- Home

- What is the long-term outlook for beef and sheep meat consumption?

What is the long-term outlook for beef and sheep meat consumption?

This article investigates the consumption of lamb and beef worldwide up to the early 2030s. Macro trends, such as environmental considerations, feed into these demand projections.

The figures in this analysis were updated on 15 October 2024 to reflect the 2024–2033 OECD consumption forecasts.

Key points

- Global demand for beef and sheep meat will increase in the coming decades; sustained demand is driven by developing regions, as both global wealth and populations grow

- The forecast consumption in developed regions (such as the UK) shows less sharp growth, and large global demand predictions are encouraging for UK export prospects. Thanks to its climate, weather and extensive production systems, the UK is one of the most sustainable places in the world to produce red meat

- Consumer preferences are evolving. While population growth drives total world consumption, trends such as health and sustainability concerns are expected to increase. Consumer concerns about health and sustainability are expected to build up to and beyond 2030, affecting per-capita meat consumption

Demand predictions are encouraging for UK export prospects

In the UK red meat has lost share to white meat in the last three decades, according to the March 2024 Defra family food survey. Globally however, there is a different story.

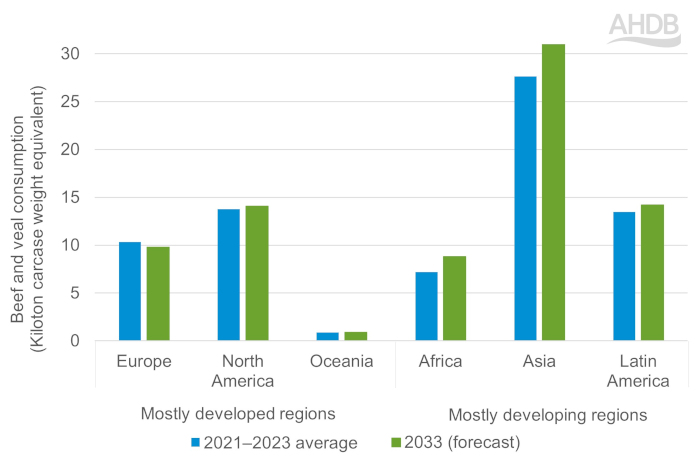

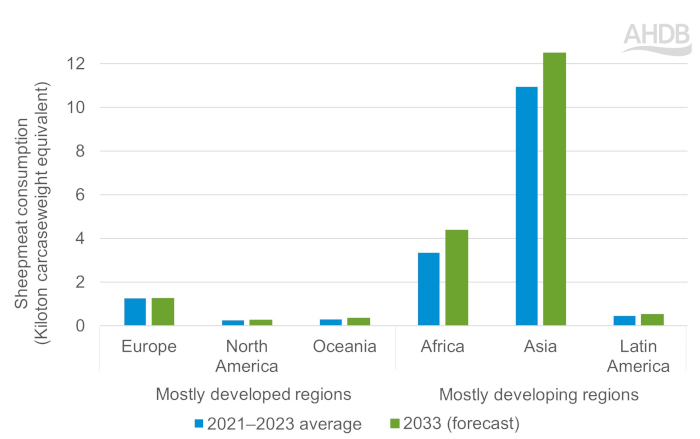

Red meat consumption is growing, and further increases in demand are expected to 2033 (Source: Agricultural Outlook from the Organisation for Economic Co-operation and Development/Food and Agriculture Organisation (OECD/FAO). According to the Agricultural Outlook, world growth in beef and sheep meat consumption is forecasted at 11% and 16% respectively. Most of this growth stems from developing regions, as populations and incomes continue to rise. This heightened demand will put pressure on supplies.

Global consumption per capita shows low growth. Beef and veal world consumption is set to grow by 1.1% per annum by 2033, while sheep meat volumes are predicted to have a slightly larger increase of 1.3%. In developed regions, total meat consumption begins to plateau; UK consumption is forecasted to see only marginal change of 0.1% growth for beef and veal, and a 0.1% decrease for sheep meat.

The predicted increase in global demand is encouraging for UK export prospects, particularly for lamb. The UK is currently the third largest exporter of sheep meat, and the global market is vital for UK sheep producers.

