Rapeseed futures near four-month highs: Grain market daily

Thursday, 21 March 2024

Market commentary

- Global wheat markets dipped yesterday after rising to their highest levels for several weeks on Tuesday. The US markets felt pressure from a stronger US dollar, which makes it harder for US wheat to compete in export markets. There was also less fresh news about the conflict in Ukraine and the market waited for the outcome of the latest Egyptian tender (LSEG).

- After reaching its highest price since 7 February on Tuesday, May-24 UK feed wheat futures eased back £0.30/t yesterday to close at £169.00/t. The Nov-24 contract closed fell £1.00/t to £189.00/t yesterday.

- After the markets closed, Egypt’s state buyer, GASC, bought 60 Kt of Romanian and 50 Kt of Bulgarian wheat. This is GASC’s first purchase since mid-February but shows Black Sea wheat is still the most competitive in the market. In addition, while French and Russian wheat prices were offered at similar levels in the tender – Russian wheat is available cheaper outside of official tenders.

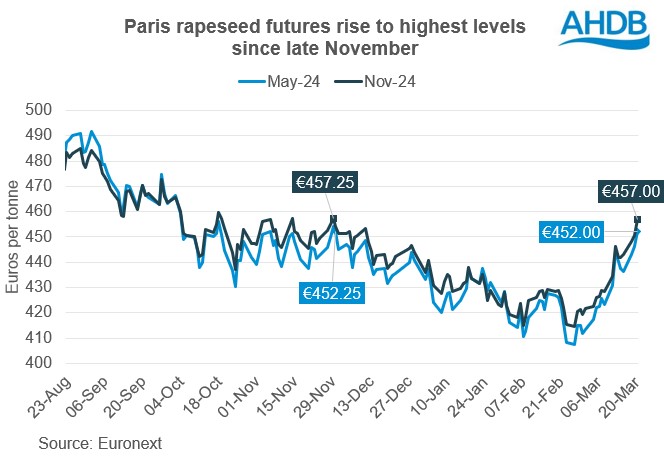

- Paris rapeseed futures gained yesterday nearing four-month highs (more below). May-24 Paris rapeseed futures gained €5.75/t yesterday to close at €452.00/t (approx. £386.00/t), while the Nov-24 contract rose €6.50/t to €457.00/t (approx. £390.50/t).

Rapeseed futures near four-month highs

Both the May-24 and Nov-24 Paris rapeseed futures contracts closed at their highest prices since late-November yesterday. Rising Chicago soyabean prices and worries about 2024/25 rapeseed production in Europe and Canada pushed prices up.

Support from soyabeans

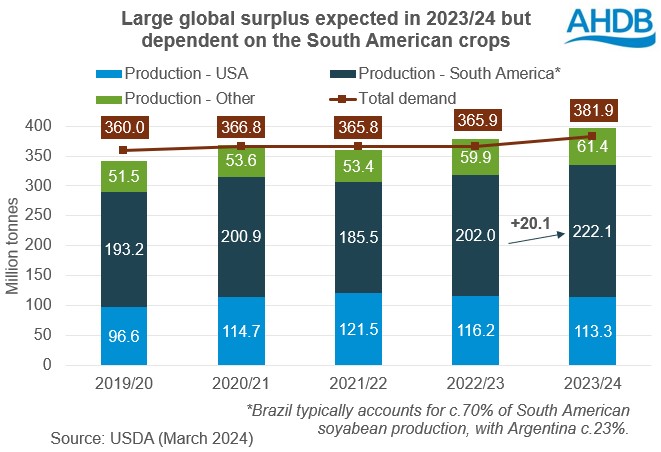

Forecasts continue to show ample global oilseeds supplies this season (2023/24), though this is based on large South American crops.

As Monday’s Market Report highlighted, there’s a widening range of forecasts for the Brazilian crop, currently being harvested. This is creating uncertainty in the market. Meanwhile, although recent rainfall led forecasters to increase Argentine crop forecasts last week, they cautioned that heavy rain needed to stop soon to avoid damage to the crop. Heavy rain has persisted in Argentina this week, meaning worries about crop damage are being factored into prices now.

These worries and uncertainty are some of the factors pushing up Chicago soyabean prices this week, and in turn Paris rapeseed futures. New soyabean export sales for US soyabeans and re-positioning by speculative traders also helped the markets to rise.

While our domestic rapeseed marketing season is into its latter stages, ending on 30 June, the new global soyabean season doesn’t start until 1 October. So old crop (2023/24) soyabean markets will continue to influence rapeseed prices for a little while yet.

Rapeseed production worries

Canadian farmers are intending to plant 3% less rapeseed for harvest 2024, as we reported in Monday’s Market Report. But there’s been unusually dry weather across large parts of key canola growing areas in Canada. While there’s still time until planting begins, more rain will be needed to support crop development.

Smaller rapeseed crops are already expected in Europe and Ukraine in 2024. Stratégie Grains predicts an 8% fall in the EU-27 crop from 2023, while UkrAgroConsult points to a 9% decline in Ukraine’s crop in 2024. AHDB’s Early Bird Survey shows the effect of incredibly challenging conditions closer to home too, with the UK area down 28% year-on-year.

Longer-term supplies still heavy

While there’s been support for prices in the past few days, longer-term the global supply picture against demand for soyabeans still looks heavy. The first forecasts for next season (2024/25) from the International Grains Council (IGC) show rising global demand for soyabean is more than outweighed by higher production. This is based on production increases next season for all three major producers, Argentina, Brazil and the US and could push global stocks even higher.

Concern about Chinese demand has been a bearish factor for markets recently. But the IGC also projects a rise in import demand from China to 103.0 Mt in 2024/25, from the 100.8 Mt forecast for this season.

Next season’s crops won’t be planted in Argentina and Brazil until the autumn, so the next key crop for the market is the 2024/25 US crop. Early projections from the USDA pointed to a 4.7% year-on-year rise in the US soyabean area in 2024 at the expense of maize. There’s key data out tomorrow; the USDA releases the results of an annual survey of US farmers’ planting intentions at 4pm (GMT).

Where next?

Whether this current support for prices lasts depends on the extent of any damage to the Argentine soyabean crop, further insights on 2024/25 rapeseed production, plus what tomorrow’s USDA report shows. If the USDA’s survey shows a smaller rise in the soyabean area than expected it could lend some more support to prices, while a larger rise could bring renewed pressure.

The IGC releases its next report on global soyabean supply and demand on 18 April. Meanwhile, the USDA releases its first supply and demand projections for 2024/25, which include rapeseed, on 10 May.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.