Weaker sterling boosts UK wheat futures: Grain market daily

Friday, 22 March 2024

Market commentary

- Global grain and oilseed markets rose yesterday, led by Chicago soyabeans. Worries about the impact of heavy rain and storms in Argentina on soyabean and maize crops triggered short covering by speculative traders. However, drier weather is forecast until the middle of next week.

- For wheat the gains were limited by optimism for the 2024 Russian wheat crop, which SovEcon reports could reach 94.0Mt. This would be even larger than the 92.8 Mt the firm estimates was harvested in 2023.

- May-24 UK feed wheat futures rose £1.55/t to £170.55/t yesterday, while the Nov-24 contract gained £1.15/t to close at £190.15/t (more below).

- May-24 Paris rapeseed futures dipped yesterday, down €3.25/t to €448.75/t, with Nov-24 contract lost €3.00/t to close at €454.00/t. The contracts dipped on profit taking after reaching their highest levels since late November on Wednesday.

- USDA releases quarterly US grain and oilseed stock levels, plus the results of its annual survey of planting intentions at 4pm next Thursday (28 March)*. These reports can often trigger market reactions.

Weaker sterling boosts UK wheat futures

UK feed wheat futures recorded stronger price rises than key global grain futures markets yesterday, as sterling weakened against key global currencies.

Using the May-24 contracts as an example, UK feed wheat futures rose by 0.9%, compared to 0.3% for Chicago wheat futures and 0.4% for Paris milling wheat futures. Chicago maize futures for May-24 gained 0.4%.

The global market rose yesterday, led by short covering and spillover support from the Chicago soyabean market; see market commentary for more details. However, the rises in UK feed wheat futures were enhanced by a drop in the value of the pound.

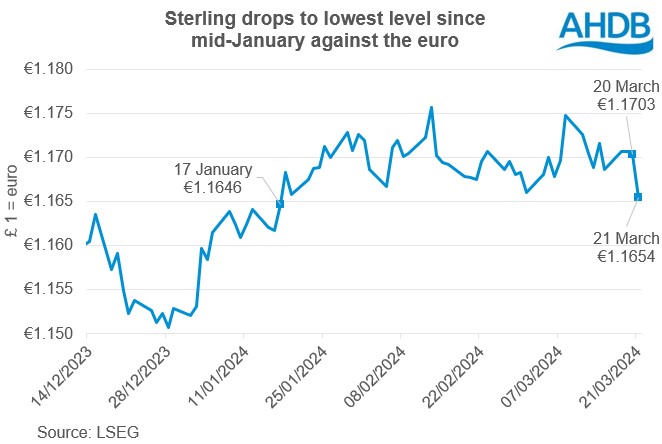

Sterling dropped from £1 = €1.1703 to £1 = €1.1654 yesterday (LSEG) due to suggestions that a cut in UK interest rates is moving back onto the agenda. Yesterday, the Bank of England held interest rates unchanged at 5.25%. However, one member of the Monetary Policy Committee, which decides the rates, voted for a slightly lower rate as the rest voted to keep rates unchanged. This is a shift from the last vote at the start of February when seven members voted to keep rates stable and two voted for further rises.

For now though, interest rates remain at their highest level since 2008, and for those with borrowings, it’s important to consider the structure of the debt.

Sterling also weakened against the US dollar yesterday, due to news from the US Federal Reserve (central bank), which supported the US dollar. The US Federal Reserve kept its plan to cut interest rates later in the year unchanged and increased its forecast for economic growth in the US this year.

Weaker sterling against the euro or US dollar makes imported grain into the UK comparatively more expensive. This means UK prices can rise more before being capped by the cost of importing grain, enabling the stronger rises in UK futures we saw yesterday. Imports of grain are firm this season.

UK economic growth, the global economy and inflation will all influence where next for interest rates and exchange rates. The Monetary Policy Committee next meets on 9 May.

*When this article was first published, the incorrect publication date for the USDA reports was included; this has been corrected.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.