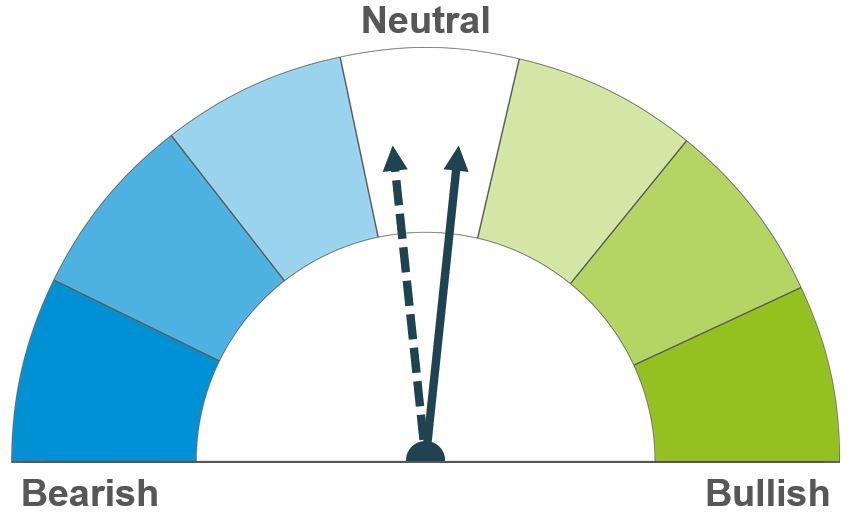

Wheat

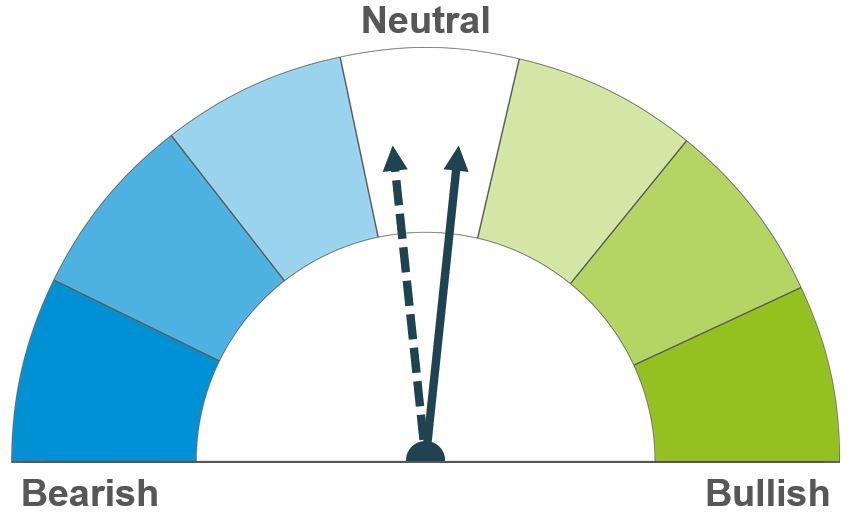

Spring weather conditions and uncertainty over the outlook for 2024/25 are the main factors for the market currently. While the supply and demand information currently available points to a neutral outlook, further support from short covering remains possible.

