Imported AN prices ease further in January: Grain market daily

Wednesday, 14 February 2024

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £168.25/t, down £1.50/t from Monday’s close. New crop futures (Nov-24) closed at £187.25/t, down £0.45/t over the same period.

- European wheat markets saw few changes yesterday, as support from a weaker Euro was weighed on by ongoing competition from Black Sea supplies and a lull in international demand.

- Despite downwards pressure in US soyabean markets yesterday, Paris rapeseed futures (May-24) closed yesterday at €425.00/t, gaining €3.25/t from Monday’s close. The Nov-24 contract ended yesterday’s session at €428.50/t, up €2.25/t.

- The French farm ministry said yesterday that it has estimated rapeseed area for the 2024 harvest to be at 1.34 Mha, down from its previous estimate of 1.35 Mha.

Imported AN prices ease further in January

AHDB’s latest GB fertiliser prices were published yesterday including data up to January. The figures showed that the spot price for imported ammonium nitrate (AN) eased last month to £350/t. This is down from £354/t in December, and down from £682/t in the same month last year. However, before the outbreak of war and prior to the European energy crisis, the five-year average (2017-21) for January was £241/t, meaning the price of imported AN remains historically elevated.

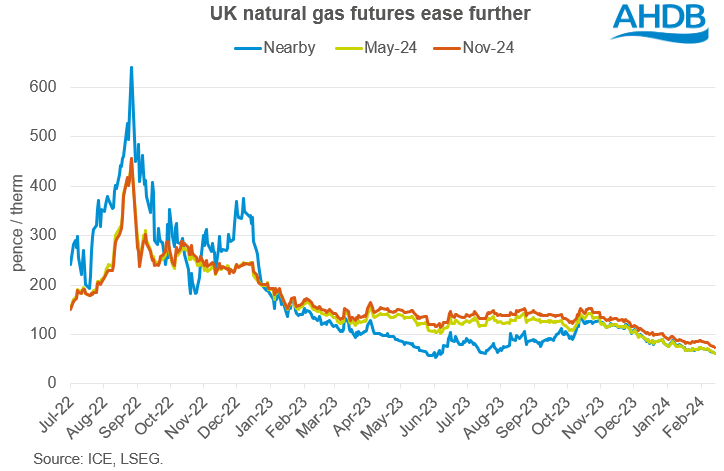

As could be expected, with natural gas accounting for approximately 60% of nitrogen fertiliser production costs, fertiliser prices have eased alongside natural gas futures. Yesterday, nearby UK natural gas futures closed at 62.19 pence/therm, the lowest since mid-July.

European natural gas prices have eased as of late, with the second-warmest winter in the last decade so far leading to sluggish demand for gas. Lacklustre demand has meant that European supplies have built up and the market remains well stocked at 73% full in the EU. Longer-term, weather forecasts also indicate that it is unlikely we will experience a cold spell next month, helping keep storage sites full, and easing pressure over the summer.

However, strategists at Goldman Sachs suggest that it is too early to say that Europe is through its energy crisis. There are concerns that the switch to dependency on Liquified Natural Gas (LNG) haven’t fully resolved the lost imports from Russia, and as such, prices remain vulnerable to any supply interruptions, or demand volatility. Some traders also suggest that given the current lower prices, we could expect to see a technical rebound in contracts imminently.

The conflict in the Middle East also remains a watchpoint in gas markets. The International Energy Agency (IEA) has warned that the escalation of regional conflict could significantly impact LNG flows in the area. Deliveries of LNG from Qatar to Europe would usually travel through the Red Sea and Suez Canal, though since 16 January, no LNG carriers have come through this route. The IEA has also estimated that demand in Europe will grow 3% this year, though remain 20% below its pre-energy crisis levels (Financial Times).

What does this mean for GB fertiliser prices moving forward?

Looking ahead, domestic fertiliser prices will likely continue to follow movement in the UK and European natural gas markets. While currently EU natural gas stocks are high and demand sluggish, factors such as weather, conflict in the Middle East and global price movement are all key watchpoints. We could also see some technical buying over the next few weeks, which could in turn filter through to fertiliser markets.

AHDB’s Agri-market outlook published last week included more insight into fertiliser and what we can expect from 2024.

Read the full report on the market outlook for nitrogen fertiliser.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.