Arable Market Report – 19 February 2024

Monday, 19 February 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

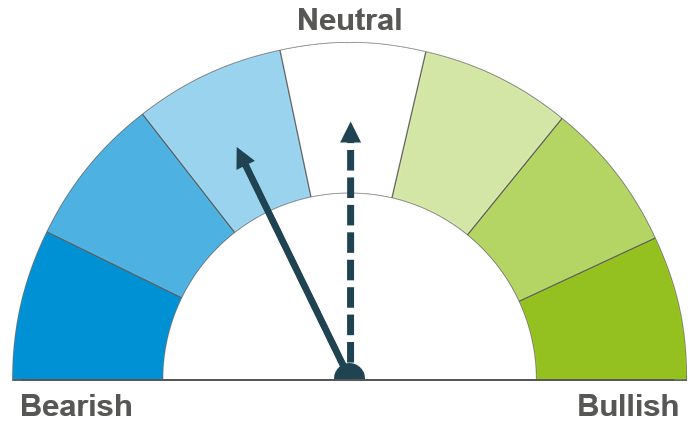

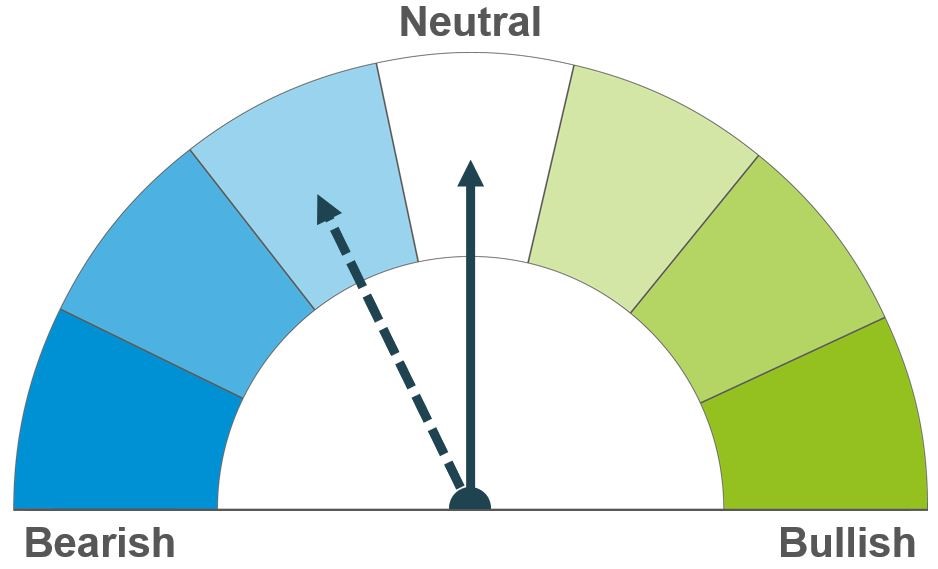

Competitive Black Sea grain and pressure from heavy supplies in maize markets continue to weigh on wheat prices short term. Longer term, the EU wheat balance is expected to be tighter on the year and conditions of planted crops are in focus.

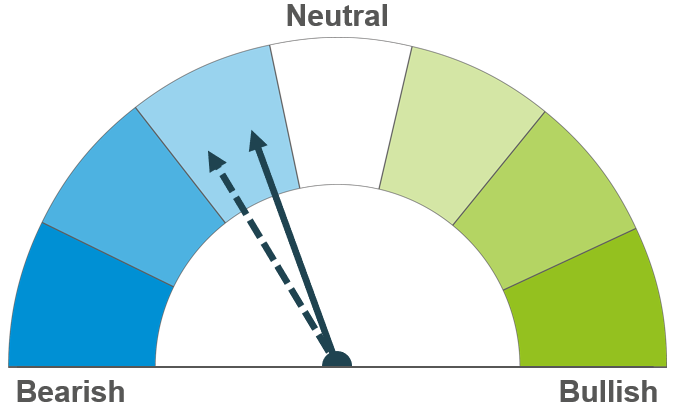

Improved weather in Argentina and rapid plantings in Brazil are weighing on maize prices short term. Longer term, combined Brazilian and Argentinian maize supplies are expected to be heavy and will likely weigh on global markets.

