Russian wheat price weighs on global market: Grain market daily

Tuesday, 13 February 2024

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £169.75/t, unchanged from Friday’s close. New crop futures (Nov-24) closed at £187.70/t, down £0.90/t over the same period.

- There was pressure on the Paris wheat market yesterday as adequate global wheat stocks and strong export competition continue to pressure the market.

- Russia’s Agriculture Ministry has proposed to increase the grain export quota up until the end of June 2024 to 28Mt, increasing the current quota of 24 Mt (Interfax). Read more information on this below.

- AgRural (Brazilian Ag consultancy) has raised their second-maize crop production to 91.2 Mt from 86.3 Mt previously, citing that planted area is larger than anticipated on an increased planting window from some soyabean crops not being sown at the end of 2023. Conab estimated planted area of the second maize crop at 31.5% complete (to 10 Feb), up from 20.4% last year.

- Paris rapeseed futures (May-24) closed yesterday at €421.75/t, gaining €3.75/t on Friday’s close. Rapeseed gained with soyabeans which were supported on bargain buying and consolidation.

Russian wheat price weighs on global market

Old crop wheat prices remain under pressure. UK wheat futures (May-24) have lost over 14% since the start of 2024, and pressure continues to loom on the market. Large global demand appears to be absent with North African and Southeast Asian demand currently subdued on the hopes grain prices move even lower.

The domestic price has weakened with Paris wheat futures, which have reduced to compete for export business with Russian grain. For context, up until 28 January, the EU has exported 18.2 Mt of common wheat, with expectations that exports are going to reach 31 Mt. This means between the end of January to June, 12.8 Mt needs to be exported or risks weighing on the closing stocks of the EU’s balance.

However, to shift this grain, prices need to be competitive to other origins such as Russian wheat. Russia’s market share has been growing with large production over the last couple of years. Last week it was reported that their wheat price has fallen further, bringing down the floor of global wheat prices.

Moreover, quarterly official data showed that the level of wheat stocks in Russia are at a record-high. As of January 01 2024, stocks were pegged at 36.5 Mt up 1% year-on-year (Sovecon, LSEG). Also, Russia’s Agriculture Ministry proposes to increase the grain export quota (up until June 30) to 28 Mt, increasing by 4 Mt on current volumes.

Sovecon’s latest data estimates February grain exports (wheat, barley & maize) at 3.7 Mt, down from 4.6 Mt the month before. 3.0 Mt of that total exports is made up of wheat.

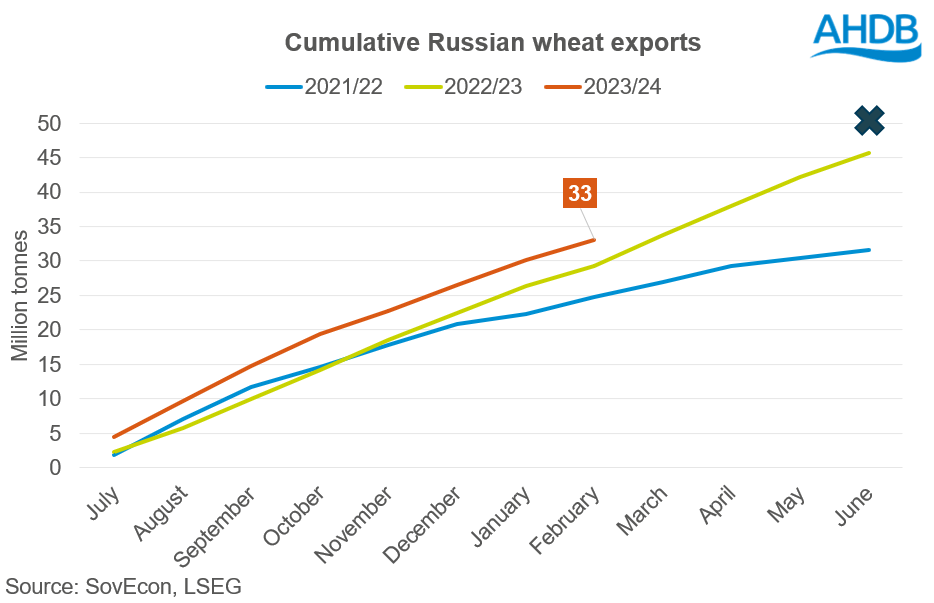

If February data is as estimated, for 2023/24 Russia will have exported 33.1 Mt of wheat, with anticipation that wheat exports are going to reach near 50 Mt for the 2023/24 market year.

With all this information and no weather story in South America, grain prices will most likely remain under pressure as stocks will need shifting and clearing before 2024 harvest, there is only so much grain that can be taken into the 2024/25 marketing year.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.