2020 Barley Production Outlook: Grain Market Daily

Tuesday, 12 May 2020

Market Commentary

- UK wheat futures (Nov-20) gained £1.20/t to close at £164.90/t, despite US and European wheat and maize prices declining slightly. The rise was due to a drop in the value of the pound against both the US dollar and euro.

- Paris rapeseed futures (Nov-20) were down €2.00/t to €373.25/t.

- Planting of maize and soyabeans continues at a rapid pace in the US and remains well ahead of the five year average for both crops. Although winter wheat conditions declined slightly and spring wheat planting remains delayed, US prices still declined due to the US dollar strengthening.

- Markets are now waiting for the next supply and demand estimates from the USDA, out at 5pm BST today. The report will include the USDA’s first forecasts for 2020/21.

2020 Barley Production Outlook

With the 2020/21 season not that far away, the focus is increasingly turning to production outlooks and the anticipated supply for next season. This week we will be focusing on the outlook for barley in 2020/21 and the challenges faced.

We are starting this week with a regional and national production outlook, using a combination of planting surveys and the ADAS Crop Conditions reports.

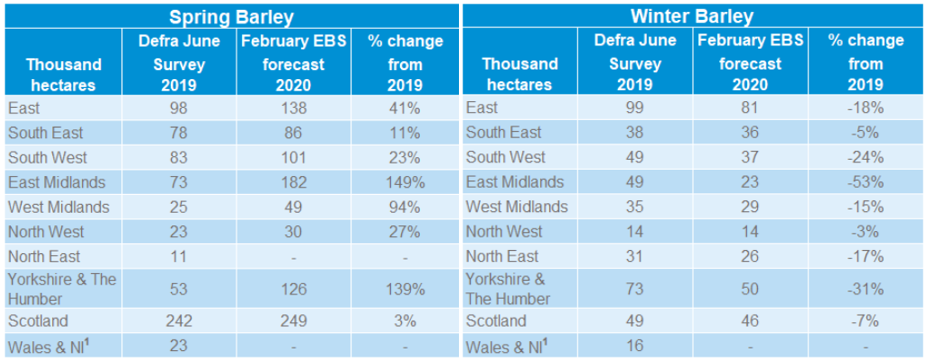

February Early Bird Survey

The February survey found a large swing towards spring barley with the area forecast up 47% from 2019, with an additional 10% more than intended in November. The further increases in spring barley are especially prevalent in those areas most impacted by the wet weather, with the East Midlands and Yorkshire & Humber more than doubling their spring barley area.

In order to get a complete picture of the final area planted for harvest 2020, please help your industry in these uncertain times by completing the planting survey form, click here to complete the form. Five minutes of your time can provide huge value to our great industry, but for this regional look into barley production we are using the February Early Bird Survey as the best currently available data.

Crop conditions

While we know the area of winter barley planted is reduced, owing to the wet autumn, the condition of winter planted barley is also down year on year, potentially negatively affecting yields.

Nationally, the proportion of winter barley in good and excellent condition in March stood at just 45%, down from 95% at the same point in March 2019 (Crop Condition Report). However, the worsening conditions are not evenly distributed, with the South West retaining 100% of the winter barley area in good and excellent condition and the South East also faring well. The West Midlands region was overall facing the worst conditions with 45% of the crop in very poor and poor condition.

Until such a point as there are more years of data to base yield forecasts off assumptions and scenarios are needed. Using the March condition scores for our yield scenarios;

- Very Poor represents 5-year low yields.

- Poor being 5-year average yields minus 5%.

- Fair representing 5-year average yields.

- Good being 5-year average yields plus 5%.

- Excellent representing 5-year yield highs.

These yield scenarios are applied to the regional areas, weighted by condition scores.

For spring production, although conditions haven’t been ideal, and there will be regional variability, 5-year average yields are used to forecast production levels.

Production

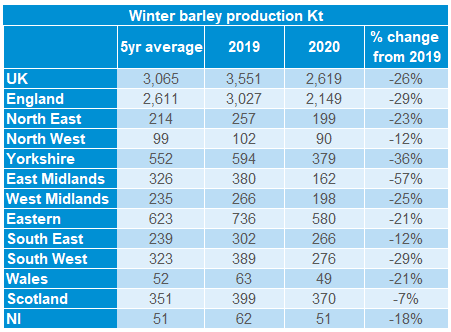

At 2.6Mt, UK winter barley production for 2020/21 may well be down 26% year on year, with the largest reductions in the East Midlands and Yorkshire & Humber regions.

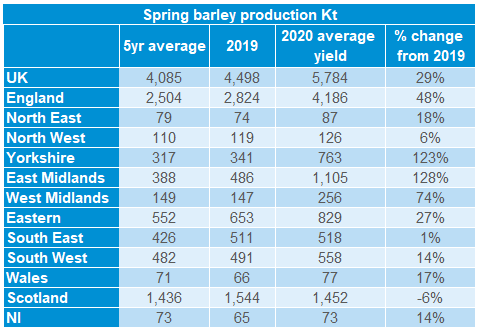

Applying a 5% variationeither side of the 5-year average yield give a spring production rangebetween 5.49 – 6.07Mt. Without further rainfall we could be heading towards the lower end of this range in production scenarios.

When applying regional 5-year average yields, at 5.78Mt, UK spring barley production could well be 1.3Mt greater year on year following the large spring barley area increases in West and East Midlands and the Yorkshire & Humber regions. The 5-year average yield is used to calculate the production scenarios below, and the potential to reach these yields will be heavily influenced by weather over the coming weeks.

With large increases in spring barley areas in the Midlands contributing to a large surplus next year, the additional cost of haulage to move this volume of barley to ports could well add further pressure to regional prices with significantly increased planting.

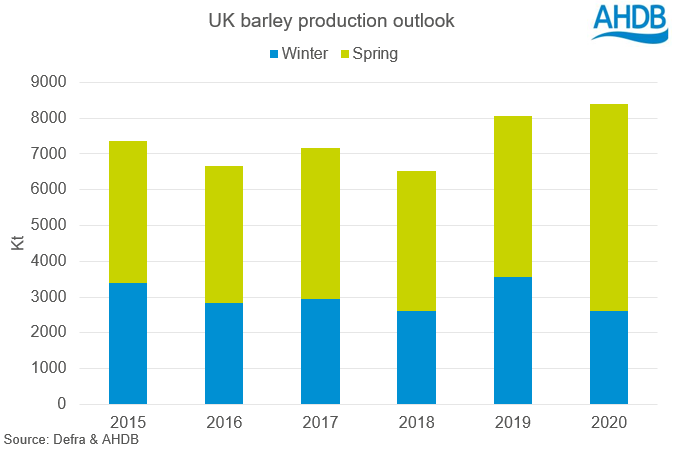

At the UK level, the loss of winter barley area and poor condition in many regions is outweighed by the significantly larger spring barley area. As previously highlighted, the current season has been characterised by a large barley surplus requiring export competitive price levels, with a likelihood that there will be an increase in ending stocks. 2020 looks set to see a similar price dynamic, requiring barley to price competitively on an exportable basis, with a potentially even greater surplus.

Tomorrow, our barley focus will continue, looking at where the UK may export to and the forward demand profiles for these countries.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.