Market Report - 02 August 2021

Monday, 2 August 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

As global supply and demand for wheat tightens, prices have continued to move ahead. Dry weather is expected to continue in the US, which could leave the market tighter still.

Maize

With little new support for maize and cancellations of Chinese imports of US maize, the market is relatively flat awaiting fresh support.

Barley

Cuts last week to the EU barley crop owed to slightly smaller yields and a smaller area. The UK winter barley harvest is 47% complete (as of 27 July) capping prices.

Global grain markets

Global grain futures

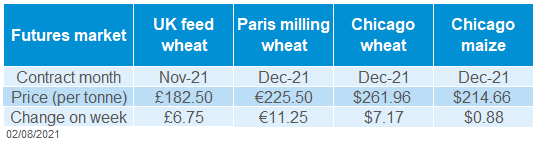

Grain markets were split last week. Chicago maize prices (Dec-21) were largely flat last week, having taken the lead in grain markets for much of the 2020/21 season. Maize markets are lacking impetus at the moment, with nothing fresh to inspire new gains. In the latest US export sales data China cancelled a further 119Kt of US maize imports.

However, wheat markets made strong gains again last week. Chicago wheat (Dec-21) gained $7.16/t, Friday to Friday, as the wheat supply outlook continued to tighten. Forecasts of the Russian wheat crop also continued to get smaller last week. The International Grains Council (IGC), cut 450Kt from its Russian wheat outlook, pegging the crop at 81.0Mt. Refinitiv also report that IKAR has reduced its estimate of the 2021/22 Russian crop to 78.5Mt from 81.5Mt.

Poor conditions in North America, resulted in cuts to wheat production forecasts for both Canada and the USA. The IGC slashed 3.8Mt from Canadian wheat production and 3.5Mt from US production. The result of this was a 2.2Mt cut to major exporters stocks. The US and Canada continue to look dry in the coming fortnight which could worsen the situation further.

Despite cuts to some regions, the outlook for the EU is improved according to the EU Commission, which eased some of the support. The EU Commission raised its soft wheat production forecast for the EU-27, now at 127.7Mt from 125.8Mt last month.

UK focus

Delivered cereals

In the week ending 27 July, 47% of the UK winter barley crop had been cut. Yields of winter barley were averaging 6.6 – 7.0t/ha; the midpoint represented the five-year average. Bushel weights of barley are so far lower than normal. Read the full Harvest report here.

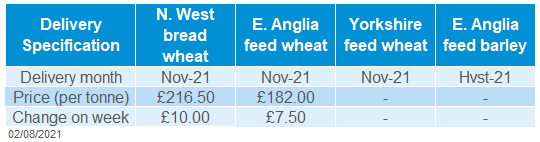

UK feed wheat futures (Nov-21), gained £6.75/t last week, ending on Friday at £182.50/t. UK prices followed the global trend in wheat prices.

Gains in the UK physical market were slightly stronger than in the futures market, suggesting a tighter feel to the domestic market week-on-week. For milling wheat, the premium of North West milling wheat over futures gained £3.00/t week-on-week to £35.00/t. Smaller premium growth was seen in the Midlands (+£1.00/t to £24.50/t) and in London/Essex (+£1.00/t to £21.50/t). With concerns over global milling quality, this is not surprising.

Oilseeds

Rapeseed

EU-27 production estimates are unchanged on the month with a hefty import requirement remaining. AHDB harvest report shows domestic rapeseed at 9% harvested as of 27 July.

Soyabeans

Forecasts of rainfall for the US Midwest weigh on markets. First forecasts of Brazilian area suggest a 4% increase year-on-year. Meanwhile, demand pressures from the Chinese pork herd remain (see last week’s report for more).

Global oilseed markets

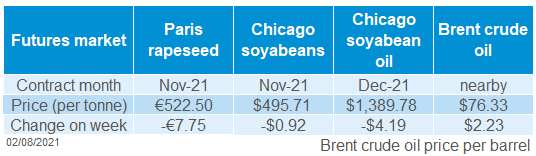

Global oilseed futures

Despite a dry week for the US crop area, profit taking in the US markets saw soyabean futures (Nov-21) decline on Friday to close down on the week. This erased the 2% gain made during the first four days of the week. Markets have dropped again this morning following fresh forecasts of rainfall for parts of the Midwest.

The first forecast for the 2021/22 Brazilian soyabean area puts an increase of 4% on the year to 40.57Mha according to Datagro. This is the 15th consecutive annual increase for the country, with planting set to begin in September. Production is forecast at 144.06Mt next season, which would be 5% higher than last season if realised.

Malaysian palm oil futures have slid 5% this morning, owing to reduced July exports and reductions in wider vegetable oil markets. This is likely weight on vegetable oil prices in the short-term.

Rapeseed focus

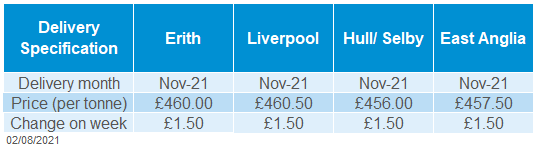

UK delivered oilseed prices

Paris rapeseed futures (Nov-21) fell €7.75/t to €522.50/t (£446.16/t) last week, tracking the Friday fall in soyabean markets. Delivered rapeseed for harvest delivery (Erith) was quoted at £452.50/t, up £0.50/t as at Friday 30 July. November delivery into Erith was quoted at £460.00/t, up £1.50/t.

On Friday, we released our first harvest report, which detailed that the domestic OSR harvest was 9% complete as of 27 July. With this, a preliminary yield is estimated at 3.0 – 3.4t/ha. Rainfall later this week could delay progression for much of the UK.

Stratégie Grains kept firm its outlook for 2021/22 rapeseed production in the EU-27, estimated at 17.03Mt. This would be 2.5% above the output last season of 16.61Mt. 2021/22 ending stocks were cut slightly as the analysts expect reduced imports from Canada and Australia due to high prices.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.