Arable Market Report - 07 August 2023

Monday, 7 August 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

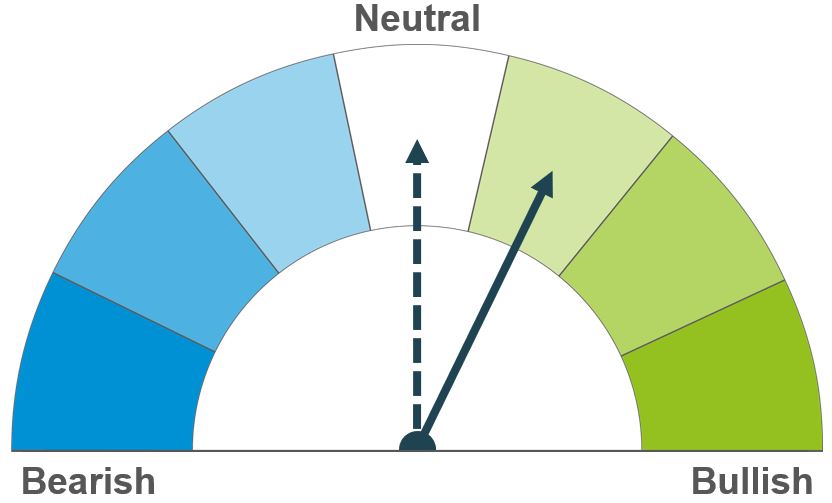

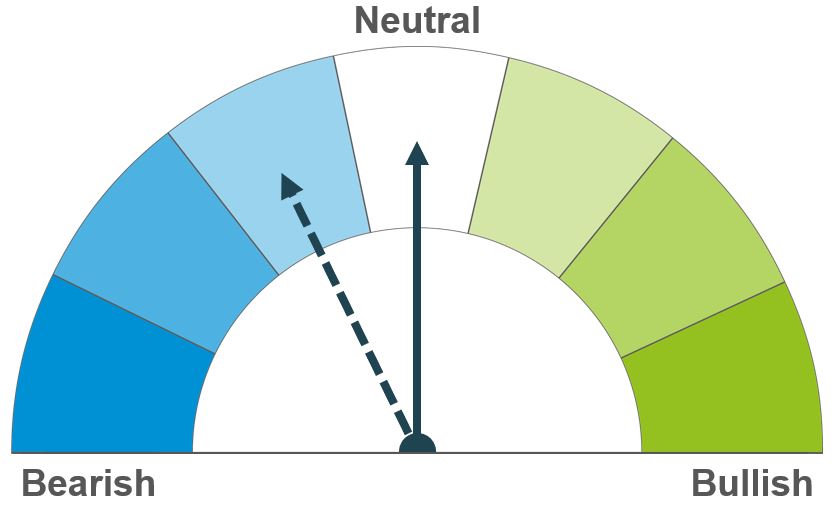

Wheat

Access to Black Sea wheat remains in focus, due to the latest developments in the war. Wheat stocks in many major wheat exporting countries are already expected to fall; any further depletion could push up wheat prices relative to other grains. But projections for ample global maize supplies could weight on the longer-term outlook for grain prices.