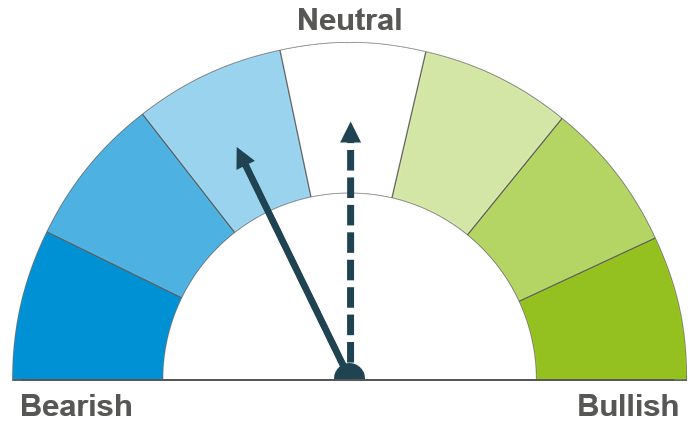

Barley prices continue to track movement in the wider grains complex. Longer-term, European and domestic plantings will be a watchpoint over the spring with question marks over the size of next season’s crop.

Global grain markets

Global grain futures

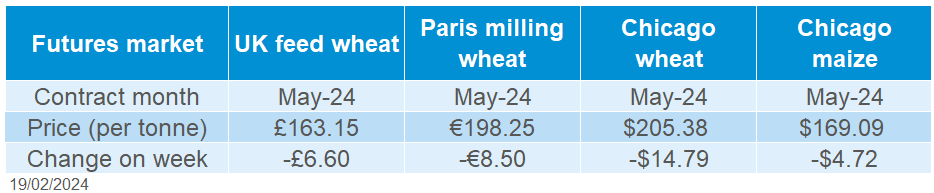

Global grain markets were overall pressured last week. Chicago wheat and maize futures (May-24) were down 6.7% and 2.7% on the week respectively. Paris milling wheat futures (May-24) fell 4.1% over the week, to close on Friday at €198.25/t. Pressure in grain markets came from improved weather in South America, competitive Black Sea supplies and news of heavy US stocks going into 2024/25.

After prior concerns over dry weather in Argentina, beneficial rains over the last week have largely prevented the condition of the country’s maize crop from worsening according to the Buenos Aires Grain Exchange. However, areas in the agricultural south such as Cordoba, were particularly impacted by the dry and hot weather, and will continue to be monitored. Current forecasts suggest more rain is due across agricultural regions of Argentina in the coming week.

Favourable weather also means Brazilian maize plantings are progressing rapidly. Last Monday, Conab said that the Safrinha maize crop was 31.5% planted, compared with 20.4% at the same point a year earlier. Due to lowering grain prices, the size of the Safrinha crop is still disputed, though in its latest estimate, Conab estimated Brazil’s total maize crop at 113.6 Mt, down 13.8% on the year.

USDA said on Thursday that it expects the area planted of maize in the USA for harvest 2024 to fall 3.8% on the year. However, with lacklustre demand, USDA forecasts that US farmers will have the most maize stored in nearly 40 years at the end of the 2024/25 season.

Competitive Black Sea exports continue to weigh on European and domestic wheat markets. Last week, Egypt’s state buyer, GASC, put out a tender for the first time since mid-January. GASC bought 120 Kt of Ukrainian and 60 Kt of Russian wheat for $255.00/t cost and freight.

Longer-term, the focus is now on European spring plantings, as well as the condition of winter-sown crops. On Friday, FranceAgriMer published data showing that the condition of France’s soft wheat crop was at its worst in four years following the rain-disrupted sowing campaign. Spring barley planting in France has also got off to a slow start. By 12 February, planting was just 20% complete, compared with 54% last season, and the five-year average of 25% (FranceAgriMer).

