Analyst Insight: A bearish old crop barley outlook

Thursday, 23 April 2020

Market Commentary

- UK feed wheat continued to gain yesterday, May-20 closing up a further £1.20/t to close at £157.20, a near two week high. The discount of UK feed wheat May-20 futures to Matif milling wheat May-20 futures had extended to a contract record of £24.01/t on Monday 20, recovering to £21.50/ by close on 22 April with further recovery this morning.

- Continued unfavourably dry conditions in Ukraine, southern Russia and Kazakhstan is providing support for global wheat markets. However while maize and oil markets are still under pressure and the covid-19 pandemic is taking precedence, support for now may well be limited.

A bearish old crop barley outlook

While the malting barley premium has come under a large amount of pressure as the demand impact from pub and food service closures is felt, feed barley markets have felt like they have tracked sideways. But is there pressure to come for the underlying feed market?

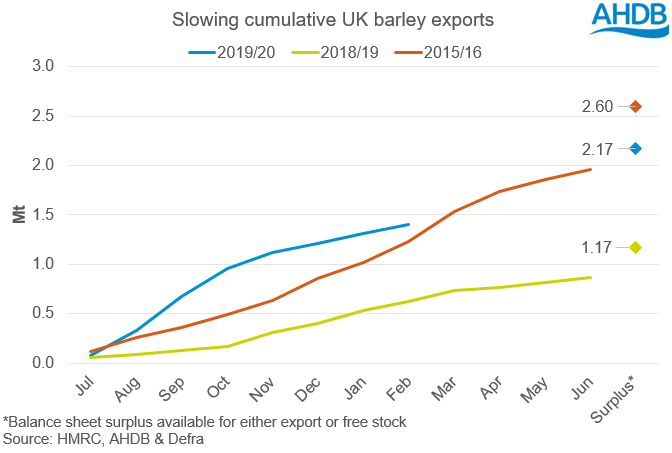

The 2019/20 season begun by being burdened with both a large barley and wheat crop. At over 8Mt the surplus for free stock or export stood at 2.168Mt, a four year high.

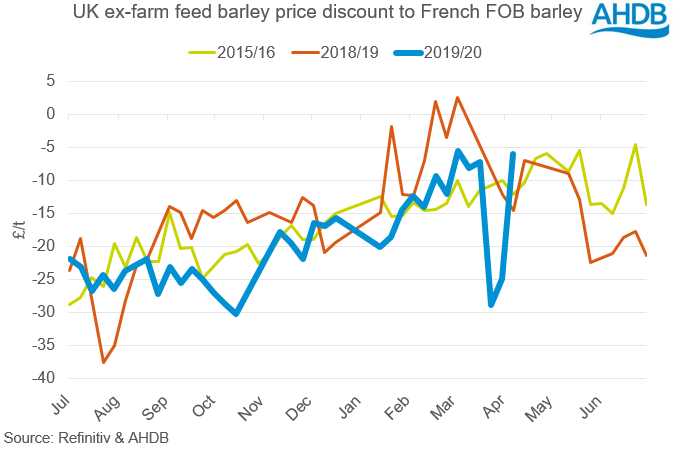

While now seeming a distant memory, large stocks and the prospect that the UK may have left the EU by December led to large price discounts to continental barley markets, allowing a fast export pace. However, post November, the monthly export pace slowed and by February there still remained 763Kt left as free stock, over 200Kt more than in 2018/19.

While the 2015/16 season at the same point had a larger remaining surplus at 1369Kt, there were significantly different outlooks at the time.

At the same point in April 2016, there was a prospect of a 1Mt smaller crop the following season. Unlike the current season where due to the wet autumn, spring barley plantings could be up by as much as 47%. Although the current dry conditions are not ideal for yield prospects, 2020/21 is still likely to be another large surplus year.

Additionally, for the same point in time in 2015/16, even with the prospects of a smaller crop the following year, feed barley prices were similar to where they currently are relative to French export prices, before falling away.

Yet there are additional economic and political factors risking the current and future barley markets.

While the pandemic and lockdown have reduced the demand for food service malting barley, and potentially added to barley stocks, even if UK feed barley is competitive relative to other origins, there remains the challenges of haulage. Additionally, post March animal feed demand for barley diminishes, further reducing the domestic demand, placing even greater importance on the ability to export.

Looking to 2020/21, there is likely to once again be challenges early on in the season with another large crop. In a déjà vu like scenario, 2020/21 faces a December EU exit date, which will yet again encourage exports to be front loaded with pressured barley sellers.

Again, in a repeat of history, maize prices are likely to be very competitive into feed rations and industrial uses, potentially displacing some feed barley demand in 2020/21. Not only as UK feed wheat remains supported owing to a poor production outlook but as global maize prices remain under pressure amid minimal ethanol demand.

Combined, the outlook for 2020/21 is lacking major incentives to store old crop feed barley into the next season. As such, further downward pressure for the remainder of old crop feed barley markets is possible as sales are made into a market facing reducing demand.

Over the coming weeks, we will seek to quantify the impacts on the different arable sectors of the current pandemic and the potential implications upon supply and demand for the remainder of 2019/20 and into 2020/21. Starting on May 12 we will be taking a more in depth look at the 2020/21 barley production outlook as part of a mini-series focusing on barley also covering export markets, brewing and distilling demand and drying costs.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.