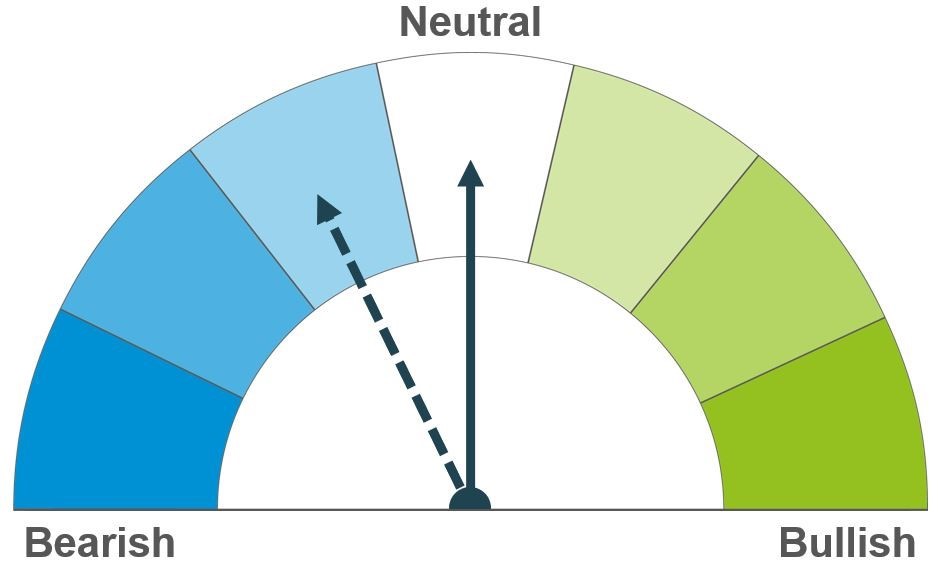

Maize

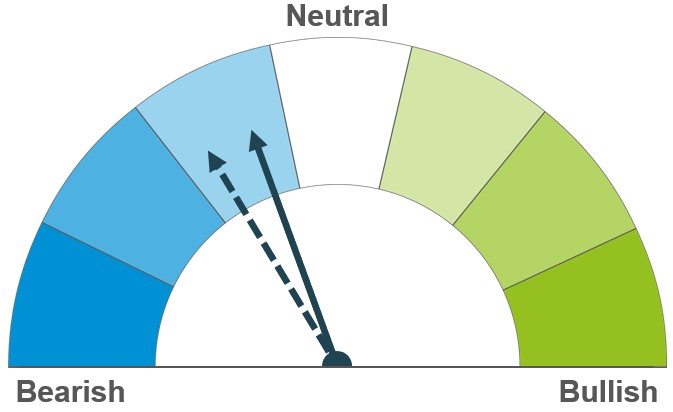

Supply and demand forecasts point to comfortable global maize supplies both in the short and longer term. However, uncertainty from weather, particularly in Argentina, and key data releases cast some uncertainty in the short term. The USDA releases US farmers’ planting intentions and quarterly stocks data on Thursday.

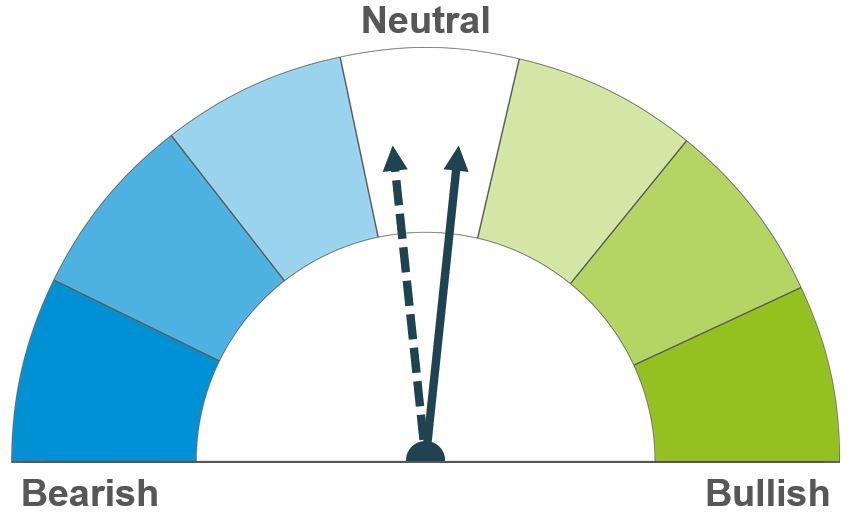

Barley

While larger crops are expected for key global producers in 2024, European planting delays and dry soils in Canada continue to mean uncertainty over the outlook in the longer term.

Global grain markets

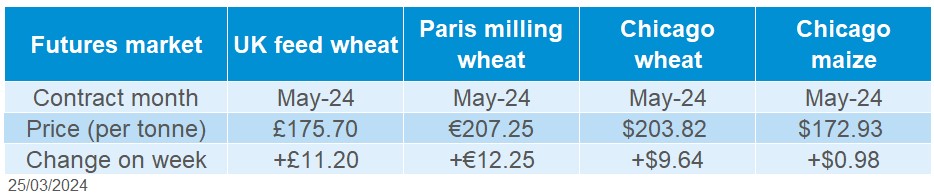

Global grain futures

Global wheat markets rose last week, with May-24 Paris futures reaching its highest level since early February and May-24 Chicago wheat at its highest since 4 March on Friday. The initial price rise was attributed to conflict escalations in the Black Sea region and news that the EU will impose tariffs on Russian grain imports.

The EU Commission announced tariffs of €95/t for imports of Russian and Belarussian grain, pending approval from Member States. For soft wheat and barley, the impact is likely to be limited as Russia accounted for less than 5% of EU-27 imports from 1 July to 28 February, but there is likely to be a bigger impact for durum wheat.

The price rises sparked further short covering by speculative traders and technical trading. Speculative traders were still heavily short in the Chicago wheat as of last Tuesday (CFTC).

Later in the week, worries about continued heavy rain in Argentina and spillover support from Chicago soyabeans helped the rises continue, though drier weather has now returned. However, despite the focus on maize, Chicago maize futures only recorded small week-on-week rises.

