Slower start to French planting as US stocks weigh: Grain market daily

Friday, 16 February 2024

Market commentary

- Global grain and oilseed prices fell yesterday after USDA predicted US grain and oilseed stocks will grow further in 2024/25 (more below)

- The fall in prices may be starting to spark some demand, with Egypt’s state buyer, GASC, tendering for the first time since mid-January. GASC bought 120 Kt of Ukrainian and 60 Kt of Russian wheat for $255.00/t cost and freight

- UK feed wheat futures for May-24 fell a further £1.70/t yesterday following the global trend, to close at £164.00/t. The Nov-24 contract lost £1.60/t to close at £182.75/t

- Paris rapeseed futures for May-24 lost €3.00/t to close at €421.50/t (approx. £361/t), while the Nov-24 contract fell €2.75/t to settle at €426.00/t (approx. £365/t)

- UK trade data for December 2023 is now available. The stats show a pick-up in barley and oat exports compared to November, but the highest monthly imports of wheat and maize so far this season

Slower start to French planting as US stocks weigh

Spring barley planting in France is off to a slower start than recent years, with 20% sown by 12 February (FranceAgriMer). This is sharply down on last year’s rapid pace (54% complete at the same point) as excess moisture hampers planting. The pace is also below the five-year average of 25% complete, but still ahead of 2021.

Meanwhile, French wheat and winter barley crops are in the poorest condition since 2020. As of 12 February, 68% of wheat (exc. durum) was in good or very good condition, compared with 93% a year ago. Meanwhile, 71% of winter barley was rated good or very good, down from 92% in 2023.

After a challenging autumn in much of northern Europe, like here, there is more emphasis on spring cropping than usual. The slower start may be part of why Stratégie Grains trimmed its forecast for the EU-27 barley crop yesterday. Now the analytics company projects 2024 barley output at 53.1 Mt, down 0.3 Mt from last month’s forecast but still 12% above the 2023 harvest. The company projects the 2024 EU wheat crop 2.5% below last year at 122.6 Mt (Reuters).

AHDB will provide an update on the potential UK areas for harvest 2024 on 8 March, subject to spring weather.

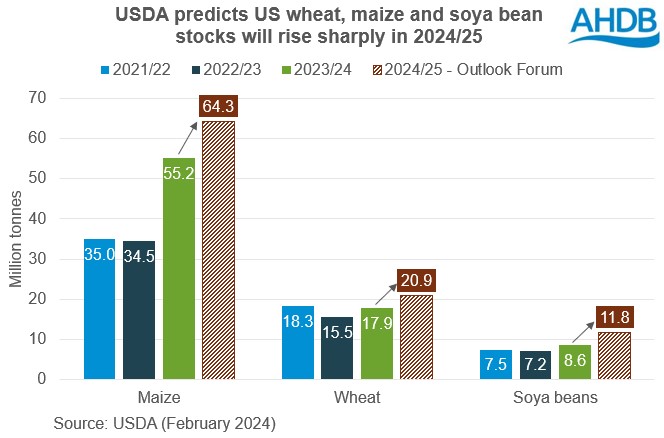

Bigger US stocks forecast for 2024/25

Yesterday, USDA announced it expected a 4.7% rise in the US soya bean planted area in 2024. This is even larger than the 4.1% rise its baseline report had suggested. USDA unveiled these projections during the first day of its annual Outlook Forum, which continues today. Using a trend yield, USDA expects a considerable build-up in US soya bean stocks in 2024/25, more than the market had expected.

Meanwhile, the US maize and wheat area forecasts are 3.8% and 5.2% below 2023 respectively. The fall in the maize area is less than the baseline report indicated, while the wheat area fall is steeper. If confirmed, smaller planted areas in 2024 put more pressure on yields to support production. However, using trend yields, USDA forecasts further sizeable year-on-year rises in US grain stocks in 2024/25.

The projections of further year-on-year rises in US soya bean, wheat and maize stock levels were key bearish factors for markets yesterday.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.