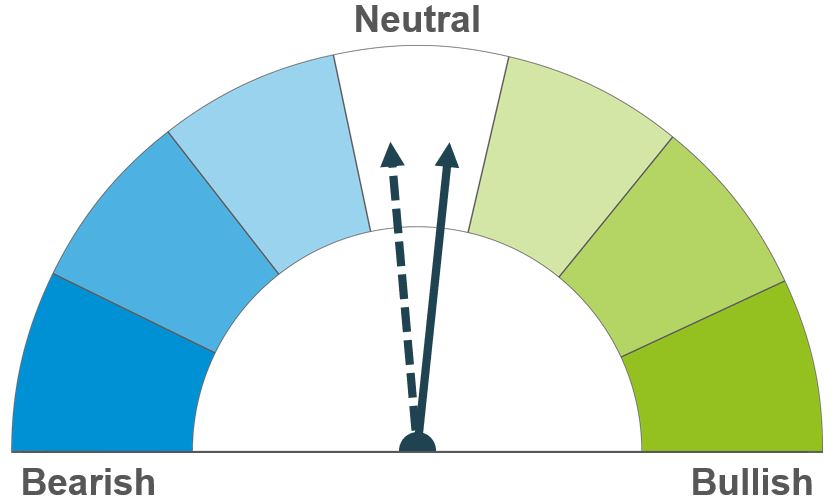

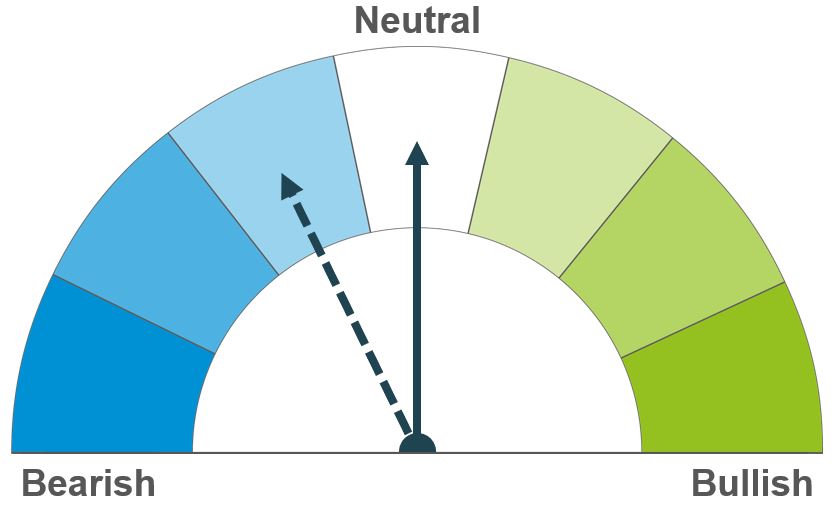

Maize

Uncertainty remains until the US maize crop is harvested. But, with confidence in the US crop increasing and a positive outlook for South America, the long-term outlook for maize is turning bearish.

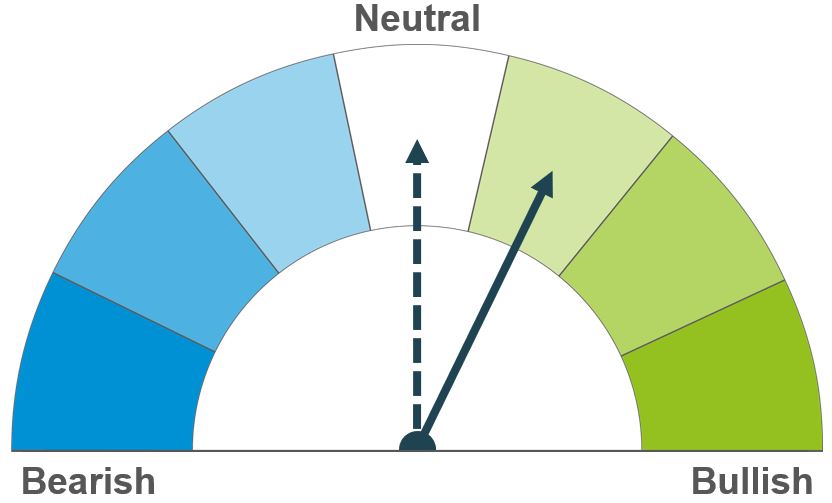

Barley

Feed barley prices could find some support relative to other grains, due to the tightness of global barley supplies. However, projections for ample global maize supplies could weight on the longer-term outlook for grain prices.

Global grain markets

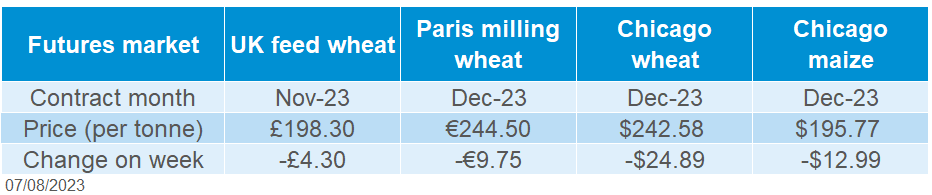

Global grain futures

Global grain futures weakened steadily last week until Thursday night. Markets focused on favourable weather forecasts for US maize, plus the competitiveness of Russian wheat. Prices rose on Friday after Ukrainian drones attacked and damaged a Russian warship in the important Russian port of Novorossiysk. However, the market still lost ground Friday-Friday.