UK focus

Delivered cereals

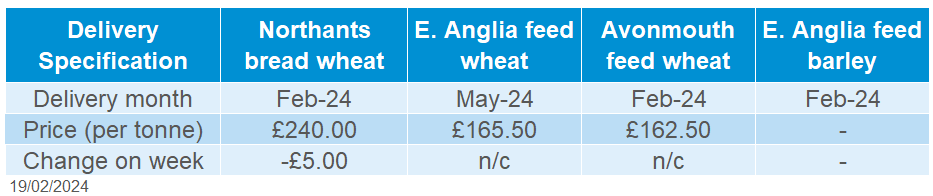

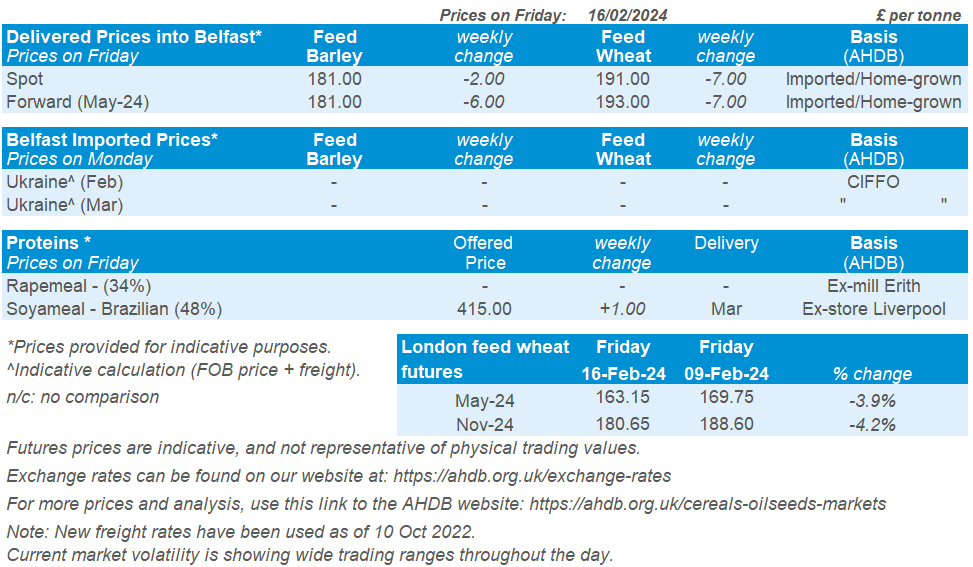

Domestic wheat futures followed global price movements down again last week. UK feed wheat futures (May-24) closed on Friday at £163.15/t, down £6.60/t on the week. The Nov-24 contract was down £7.95/t over the week, closing on Friday at £180.65/t.

Delivered prices followed the direction of futures markets from Thursday to Thursday. Feed wheat into East Anglia for May delivery was quoted at £165.50/t on Thursday, with no weekly comparison. Bread wheat delivered into Northamptonshire for February was quoted at £240.00/t, down £5.00/t on the week. Pressure on feed wheat prices continues with constrained demand from the GB animal feed industry.

The UK trade data has been updated, including import and export figures up until the end of December 2023. This season to date (Jul–Dec), wheat imports were strong, totalling 1.037 Mt, up 45% on the year. As expected in our latest UK supply and demand estimates, this rise is likely due to the continued demand for higher quality milling wheat, but the UK is currently unable to meet these demand levels domestically.

AHDB’s latest GB fertiliser prices have been released, including January 2024 data. The figures show that the price for imported AN have eased once again in January. However factors such as weather, conflict in the Middle East and global price movement remain key watch points.

Oilseeds

Rapeseed

Soya beans

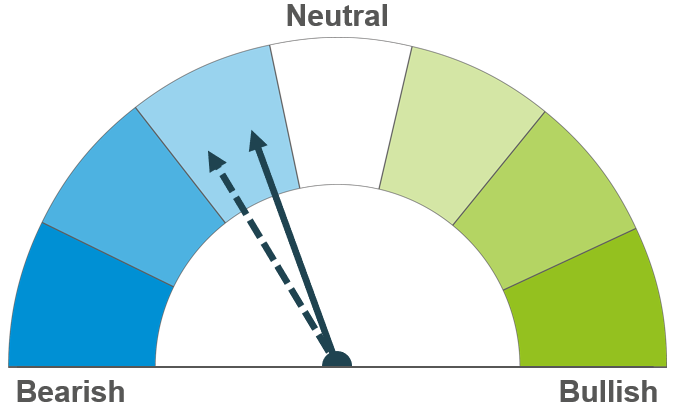

Short term rapeseed prices are supported over the prospects of lower supplies from Europe and Ukraine for 2024 harvest and crude oil. However, longer term prices could still drop with the oilseed complex, especially if large US soya bean crops are realised.

