GB animal feed production rises this season to date: Grain market daily

Wednesday, 20 March 2024

Market commentary

- UK feed wheat futures (May-24) closed at £169.30/t yesterday, up £2.35/t from Monday’s close. New crop futures (Nov-24) gained £2.25/t over the same period, ending the session at £190.00/t.

- UK feed wheat futures followed both the Chicago and Paris wheat markets up yesterday. The Chicago market was supported on technical moves as traders look to unwind short positions ahead of uncertain weather as we enter spring. Further to that, wheat markets were supported from Black Sea tensions, this kept an element of support from the Russian strikes on Ukrainian ports raising worries around exports.

- Paris rapeseed futures (May-24) closed yesterday at €446.25/t, climbing €3.00/t from Monday’s close. The Nov-24 contract ended the session at €450.50/t, up €2.50/t over the same period.

- Paris rapeseed prices rose yesterday with ICE canola futures, which were supported as commodity funds hold a large net short position on canola and are covering some of it ahead of Canada’s sowing campaign starting soon.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB

GB animal feed production rises this season to date

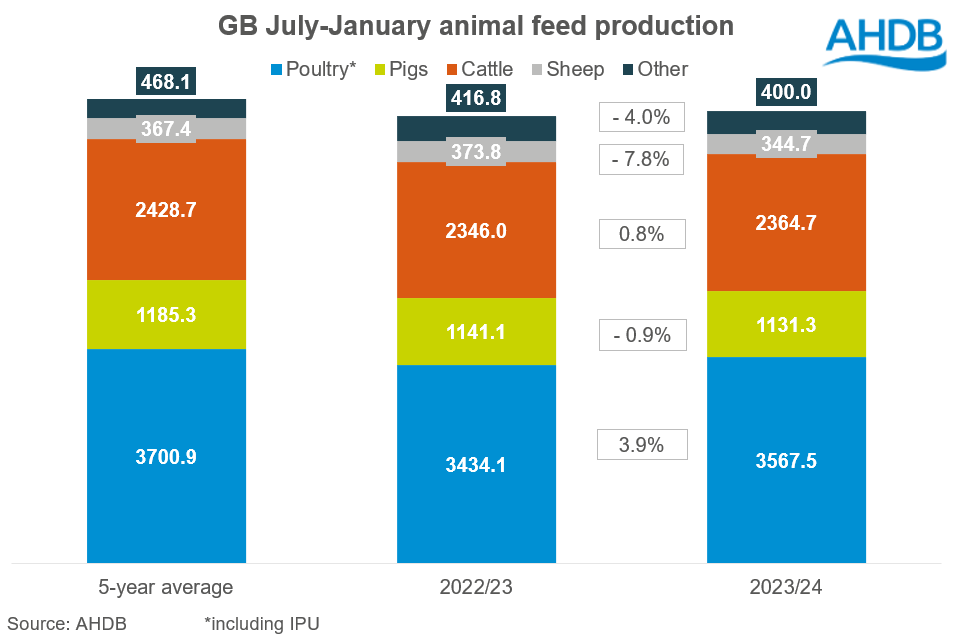

In the latest GB animal feed production data, this season-to-date (Jul-Jan), total production including integrated poultry units (IPU) totalled 7.81 Mt. This is up 1.3% on the same period last year, when feed production totalled 7.71 Mt.

So far this season (Jul-Jan), animal feed production by compounders for cattle, sheep, poultry, and pigs (excluding IPUs) saw a decline of 0.8% (51 Kt). However, despite poultry feed production by compounders declining by 0.6% (14 Kt) so far this season, production by IPUs grew by 12.4% (147 Kt), outweighing the loss.

Aside from poultry, cattle was the only sector to see a rise in feed production, albeit marginal (0.8%). Reports suggests that wet weather at the end of 2023 may have hindered the ability to finish cattle, with farmers using compound feeds to try and combat any reduction in finishing times. However, compared to the five-year average, cattle feed production this season is still down 2.6% mainly due to sluggish demand for compounds for dairy cows.

Sheep feed production saw the largest dip so far this season, down 7.8%. This was mainly driven by a reduction in the usage of compounds for growing and finishing sheep, back 11.5% on the year (-28.1 Kt). The lacklustre feed demand is likely to be driven by an overall decline in sheep meat production in 2023, with a reduction in UK flock numbers. Likewise, to the other livestock sectors, sheep producers have been forced to tighten their belts impacted by high input costs forcing them to seek cheaper feed options.

Pig feed production season to date is down 0.9% from last season and 4.6% from the 5-year average. This decline was mainly driven by a reduction in link/early grower feed (-24.1 Kt). This follows a continued period of challenging times for the UK pork industry throughout 2023, resulting in a significant reduction in the number of finishing pigs in 2023.

Finally, the poultry sector (including IPUs) has seen the largest growth in production this season, up by 3.9%, driven by an uptick in production from IPUs. The industry still appears to be recovering from high input costs and the impact of avian influenza but is looking more positive in terms of feed demand.

What does this mean for cereals usage?

The usage of wheat, barley, maize and oats in feed production this season has totalled 2.84 Mt (Jul-Jan) compared to 2.86 Mt for the same period last season, a total decline of 0.9%. Barley was the only cereal to see a rise in usage, increasing by 2.9% this season. Wheat (-0.3%), oats (-29.1%) and maize (-11.8%) all saw declines.

Barley is currently being used heavily in feed rations due to its discount to other cereals. For February, the average UK ex-farm feed barley price sat at a discount of £25.40/t to feed wheat, compared to £20.70/t for the same period last year. Due to its discount under wheat, the greater usage of barley is likely to continue throughout the season and possibly into next year. Our most recent Early Bird Survey showed a reduction in total wheat area this year, but an increase in total barley area, suggesting greater availability of barley comparative to wheat next season.

AHDB’s most recent supply and demand estimates suggest that, total animal feed demand is forecast to remain relatively sluggish with just slight recovery expected within the poultry sector. Though caution remains regarding input costs particularly within the cattle and pig sector. AHDB’s next UK supply and demand estimates update is due next week.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.