As earlier planted US maize crops start to move out of their reproductive stage, confidence in the crop is starting to grow. Last week, StoneX forecast the US average yield very close to the official USDA figure, released in July. The USDA releases its updated World Agricultural Supply and Demand Estimates (WASDE) out on Friday. These will include the first survey-based forecast for the 2023 US maize yield.

Meanwhile, yields from the second (Safrinha) Brazilian maize crop of the 2022/23 season are high, with over half the crop now harvested (AgRural). Plus, an early projection by local analysts Celeres suggests that 2023/24 total Brazilian maize output could be even bigger than in 2022/23.

Wet weather is hampering harvesting across northern Europe. In particular, there are growing concerns about yields and quality in Germany. More showers are forecast in Germany and parts of eastern Europe in the week ahead.

India is considering reducing or removing its tariffs on wheat imports. The country restricted exports of rice last month to curb domestic food price inflation. Any Indian wheat imports could further deplete stocks in major exporting countries.

China lifted its anti-dumping tariffs on imports of Australian barley last week. This is likely to see Australian barley return to China at the expense of French, Canadian, and Argentine exports.

UK focus

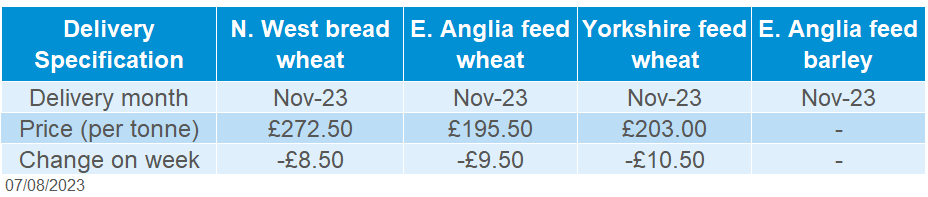

Delivered cereals

UK feed wheat futures (Nov-23) fell £4.30/t over the week (Fri-Fri). The contract followed global markets lower at the start of last week but gained slightly on Wednesday as sterling weakened against both the euro and US dollar. Sterling weakened ahead of the Bank of England's interest rate decision; the rate rose by 0.25% to 5.25%. The Nov-23 wheat price dropped again on Thursday, closing as low as £195.15/t, before lifting on Friday to end the week at £198.30/t.

In AHDB’s delivered price survey feed wheat prices fell largely in line with the futures prices (Thu-Thu). However, bread wheat prices showed smaller falls, as wet weather continued to hamper harvest progress.

Last week’s Analyst’s Insight looked at the costs of drying grain from different moisture levels to 15% and there’s also guidance on sampling, storage, contract tips, and more in AHDB’s harvest toolkit. Plus, look out for highlights from AHDB’s second GB harvest report of 2023 in next week’s Market Report.

Last week, AHDB published GB animal feed and UK human and industrial cereal usage statistics for the month of June 2023. There are now full season totals of usage for the 2022/23 marketing year (Jul-Jun):

- GB compound animal feed production for 2022/23 totalled 11.16 Mt, down 5.7% year-on-year. AHDB analysts look at the outlook for the pig herd and pig feed demand in 2023/24 here.

- UK flour millers (inc. bioethanol and starch) used a total of 6.13 Mt in 2022/23, up 2.1% year-on-year.

- UK Brewers, Maltsters, and Distillers (BMDs) used 1.97 Mt of barley in 2022/23, 5.0% more than 2021/22. BMDs also used 1.06 Mt of wheat, up 6.4% year-on-year.

- Oat millers in the UK milled a total of 492 Kt of oats, down 1.9% year-on-year.