South American crop prospects are bolstered from recent rains and harvest has started in Brazil, meaning pressure on prices is expected. Longer term, forecasts of large US production and stocks for 2024/25 could weigh.

Global oilseed markets

Global oilseed futures

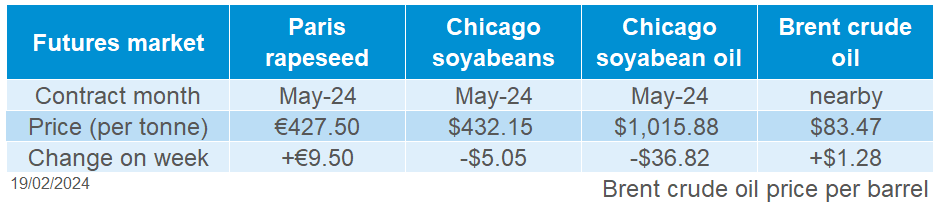

Pressure continued on Chicago soya beans futures (May-24) as the contract ended down 1.2% across the week, closing Friday at $432.15/t. Adding to price pressure was improved South American crop prospects, lacklustre demand and insight into 2024/25 US soya bean plantings.

Widespread rain across Argentina’s agricultural region over the last seven days has bolstered the soya bean supply outlook. Many agricultural consultancies peg this crop at 50 Mt or more; the Buenos Aires Grain Exchange estimates the crop at 52.5 Mt. Weather throughout the end of January and February has been ideal for growing conditions. This large crop is outweighing some of the crop losses from Brazil, whose soyabean harvest was 31.1% complete on Friday, ahead of the same point last year when it was 24.8% (Patria Agronegocios). With both nations supplying large soyabean crops to the global market, which could have the ability to continue pressuring prices.

Further to that, the USDA Agricultural Outlook Forum last week provided a further bearish sentiment for markets. US soya bean plantings for 2024/25 are expected to rise 4.7%, as oilseed is favoured over maize. USDA expects a considerable build-up in soya bean stocks in 2024/25, higher than market expectations – read more information here.

As for demand, it has been weakening from China as a shrinking pig herd reduces demand for animal feed.

US soya beans export sales for 2023/24 (to week ending 8 Feb) were estimated at 340.8 Kt, up 4% from the previous week. But the sales are down 23% from the prior four-week average, and at the low end of trade estimates of 300–800 Kt (USDA, LSEG).

The National Oilseed Processors Association (NOPA) estimated the January US soyabean crush figures at 5.1 Mt. This is down 4.9% in comparison with December’s record and more than was expected. But the January 2024 figures remain up 3.8% from a year ago.

Rapeseed focus

UK delivered oilseed prices

Despite pressure in soyabean markets, rapeseed prices gained, with marginal support in crude oil. Further to that, it was reported on Thursday that the combined Ukrainian grain and oilseed harvest may fall 15–20 % in 2024 from a smaller sown area (UCAB business association). With supplies of EU rapeseed anticipated to be lower for 2024 harvest, this reduction from Ukraine could further tighten the oilseed/vegetable oil market as Ukraine is a large supplier to the EU market.

Paris rapeseed futures (May-24) closed Friday at €427.50/t, gaining €9.50/t across the week. Gains were more limited for new crop futures (Nov-24), which closed at €429.25/t, gaining €4.25/t over the same period.

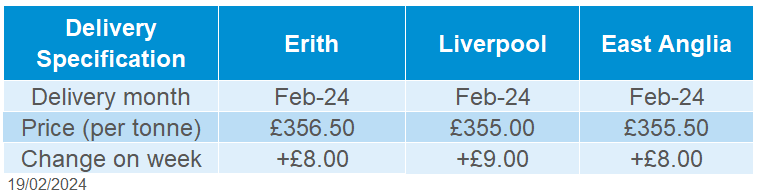

Domestic delivered rapeseed (into Erith, Feb-24) was quoted at £356.50/t on Friday, gaining £8.00/t on the week. Hvst-24 was quoted at £356.00/t, up £7.50/t over the same period for the same location.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.