Analyst Insight: A look at feed markets

Thursday, 21 May 2020

Market Commentary

- UK new-crop wheat futures (Nov-20) closed yesterday at £169.25/t, a rise of £3.55/t on the day. A weakening of sterling and a tightening new crop picture has driven the rise

- Yesterday, the Russian agriculture ministry downgraded its expectations of 2020/21 cereal production, expecting a total grain harvest of 120Mt, down 5.3Mt from its previous forecast. The sustained dry weather across several key regions has affected expected yields. If realised, this harvest would fall below last year by 1.2Mt.

- US soyabean futures rose to a week high, bolstered by hopes of renewed export demand and a weakened dollar. The Nov-20 soyabean contract closed at $313.79/t yesterday, a rise of $3.12/t from Friday.

A look at feed markets

The closure of the food service industry for almost two months now has reduced demand for meat and grain products. The impact of coronavirus on meat and dairy production will likely translate to a fall in demand for feed grains. Anecdotal industry reports suggest this effect on demand is likely to persist for the next six-to-twelve months at least.

Demand shrinking could relieve pressure on the lower wheat supplies next season. Regardless, we are likely to see imported maize feature more in feed inclusions next season due to its cheap availability.

One supporting aspect for feed demand in the short-term would be the potential decline in pasture quality. Though grass quality has fared well recently, there are concerns going forward over the lack of significant rainfall. The latest weekly figures highlight a large drop in growth rate at 48.9 kg DM/ha in the week ending 25 May.

Market pressures

The impact of coronavirus on demand is another factor for feed markets. The closure of the education, hospitality and food service sectors since March 23 has reduced demand for meat and dairy products. Deadweight beef and lamb prices initially plummeted, but have seen some recovery recently. Supermarket demand, especially for BBQ cuts have supported prices. Since April, many dairy producers have had to curb production where possible. Instances of herd reductions will have an impact too, creating a knock-on effect for feed demand.

Longer term trends in domestic feed demand are also key, GB pork and poultry (compound + IPU) sectors have seen an increase of 6.0% and 3.4% respectively for total feed production following growth in meat production this season. Over the same period, total sheep and cattle and calf feed production declined 6.8% and 6.2% respectively. With beef and lamb sectors now having the option of grazing to supplement feed, total feed production is expected to decline this season, unless pasture quality declines.

Usually, animal feed production peaks in March then tails off in the months after, as the option of grazing pastures becomes preferred. In 2018, following the "Beast from the East" and following drought, we saw an increase in domestic compound feed production.

With dry conditions an issue so far this season, grass growth will need monitoring.

Could grass growth then have an impact?

Seasonal grass growth data (kg DM/ha) up to May 25, shows 2020 growth is trending below the five-year average. The lack of significant rainfall events since mid-March has created dryness concerns for much of the UK. Over April, the UK received 40% of long-term average rainfall figures for the month.

With the second-cut of silage approaching, quality is vital for this stage. Should the lack of rainfall persist and we see grass quality nosedive, it would be feasible to see an uptick in animal feed production to supplement poorer grazing quality over the shorter term.

What is the supply situation?

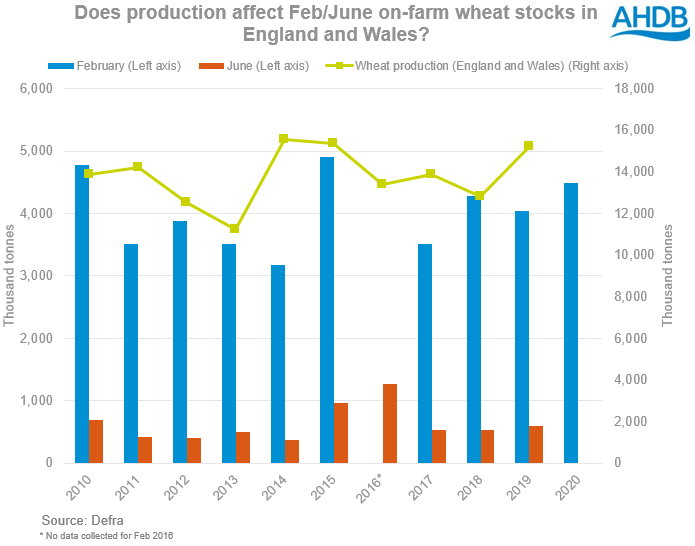

Wheat supplies held on farm were estimated at 4.5Mt at end-Feb this year, an increase of 11% on end-Feb 2019. Approximately 29% of wheat production in England and Wales was on farm at the end of February.

Barley stocks on farm were 62% up on end-Feb last year, estimated at 1.2Mt. This means 20% of the England and Wales barley production figure remained on farm by the end of February.

The UK could be set for a sub–10Mt wheat crop next season. Despite the increased old-crop carryover buffering supplies somewhat, availability for feed markets will be lessened.

Last week, we published our production estimates for the 20/21 UK barley crop estimating the crop could be reach 8.3Mt. One developing issue is the lack of adequate rainfall since mid-March. As the dryness persists, crop yields are likely to worsen, making pre-harvest production estimates likely to change too.

Animal feed manufacturers (compound and integrated poultry units) have increased inclusions of wheat and barley in rations in the season-to-March, up 21.9% and 1.5% respectively.

Longer term?

Yesterday, James examined potential import tariffs on wheat that will come into effect at the beginning of 2021. UK imports of wheat classed as below premium milling quality will face a £79.00/t tariff. A front-loading of wheat imports could occur as the tariffs come into effect from January 2021. From a feed perspective this will likely result in an increase of imported maize throughout the season, which will be tariff free.

There is likely to be considerable maize imports into the UK to supplement ruminant feed markets next season. Yesterday, new-crop Paris maize futures (Nov-20) closed at £149.67/t. The imported maize price will represent the relative ceiling for domestic feed grain prices. Ukraine is estimated to produce a 39.0Mt maize crop for the 2020/21 season, of which an estimated 33.0Mt is destined for export markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.