Canadian wheat (exc. Durum) and barley production are forecast to rise 8% and 7% year-on-year in 2024/25 by Agriculture and Agri-Food Canada. Farmers’ intentions to plant smaller areas are offset by the assumption of a return to normal yields from 2023’s low levels. A rebound in yields also is forecast to raise oat production in 2024, but it may not be enough to lift Canadian oat stocks from current historical lows. Dry soils are also a concern, and more rain is needed before planting starts in May.

Concerns also persist for crops in parts of Europe, with less than half (48%) of the French spring barley crop planted by 18 March. This is well behind the five-year average pace of 89% complete. The condition of winter crops remained stable week-on-week, though still the worst since 2020.

Meanwhile, beneficial rain is forecast for much of the US maize growing belt this week. This should support soil moisture ahead of planting. US crop progress reports resume next Monday (1 April) after the winter break.

UK focus

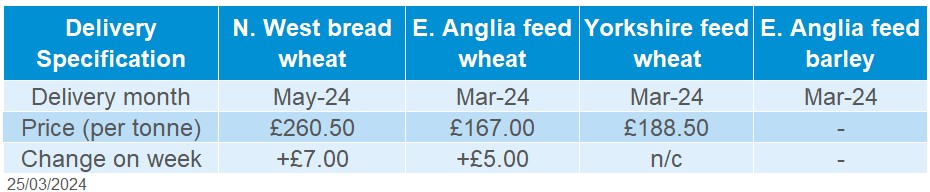

Delivered cereals

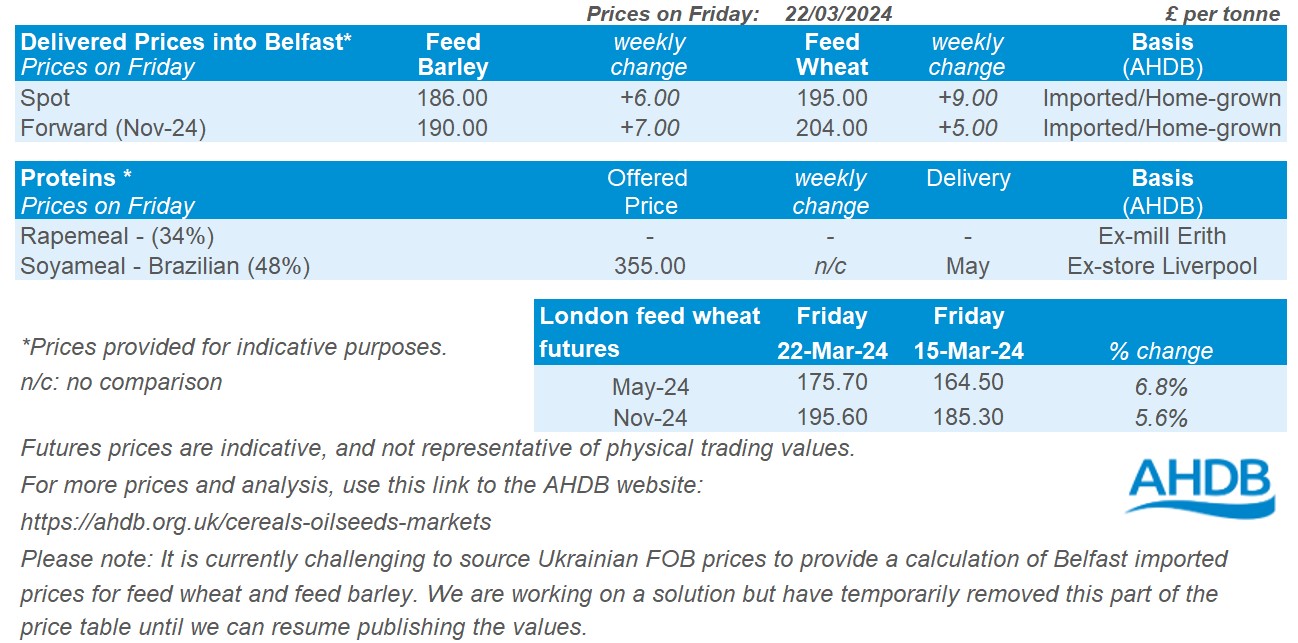

UK feed wheat futures rose following the global trend, though they received an extra boost towards the end of the week from sterling weakening against both the euro and US dollar. May-24 feed wheat futures gained £11.20/t (7%) to close at £175.70/t, with the Nov-24 contract up £10.30/t (6%) to £195.60/t. Meanwhile, May-24 Paris milling wheat futures gained 6% over the week, with Chicago wheat futures up 5%.

