GB animal feed production remains slow for first half of the season: Grain market daily

Wednesday, 7 February 2024

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £174.00/t, up £0.50/t from Monday’s close. The Nov-24 contract fell £0.50/t over the same period, closing at £191.50/t

- European wheat markets ended mixed yesterday, due to a lack of export demand, combined with markets waiting for news from tomorrow's USDA World Agricultural Supply and Demand Estimates (WASDE) update. In a Reuters pre-report poll, analysts are expecting world ending stocks of wheat to remain unchanged from last month’s estimate (LSEG)

- Paris rapeseed futures (May-24) gained €7.00/t yesterday, ending the session at €421.25/t. The Nov-24 contract was up €5.25/t over the same period, closing at €423.50/t

- Paris rapeseed futures followed US soya bean markets up yesterday. Support came from technical buying and adjustments ahead of tomorrow’s WASDE release, with trade estimates suggesting cuts to the Brazilian soya bean production figure

GB animal feed production remains slow for first half of the season

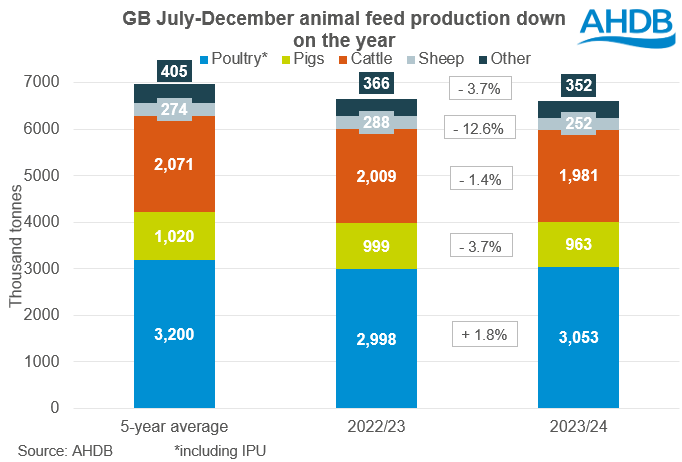

Last Thursday, AHDB published the latest GB animal feed production figures, including data on cereal usage and feed production up to December. The data showed that from July to December this season total animal feed production, including integrated poultry units (IPUs), was down 0.9% on the same period last season, and the lowest level since 2015/16. Pig, cattle and sheep have all seen a yearly decline in feed production so far this season. Though poultry feed production (including IPUs) has seen a yearly rise.

This season to date (Jul–Dec), pig feed production has totalled 962.8 Kt, down 3.7% or 36.6 Kt on the year. Key losses were seen in link/early grower feed (-41 Kt) and pig finishing compounds (-25.6 Kt). While cautious optimism remains in the pig industry, historically high costs of production continue to hinder any significant rebound.

Elevated costs are also continuing to impact cattle feed demand. Cattle and calf feed production this season to date is down 1.4% on the year.

Between July and December, sheep feed production was down 12.6% or 36.2 Kt on the year. This decline was largely due to losses in compounds for growing and finishing sheep, down 15% on the year. As we continue through the winter, focus will now shift to ewe feed. Blends for breeding sheep were down 29% in December.

Finally, due to an uptick in production by IPUs, total poultry feed demand saw a 1.8% yearly increase from July to December this season. While avian flu and high energy prices will continue to be monitored, a strong first half of the season indicates some recovery in the industry.

Please note, AHDB is due to publish its latest agri market outlook tomorrow, including more insight into each of the sectors above.

What does this mean for cereals usage?

This season to date (Jul–Dec), usage of wheat, barley, maize and oats has totalled 2,416.3 Kt, down 2.8% or 69.5 Kt on the year. In AHDB’s latest UK supply and demand estimates, total cereals usage for animal feed is forecast at 12.480 Mt, relatively unchanged on the year and still the second lowest level since 2016/17.

In terms of cereal splits, barley is featuring more heavily in feed rations as of late due to its relative price. The discount of the spot UK average ex-farm feed barley price to feed wheat sat at £24.30/t in January 2024, compared to £15.90/t in the same month a year earlier. Due to its level of discount over wheat, barley usage is expected to remain firm for the remainder of the season. Maize is also forecast to price more competitively into production later in the season, capping any climbs in wheat demand.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.