Australian sheep meat in the UK

Monday, 21 June 2021

The UK has recently agreed a Free Trade Agreement with Australia, which among other things will increase market access to the UK for Australian sheep meat.

Some details of the deal have been released by the Australian Minister for Trade:

“Sheep meat tariffs will be eliminated after ten years. During the transition period, Australia will have immediate access to a duty-free quota of 25,000 tonnes, rising in equal instalments to 75,000 tonnes in year 10. In the subsequent five years a safeguard will apply on sheep meat imports exceeding a further volume threshold rising in equal instalments to 125,000 tonnes, levying a tariff safeguard duty of 20 per cent for the rest of the calendar year.”

Australia already has 15,349 tonnes (carcase weight) of tariff free access to the UK for sheep meat, following the UK’s departure from the EU.

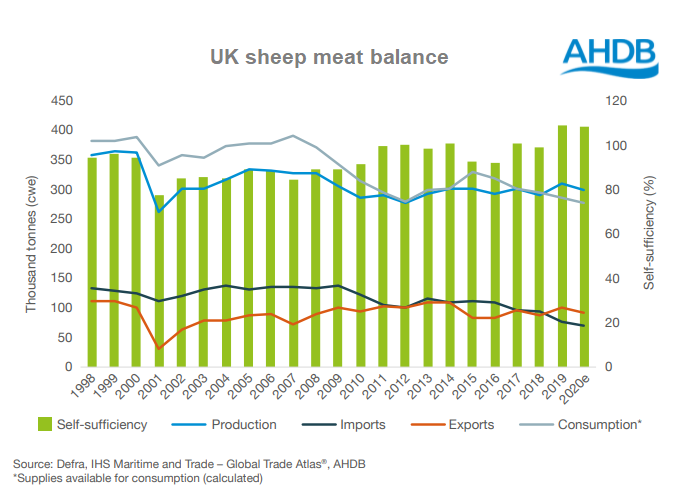

Australia dominates the global sheep market when it comes to export volumes, with New Zealand a close second. The UK is a distant third, but it is also the fourth biggest importer of sheep meat. Not including 2020’s unusual volumes, over the past 10 years the UK has imported an average of around 87,500 tonnes of fresh and frozen sheep meat each year. New Zealand has typically supplied 70% of that, and Australia 13% (11,000 tonnes), most of the rest comes from the EU. It’s worth noting that volumes from both Australia and particularly New Zealand have been falling in recent years, as total UK imports have fallen, but also as opportunities in growing markets closer to home have presented themselves.

How much Australian sheep meat could we expect?

We are already working with the agricultural economists at Harper Adams University to get precise numbers on the possible impact of this trade deal. We intend to publish results of this modelling when the full details of the deal are released – and ahead of scrutiny by the Trade and Agriculture Commission and parliament.

In the meantime, Australia is coming out of a period of extended drought, and it is likely it would take some time for supply chains to develop to the satisfaction of UK retailers. However, ABARES forecasts sheep meat export volumes to increase by 5% in 2021/2022 to 435,000 tonnes in total, and notes that the country has historically low sheep numbers. Australia last had fewer than 66 million sheep in the early 1900s.

Although Australia has access to a wealth of markets around the world, the UK is toward the premium end in terms of price. Australia is typically a keen user of its EU quota. Of the 494,000 tonnes of sheep meat that Australia exported in 2019, 150,000 tonnes went to markets that paid more on average than the UK, and 336,000 tonnes went to markets that paid less on average.

Together, these suggest that Australian exporters would likely wish to upgrade at least some of their volumes away from other markets towards the UK. However, it is possible that behaviour may be relatively short-lived. New Zealand has been pivoting exports away from Europe/UK towards Asia, driven by higher achievable prices and a growing middle class in that market. So although in the short term the UK market may be a better prospect for Australian exporters compared to other markets it has right now, this may not always be the case.

The headlines have focused on the overall volume of quotas for sheep meat, but how this is applied will be critical. It’s reasonable to assume this is considered carefully by decision-makers, not just on how it is divided up between fresh and frozen product for example, but possibly going down to specific commodity codes and even seasonality. New trade deals will understandably receive detailed scrutiny from our farmers, and that will certainly the case for sheep meat. Not only was it a particularly sensitive product area in UK/EU discussions but the impact of the phase out of direct payments will be particularly severe for the grazing livestock sector.

This brings us back to the fact that more FTAs will connect us more closely with world markets and prices. For UK sheep producers, there is a clear rationale not only to focus on costs, but also to prepare for more volatility. These changes are not immediately straightforward to manage in a sector where risk management options are currently limited, and the questions on maintenance of standards and impacts of future trade deals remain areas of development that we will be analysing.

For more information on the UK’s position in the global sheep meat market, and future opportunities, read this Horizon report.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.