UK delivered prices rose broadly in line with UK futures prices Thursday to Thursday. Bread wheat for delivery to North West in May was quoted at £260.50/t, up £7.00/t week-on-week, with the premium to May-24 futures holding firm.

You can find our latest analysis of UK trade imports and exports covering data up until the end of January here, plus a look at trends in compound animal feed production this season here. The first UK crop condition report of 2024 is due out on Thursday, along with updated UK supply and demand estimates.

Oilseeds

Rapeseed

Rapeseed prices are currently supported by reduced rapeseed areas in the EU, Ukraine and Canada. In the longer term, Canadian weather over the summer is key for determining rapeseed’s premium to soyabeans.

Soyabeans

South American soyabeans are coming to the market as harvesting progress. Pressure is expected to continue on soyabean prices unless a wet spring in the USA impacts the upcoming plantings.

Global oilseed markets

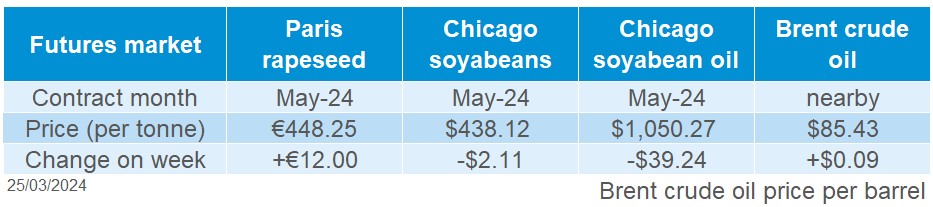

Global oilseed futures

Despite three prior successive weeks of gains for Chicago soybean futures (May-24), the market was pressured last week and closed Friday at $438.17/t – down 0.5% across the week.

Towards the start of the week there was an element of pressure on the market as Brazil’s soyabean harvest progressed and a storm across the US Midwest aided soil moisture for the upcoming soyabean planting campaign. Then, towards the middle of the week, the market was supported by bargain buying and excessive rains in Argentina, posing a potential risk to crop quality. Towards the end of the week the market was pressured from profit taking and farmer selling as nearby Chicago soyabean futures closed at their highest level since the end of January 2024 on Thursday.

The market focus is still on South America’s soyabean harvests. On Friday it was reported that Brazil’s soyabean harvest was 69.3% complete, similar to the same point last year of 70.4% (Patria Agronegocios). With harvesting coming to an end in the major producing regions of Brazil, the focus will start to turn towards Argentina’s soyabean harvest.

Recent heavy rains in Argentina have now paused for a few days. Some soyabean crops are under water from excessive rain and hail, though the recent rains in some areas have benefited soyabean fields (Rosario Grain Exchange). There haven’t been any major changes to Argentina’s production numbers as of yet, despite market support. The Buenos Aires Grain Exchange maintained its soyabean production estimate at 52.5 Mt.

The USDA reported net sales (to 14 March) of 494 Kt of soyabeans for the 2023/24 marketing year, up 31% from the previous week and 86% from the prior four-week average. This was in line with trade expectations of 250 Kt to 800 Kt.

The key piece of market information this week is the USDA planting intentions and quarterly stocks reports, which are out this Thursday (28 March). Average trade estimates suggest that the 2024/25 US soyabean area will be 35.0 Mha, down from 35.4 Mha estimated at the USDA 2024 outlook forum (LSEG).

Rapeseed focus

UK delivered oilseed prices

Rapeseed prices continue to be supported week on week, with concerns continuing regarding rapeseed production in the EU-27, Canada and reduced crops in Ukraine.

From this, Paris rapeseed futures (May-24) were up across the week by €12.00/t, closing at €448.25/t on Friday. New crop (Nov-24) futures were up €10.50/t over the same period, closing at €453.75/t.

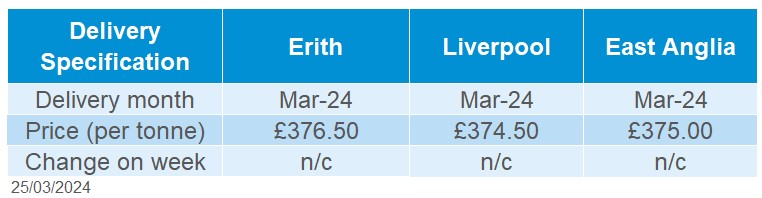

Domestic delivered rapeseed into Erith (Mar-24) was quoted at £376.50/t on Friday, with no comparison on the week. Delivery for Harvest-24 was quoted at £379.50/t, up £10.00/t week on week.

AHDB’s next UK crop report will be out on Thursday (28 March).

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.