Market Report - 26 July 2021

Monday, 26 July 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

Global grain markets

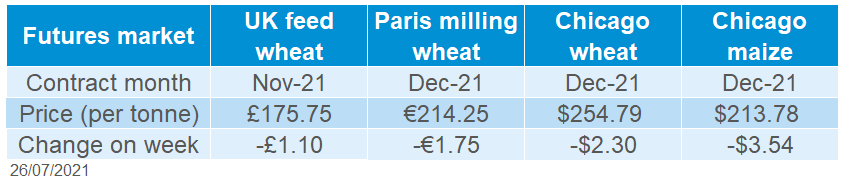

Global grain futures

Markets ended last week slightly lower as the weather outlook for the US improved. China also cancelled 160Kt of US maize exports for the 2020/21 season, which ends on 31 August for maize.

In the early part of the week, concerns for US and Canadian crops and buying by speculative traders pushed prices up. However, the forecast for US maize areas turned wetter as the week progressed. This change, plus profit taking by speculative traders in the US, meant global prices ended the week down.

Rain fell in the northwest Midwest over the weekend. This should help maize crops in the area after drier than usual conditions over the past month. The forecasts show more rain for the northern areas, but drier in the central Midwest this week.

There was also some rain in the Canadian Prairies, but it may already be too late for these crops. The latest Saskatchewan crop report stated that any rain now would only help stabilise yields. The USDA forecast Canada to provide 13% of world barley and 11% of wheat exports this season. With Canadian stocks already low and the dry weather, that looks rather optimistic.

Elsewhere, harvests are slowly advancing. But, there’s still a lot of uncertainty, including over wheat and barley quality in France and Germany after rain delays. Harvesting is now reaching the Russian critical ‘black earth’ regions, so we’ll know a lot more over the next week or so.

UK focus

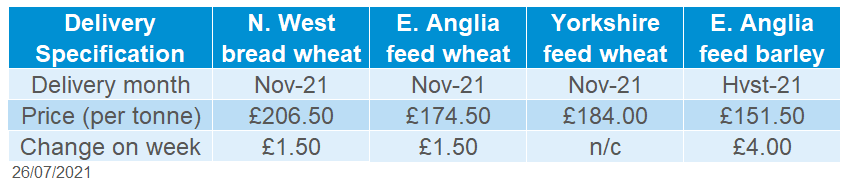

Delivered cereals

UK delivered prices rose last week Thursday-Thursday. However, Nov-21 delivered wheat (milling and feed) prices rose by less than Nov-21 futures over the same period, reducing the basis.

Last week the gap between bread and feed wheat prices was stable. However, the gap could widen if there are issues with UK quality. This is especially given the uncertainty over crops in Germany and Canada, which are typical import origins for the UK.

Feed barley prices rose by more than feed wheat, closing the discount by £2.00/t to £18.50/t in the Avon area (Hvst delivery).

Meanwhile, prices for feed wheat delivered before the end of this month were again over £30/t higher than prices for harvest delivery.

Oilseeds

Rapeseed

Soyabeans

Global oilseed markets

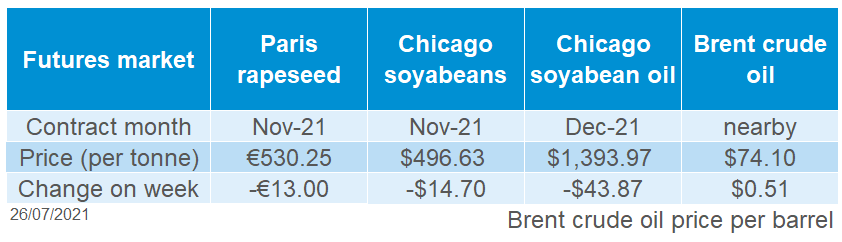

Global oilseed futures

Pressuring the oilseed complex over the last week was a combination of improved weather and reduced demand. Due to this, Chicago soyabeans futures (Nov-21) were down 2.9% across the week.

Longer-term weather models indicate cooler weather across parts of key regions in the US. There is much needed rain forecast in Iowa and Minnesota, both key soyabean producing states.

Another pressure on global soyabean prices is the slowing demand from China for soyabeans. Chinese imports are set to slow in late 2021, after a record 48.9Mt was imported in the first half of 2021, up 9% year-on-year. What will slow this demand is the reduction in hog margins in China, which are down 100% since the start of 2021 (Refinitiv).

Exports of Malaysian palm oil products for July 1-25 July fell 0.5% to 1.14Mt Cargo Surveyor Intertek Testing Services reported on Sunday.

Rapeseed focus

UK delivered oilseed prices

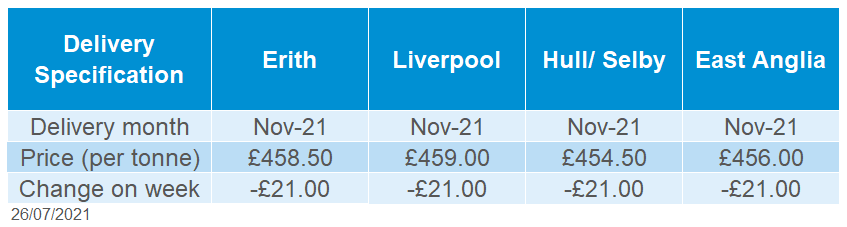

Paris rapeseed futures (Nov-21) closed Friday at €530.25/t, down €13.00/t across the week. Delivered rapeseed (Nov-21, into Erith) was quoted at £458.50/t, down £21.00/t across the week.

Sterling strengthening against the euro across the week added further pressure on our domestic market. Trading closed Friday at £1 = €1.1683, up by 0.2% across the week (Refinitiv).

Canadian canola futures (Nov-21) were down 3.7% across the week. Much of the drought impact has been priced in and weather models suggest widespread precipitation over the Canadian Prairies in the next couple of weeks.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.