Import schedule provides wheat price risk: Grain Market Daily

Wednesday, 20 May 2020

Market Commentary

- New crop (Nov-20) UK feed wheat futures continued to find strength yesterday, in line with global markets. The Nov-20 contract closed up £0.20/t, at £165.70/t, recording its fourth consecutive day of gains.

- Dry conditions in Europe remain a significant watch point for new crop prices, with the two week outlook continue to highlight a lack of rainfall.

- On Monday, the EU released its latest crop condition (MARS) report. The report highlights the challenges faced by the ongoing dryness, reducing yield estimates for new crop winter cereals on its previous estimate.

- Also on Monday, the USDA released its latest crop condition report. Maize and soyabean planting continued to progress rapidly. Spring wheat planting continues behind last year’s pace with cold weather affecting the Northern states.

Import schedule provides wheat price risk

Yesterday, the UK government released its import tariff schedule, which is due to come into force once the UK leaves the European Union on 31 December 2020. For arable, the tariff schedule largely reflects the adoption of EU tariff rates, transformed by currency, whilst for maize the tariff rate has been liberalised to zero.

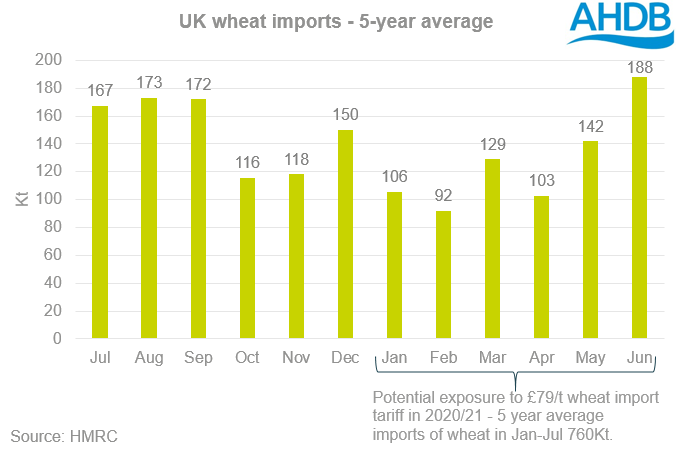

The maintaining of tariffs on wheat and barley reflects the UK historic position as a net exporter in both products. However, this poses a potential risk for the domestic market next season, if there is no trade agreement between the UK and EU.

Next season the UK could be set for a sub 10Mt wheat crop. This, combined with uncertain wheat quality, could mean the UK has a need to import an increased volume of low and medium grade wheat.

The UK is set to adopt a zero rate tariff on high quality wheat; defined as over 13.5% protein, 78kg/hl specific weight and 230s Hagberg Falling Number, but below that, a tariff of £79.00/t is proposed. This could cause supply headaches beyond the end of December, supporting domestic milling premiums.

In reality, the support will be limited; we are likely to see a considerable front-loading of wheat imports through the first half of the season, to compensate for the potential loss of imports in the second half of the year.

The impact of tariffs on wheat is likely to be a short time risk with a somewhat freak year anticipated for wheat production. In a “normal” year, if there is such a thing anymore, UK wheat imports are likely to be minimal and from an importing perspective, are likely to be focused on the higher quality group.

From a feed perspective, in low cost years, the imposition of a tariff would likely drive compounders away from wheat where possible and result in increased inclusions of imported maize.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.