April sheep meat imports down on the year as exports remain stable

Friday, 30 June 2023

Imports

Fresh and frozen sheep meat imports have seen a reduction from March levels, as shipments particularly from New Zealand continue to fall. Imports totalled just under 3,700 tonnes in April, a drop of 23% from the previous month. Compared to April 2022, shipments into the UK have fallen by 41%, equalling 2,500 tonnes. On the five-year average, shipments for April 2023 have fallen by 3,350 tonnes.

New Zealand shipments have seen the largest decline on the month, down 1,200 tonnes, a fall of 36%. On the year, compared to April 2022, imports from New Zealand have fallen by almost 50%, nearly 2,000 tonnes. Imports from Australia remain above March’s level, at 830 tonnes, an increase of just under 200 tonnes. However, there has been a fall of 360 tonnes from import levels seen in the previous April. As a result of the Free Trade Agreement between the UK and Australia, there is a tariff-free quota that allow shipments of Australian sheep meat into the UK without tariffs. As of 26 June 2023, 4% of the total quota has been filled (580 tonnes); this quota came into force on 31 May 2023. The quota provides access for up to a further 14,150 tonnes to be shipped in the year ending 31 December 2023 in product weight. This is, however, still lower than the previous quota of tariff free access in place at 15,349 tonnes (carcase weight equivalent), following the UK’s departure from the EU. The differences in trade terms, particularly the movement from carcase weight equivalent to product-coded weight, may have an impact.

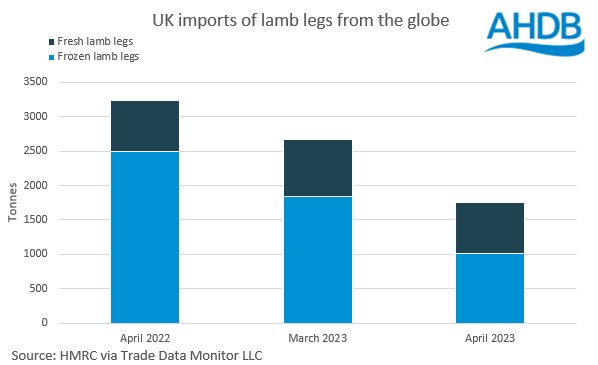

In terms of the products shipped into the UK, frozen lamb legs remain the largest product, at 1,020 tonnes in April. However, quantities have fallen by 820 tonnes (45%) from March, and down almost 1,500 tonnes (59%) in April 2022. Second to this is fresh lamb legs, at 735 tonnes in April. This is a small decline of just under 100 tonnes (12%) from March’s level, and levels remain equal from April 2022.

Exports

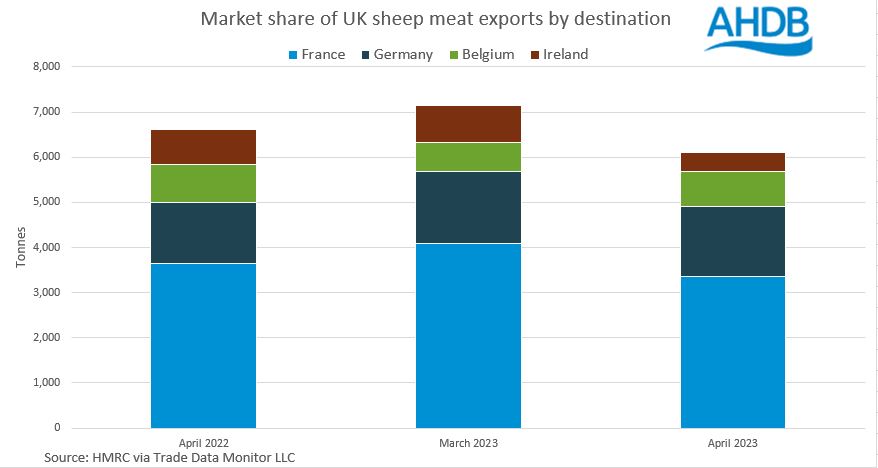

Exports of fresh and frozen sheep meat totalled 7,200 tonnes in April, down 1,700 tonnes from March, a fall of 19%. March’s export volumes were the highest within the last 12 months, hence the large decline. Compared to the same time in the previous year, volumes exported remain stable, down only 160 tonnes (2%).

France presents the largest destination for UK sheep meat exports, at 47% of the total in April 2023, which is a slight decrease of 3% from 2022. Exports to France totalled 3,400 tonnes in April, a fall of 724 tonnes from the previous month. Looking at the previous April, exports have fallen by 285 tonnes. Exports to Germany totalled 1,500 tonnes in April, a minor drop of 62 tonnes from March’s levels. Exports have seen growth on the previous year, up 200 tonnes, as the share of exports to Germany has grown from 18% to 22%.

Fresh lamb carcases remain a key product exported, sitting at 5,800 tonnes in April. This is a fall of just over 1,000 tonnes from March’s levels, which stood at 12-month highs. Despite the fall over the month, lamb carcase exports have grown on the year, up 325 tonnes (6%). This has helped contribute to growth in the share of lamb carcases exported, up from 75% in April 2022 to 81% in April 2023.

Fresh bone-in cuts have also suffered from a fall in export volumes, hitting 820 tonnes in April, a fall of 325 tonnes on the month. A similar drop has been seen on the year, down 275 tonnes from April 2022. This has led to a fall in the share of exports from 15% to 11% in 2023.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.