UK wheat futures gap to Paris wheat widening: Grain market daily

Tuesday, 3 August 2021

Market commentary

- Nov-21 UK feed wheat futures gained £3.85/t yesterday amid more negative news about US and Russian wheat crops. The contract closed £186.35/t, its highest price since 12 May. The May-22 contract gained £4.70/t to £192.20/t.

- The condition of US maize crops inched lower again. As at 1 August, 62% was in ‘good’ or ‘excellent’ condition, down from 64% last week and 72% last year (USDA).

- Paris rapeseed futures (Nov-21) rose due to worries about palm oil availability due to labour shortages. The contract gained €75/t from Friday to close yesterday at €527.25/t, equating to £450.75/t.

- Oilseed prices could face pressure today after crude oil prices fell and US soyabean crop condition ratings improved. The latest USDA crop progress report rates 60% of the US crop as ‘good’ or ‘excellent’, up from 58% last week.

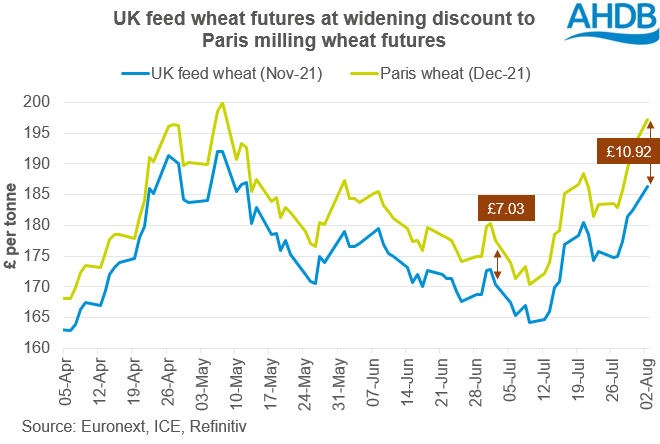

UK wheat futures gap to Paris wheat widening

Yesterday, Dec-21 Paris wheat futures passed its 7 May peak, as the world market reacted to more negative news about world wheat supplies. The contract closed at €230.75/t, up €5.25/t from Friday.

- SovEcon cut 5.9Mt from its forecast of the Russian wheat crop. The crop is now estimated at 76.4Mt. This follows official data showing the winter wheat area was 1.2Mha smaller than expected, pointing to higher winterkill. This follows a 3.0Mt cut by IKAR last week. A smaller Russian crop could reduce the volume available for export in 2021/22. The USDA currently expects Russia to be the world’s top exporter of wheat this season and ship 40.0Mt.

- The US spring wheat harvest was 17% complete by 1 August (USDA), well ahead of the five-year average (8%). Crops are in poor condition due to hot, dry conditions. Early quality results from US Wheat Associates also show lower bushel weights and higher proteins.

This news also pushed Nov-21 UK feed wheat futures up but the contract is still around £8.00/t below its April peak. As a result, the gap between UK and Paris wheat futures is widening.

The UK Nov-21 futures price is now nearly £11/t below the Paris Dec-21 price. We usually see a discount of this size when the UK needs to export wheat. However, while UK wheat production could be around 14.9Mt this year, we are expecting animal feed and ethanol demand to rise too. This will keep the UK market tight. As a result, it’s uncertain how much wheat the UK can export this season.

Last week (Thursday-Thursday), UK delivered wheat prices rose more than the Nov-21 futures, widening the gap (or basis). This suggests that currently it’s the cash prices that are keeping exports priced out. This is likely to continue until we get some confirmation of the UK crop size and early demand trends, therefore potential export availability. In the coming weeks, expect either:

- UK wheat futures to track Paris futures more closely to close the gap.

- Or UK delivered prices to hold or widen their premiums over UK futures.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.