Could we see some recovery in pig feed demand this season? Grain market daily

Wednesday, 2 August 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £195.65/t yesterday, down £2.20/t from Monday’s close. The Nov-24 contract fell £1.65/t over the same period, ending the session at £198.00/t.

- The US had been told yesterday that Russia is prepared to return to talks on the Black Sea Initiative deal, though according to the US envoy to the United Nations, there hasn't been any evidence to support this yet. In the early hours of this morning, Russia attacked several of Ukraine’s grain ports. This included an inland port across the Danube port of Izmail, Ukraine’s main alternative route for grain exports following the end of the deal (Refinitiv).

- Paris rapeseed futures (Nov-23) were pressured down €4.25/t yesterday, to close at €440.75/t. The Nov-24 contract was up €1.75/t over the same period, closing at €456.75/t.

- Today, industry and government are meeting to discuss the recently announced potential changes to the recognition of the UK adhering to the Renewable Energy Directive (RED) II by the European Commission. This currently allows UK cereals and oilseeds to be consumed in the EU as bio-fuels and it's removal could mean that we have a greater volume of grain on the domestic market, potentially increasing domestic stocks. AHDB have delivered valuable impartial evidence and analysis to industry on what impacts this could have. Further in-depth analysis will be published next week.

Could we see some recovery in pig feed demand this season?

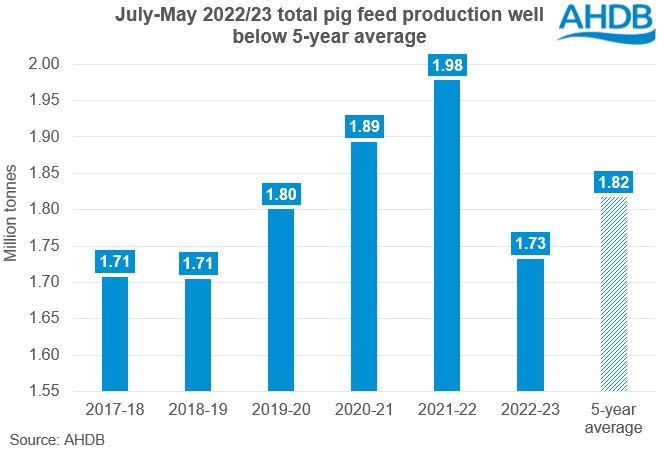

As was documented over the last marketing year, the 2022/23 season saw reductions in cereals usage for animal feed. Pig and poultry feed demand saw the biggest declines in percentage terms, with total pig feed production from July to May down 12.4% when compared with the same period the previous year.

Based on 5-year averages (2017/18 – 2021/22), pig feed production accounts for c.17% of total animal feed production, so it’s important to consider what might happen to herd numbers going forward, as this will impact domestic cereals usage.

According to recent analysis, the UK pork marketplace remains very tight with year-to-date production and slaughter figures for the first half of the year recording significant year-on-year declines. From January to June this year, UK pig meat production totalled 457.1 Kt, the lowest volume for that period in 6 years.

However, on Monday, AHDB published the latest quarterly pork cost of production and margin estimates for 2023 Q2. These estimates show improvements in cost of production and net margins, which have not been seen since 2020 (see more information below).

Anecdotal reports generally suggest that a gradual recovery can be expected in the pig herd, and that there is cautious optimism in the sector. In the June pork market outlook, breeding herd numbers were still expected to increase by 7,000 head between June 2022 and June 2023.

If we do in fact see this gradual rebound in the pig herd, we could see feed demand begin to pick up and these recent declines in feed to shrink over the next few months. Though it is unlikely we will see pig feed production increase back to 2021/22 levels anytime soon.

Q2 2023 Pork cost of production

These estimates use performance figures for breeding and finishing herds*. It indicates that the full economic cost of production for Q2 2023 is estimated at 196p/kg deadweight, with margins per slaughter pig estimated at £22 per head. The estimated cost of production has fallen by 17p/kg from 2023 Q1, when the estimated cost of production stood at 213p/kg.

Feed costs have fallen again from the first quarter of 2023 by 17p and now make up an estimated 63% of total costs in the second quarter of 2023. This marks the lowest percentage of feed costs as total costs since Q3 in 2020.

However, interest rates continued to rise in Q2 of 2023 which put pressure on costs associated with buildings, mortgages, and any related finance.

Pig prices have risen throughout Q2 2023, up 10p to 221p/kg (APP), and up 13p to 221p/kg (SPP) from Q1. These historically high prices helped bring the net margins to levels not seen since Q3 of 2020.

*Due to changes in provider, the figures for Q2 2023 feeding and breeding herds use twelve-month performance data from 31 March 2023.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.