Oilseeds

Rapeseed

Short-term, the conflict in the Black Sea is adding to price volatility. Longer-term, the global rapeseed market looks well supplied, but Canadian weather is in focus currently as it has been dry.

Soyabeans

Short-term, US weather is pressuring the market, but strong demand and conflict in the Black Sea are filtering through into some support. Longer-term, South America is going to produce large crops going into 2024.

Global oilseed markets

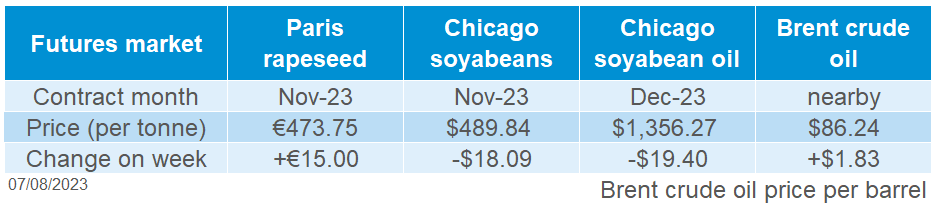

Global oilseed futures

There was pressure across the week for Chicago soyabean futures (Nov-23), which ended the week down 3.6% at $489.84/t.

Driving much of the pressure at the start of the week was expectations of cooler and wetter weather across the US Midwest in August. This is expected to bolster crop development and reduce concerns over heat damage to US crops. Despite strong demand for US soyabeans, the weather story outweighed this. There was a slight uptick for Chicago soyabean prices at the end of the week from stronger crude oil and vegetable oil markets, plus the concerns in the Black Sea. But the market was still down across the week.

At the start of last week, the USDA crop condition report (to 30 July) estimated that soyabeans were 52% good-to-excellent. This was down 2% from the week before, slightly more than trade expectations of a 1% fall. There will be another update this evening on crop conditions. Widespread rains over the US Midwest in the next seven days will improve the outlook for this crop.

The USDA reported strong demand for US soyabeans. Export sales (to week ending July 27) were estimated at 2.7 Mt, near the high end of trade expectations, which ranged from 1.1 Mt to 2.9 Mt (Refinitiv). Despite this strong demand, weather forecast mentioned above outweighed this news.

Looking longer term, Brazilian soyabean production is expected to grow by 3.7% to 163.5 Mt in 2023/24. Farmers are expected to plant a larger area than for 2022/23; the record 2022/23 crop is currently being exported (StoneX).

According to a Reuters poll, Malaysian palm oil inventories at the end of July are likely to rise to a five-month high of 1.79 Mt, as higher production offsets an increase in exports. Official Malaysian Palm Oil Board data is scheduled to be released this Thursday (10 Aug). Longer-term market direction will be set by the intensity of the El Niño weather phenomenon, which is expected to bring drier weather to Southeast Asia.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed Friday at €473.25/t, gaining €15.00/t across the week. The rapeseed market followed the drop with Chicago soyabeans at the start of the week but gained towards the end of the week.

Supporting the market at the end of the week were concerns of the escalation of conflict in the Black Sea, which also supported soya oil and crude oil markets. There were further gains as Canadian canola futures gained at the end of the week on dry weather on the Canadian Prairies. There are some concerns of lower canola yields this year from dry Canadian conditions.

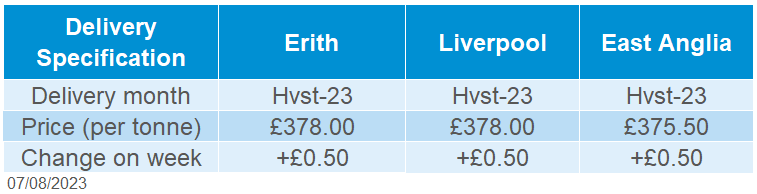

Delivered rapeseed (into Erith, Hvst-23) was quoted at £378.00/t, gaining £0.50/t across the week. The AHDB delivered survey didn’t capture the higher weekly gains seen on the Paris futures market due to the time of the survey. The survey was conducted mid-morning on Friday 04 August, while the Paris market ended Friday’s session with further support.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.