What could the coronavirus mean for malting barley? Grain Market Daily

Wednesday, 8 April 2020

Market Commentary

-

The volatility in oil markets has reduced over the week, trading between $30/bbl and $34/bbl this week. Following last week’s gains, the somewhat subsequent sideways trading has added a degree of stability to commodity markets.

-

Following USDA reports on the good condition of wheat, US Chicago wheat futures (May-20) came under some pressure yesterday, falling $2.39/t yesterday, to close at $201.79/t.

-

Chicago maize has recovered slightly from the lows on Monday 6 of $129.04/t to close yesterday at $130.51/t, however with reduced ethanol demand is likely to remain under pressure.

-

May-20 UK feed wheat futures fell fractionally yesterday by £0.15/t to close at £157.20/t as the value of the pound strengthened against the dollar. New Crop Nov-20 also fell by £0.15/t, closing at £166.75/t.

What could the coronavirus mean for malting barley?

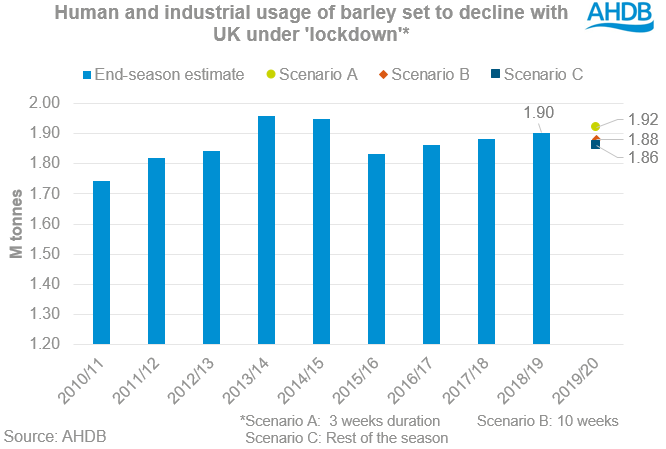

To provide some insight into the impact of the coronavirus pandemic on malting barley demand in the UK, we’ve created some scenarios using UK usage data.

The immediate impact is due to the loss of beer sales, through pubs, restaurants and events. Although there may be a partial mitigation by increases to retail sales. The key factor longer term will be continued production by distilleries. However, this article just focuses on the brewing sector.

The current situation

The barley used by Brewers, Maltsters and Distillers for the season to date (Jul - Feb) according to AHDB is 1.26Mt. The latest AHDB balance sheet estimate for total human and industrial (H&I) usage for the season is 1.93Mt. With usage by February at 1.262Mt, this left an approximate remaining usage of 0.67Mt for the rest of the season (Mar-Jun).

However, the balance sheet estimates were made in the early days of the coronavirus outbreak in the UK. As such, these estimates show what would have been expected if business had carried on as usual.

Industry sources indicate the spilt of malting barley used to produce malt for distilling, food, and export vs brewing is roughly is 69% and 31%, respectively. Of the malting barley used for brewing, the approximate spilt for retail vs food service is 55% and 45%, respectively (British Beer & Pub Association). Following usage through, this leaves an annual requirement for brewing at 598Kt of which, 269 is food service.

With coronavirus leading to the closure of pubs, bars and restaurants, this has effectively cut demand for beer within the food service sector. Craft beer production is also likely to be hit very hard, with most being sold through pubs.

Although stockpiling has led to an increased demand for beer from retail outlets, it’s difficult to predict how this will develop longer term. As stockpiling cannot go on indefinitely, this will more than likely slow, so has been left unchanged for now.

The scenarios

We have taken the “business as usual” figure for the rest of the season (0.67Mt) and removed the food service element (assumed to be 14% of total H&I barley usage) starting mid-March, for:

A - A 3-week lockdown, as originally indicated

B - A middle point of 10 weeks

C - The rest of the season (15 weeks )

All three scenarios show a drop in malting barley requirement.

Under the most severe of the scenarios, scenario C, it would mean 63Kt less barley would be required to produce malt for brewing in the remainder of this marketing season.

Malting barley market effects

According to AHDB Corn Returns, over 60% of malting barley bought in a season is purchased pre-Christmas, with a further 30% purchased Jan-March and the remaining 10% post-March. This means it is likely that 90% of their intended barley purchases happened before the lockdown came into effect. With approximately 598Kt originally forecast to be required for brewing (31% of demand), and potentially up to 90% possibly already purchased (540Kt), this could originally have left approximately just 60Kt of demand remaining for the 2019/20 season if this purchasing trend is applied across brewing purchases.

So, taking into account a possible 63Kt food service reduction in usage for the remainder of the season, there could have been enough malting barley already sold to cover the remainder of the season. Therefore, demand for brewing malting barley for the remainder of 2019/20 may have potentially been removed.

Malting barley from the 2019 crop bought (and stored) by maltsters but not used this season, will be rolled forward. As such, MAGB have said this would reduce their members’ requirements from the 2020 crop. If the lockdown is relatively short lived, this impact will be minimised, but the duration is important, as is the potential impact that a disrupted distilling sector would have. With the Early Bird Surveys forecasting a 47% increase in spring barley plantings, 2020/21 barley outlooks were already for continued pressure.

Where could the extra barley go?

Any remaining 2019 crop not yet sold as malting barley for brewing may well now struggle to find a domestic home. AHDB Corn Returns listed no malting barley sales from May to July for the week ending 2 April. Animal feed may now be a more likely market, though barley remains under pressure and with a large domestic surplus in 2019/20.

Export is still possible, but logistical challenges and changes to overseas demand could well reduce this option in the weeks ahead. From July 2019 – January 2020 the UK shipped 1.308Mt of barley; data for February is due out this week.

Overall, it seems likely that the shutdown of food service outlooks due to the coronavirus will add to the UK’s barley 2019/20 carry out stocks, which were already likely to have been larger due to the size of the 2019 crop.

Looking ahead to 2020/21

While there are impacts being felt this season from the coronavirus pandemic, it also leaves questions about the 2020/21 season. With much of Europe in a similar position and large spring barley areas being planted, weather dependent, production of malting barley could be high relative to demand in 2020/21. As it stands, malting barley premiums are likely to be under pressure in 2020/21, and depending upon the distilling sector and length of lockdown could also face a reduction in demand.

Many distillers, where they have been able to put robust social distancing in place, are reported to be continuing production as usual, and some are also producing hand sanitizer for the NHS and more. However, other distillers have temporarily closed, and as this situation becomes clear, we will assess the potential impact.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.