Read our analysis of global prospects for UK agri-food exports

How consumption of beef and veal will change

Source: OECD/FAO

How consumption of sheep meat will change

Source: OECD/FAO

Changing demographics

The global population is projected to reach 8.7 billion by 2033, up from 8 billion in 2023. For low-income countries, population growth will be the most influential factor for growth (OECD/FAO). In the UK, birth rates are expected to slow but migration continues to drive population growth.

The UK’s ageing population affects future demand, as consumption habits vary by age. Older demographics typically consume more beef and lamb, whereas younger consumers (aged up to 28) lean towards poultry (Kantar, 2024). These different habits tend to stick as consumers move through life stages. We could see a future where chicken is preferred to red meat, as the children of today become the food shoppers of the future.

Consumers over 55 years old will remain a key group into 2033, but by that time a larger proportion of the population will be made up of younger shoppers, so we may see a shift in the demographic of the average red meat shopper.

‘Generation Z’ accounts for 15% of the UK population: having witnessed significant financial squeezes and disruption to the economy in the last few years, they tend to be hyper-aware of the need to save (Mintel, 2024).

Changing income levels

In 2024, inflationary effects on consumer prices have had a negative effect on purchasing power. However, meat still remains a mealtime staple for many.

In the UK we have seen consumer behaviour shift, in the form of utilising cheaper cuts of meat and switching to cheaper proteins. In the longer term, however, the OECD/FAO highlights that disposable income in developed countries is not a key driver for meat consumption volumes. Instead, factors such as health, environment and animal welfare will be more influential.

In developing countries, economic changes are a more influential factor than in the UK, though population remains the most influential factor for red meat consumption. On a per capita level, rising income levels are expected to increase demand for higher-value foods, including red meat.

Changing preferences

In higher-income countries, consumers are becoming more concerned about health, the environment and animal welfare, particularly when it comes to beef (OECD/FAO). Though the positioning of different kinds of red meat varies within these considerations, for some types of consumers these issues will limit long-term growth.

Products that cater for environmental and welfare preferences typically come at a higher price point. Nevertheless in the coming years these concerns are likely to increase.

Convenience

Globally, convenience meals have become much more widespread; quick, simple meals have been rising in popularity since the Covid pandemic.

This trend implies that domestic marketing and the export market will become more necessary to ensure efficient utilisation of larger, unprocessed cuts, supporting carcase balance and overall value.

Health

The OECD/FAO predicts a small decrease in red meat consumption per capita in the EU, with health concerns being a driver for the reduction in beef.

Consumers increasingly search for food to cater to a diverse range of health needs. Mintel highlights that − for Gen Z’s in particular − physical and mental well-being are top priorities, and they may seek out healthy food as part of this. Consumer views around red meat, especially processed categories, may limit long-term growth because of this focus on health. Retailers may need to consider reminding younger consumers of the benefits of consuming lean red meat.

As public health challenges increase, government intervention − such as high in fat, sugar or salt (HFSS) regulation − has potential to shift demand away from processed categories which fall with these descriptions.

Sustainability

Climate change, environmental sustainability and net zero are all strongly connected to farming and food production industries. Concerns about these affect not just government action, but individual food choices.

Gen Z’s are generally the demographic most concerned about climate change. Recognising that these people are the voice of the future, AHDB targets the upcoming shopper through reputational work, such as our ongoing ‘Let’s Eat Balanced’ campaign.

The UK (among other countries) has committed to reaching net zero emissions by 2050, and the Government has agreed to legislation and targets to reduce our impact on the environment.

Agricultural policy shifts are incentivising the provision of action in aid of the environment. In England, monetary incentives − such as the Sustainable Farming Incentive and carbon markets − put pressure on meat production resources. This could lead to raised costs for consumers, and high cost is already a key driver for them to cut back.

Of total main meal occasions in the UK, 56.9% of main meals eaten at home still contain meat, fish or poultry (52 w/e 18 February 2024) but, the trend towards limiting red meat consumption has been increasing. Domestically, this trend seems to have been cost driven, with consumers turning to flexitarian meals due to financial concerns.

Values are shifting towards increased concern around health and the environment. In order to keep consumers engaged with British red meat, it is vital to continuously monitor and align with consumer preferences both domestically and abroad.