- Home

- Beef trade and production in Switzerland

Beef trade and production in Switzerland

Switzerland’s beef sector focuses on the production of top-quality meat raised to high welfare standards. This section presents an analysis of the production and trade patterns of the Swiss beef industry.

Overview

Much of the terrain in Switzerland is alpine and unsuitable for cropping. Its agricultural land is primarily made up of grassland (70%), lending itself to grass-fed livestock systems. Swiss beef is mostly produced using extensive agricultural practices.

Switzerland produces 602,000 head of beef cattle per year; the average size of a cattle holding is 20 cows.

High animal welfare standards and high environmental standards are enforced by legislation. Also, there are financial incentives for farmers to apply practices that benefit the environment. Around 10% of beef farms are organic, compared with 3.2% in the UK.

Some cattle breeds are used to yield both milk and meat. Swiss Braunvieh (“brown cattle”) and Swiss Fleckvieh (Holstein cross Simmental) are common dual-purpose breeds.

Production

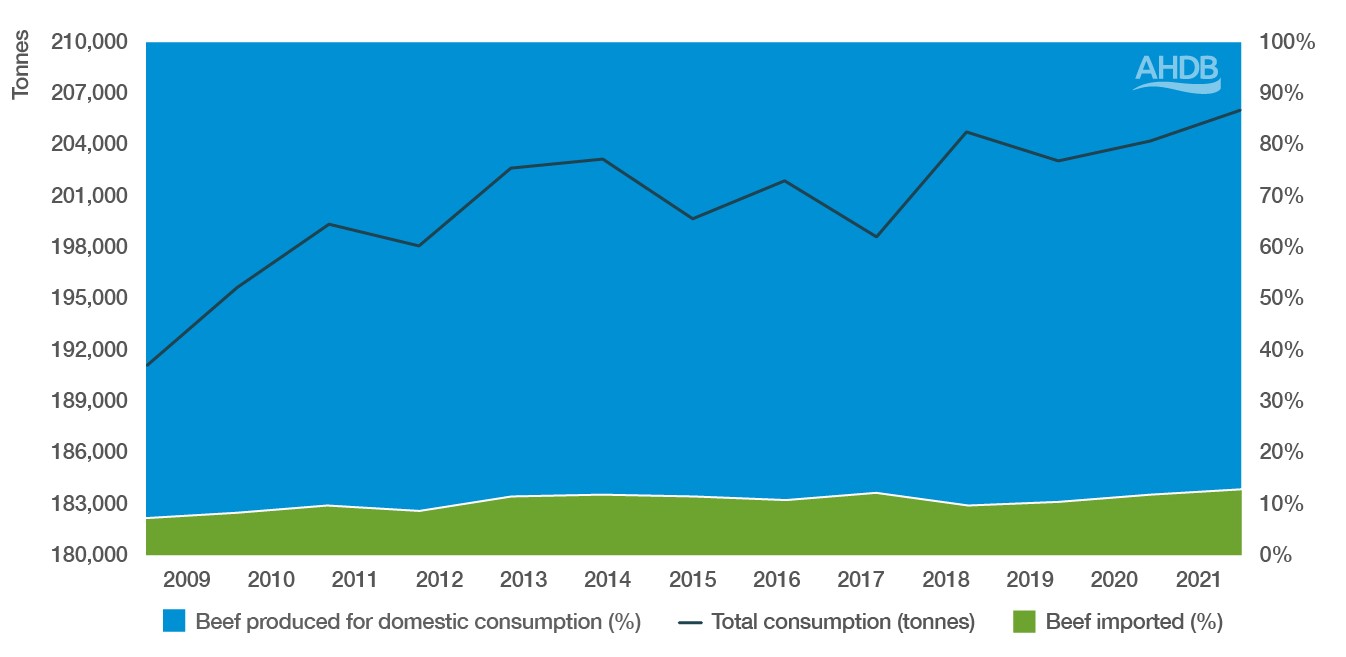

Due to government incentives for farmers to produce beef for domestic consumption, Switzerland has a stable national herd number and achieved 87% self-sufficiency in beef in 2021, as shown in Figure 1.

Figure 1. Proportion of Swiss-produced beef and beef imports

Source: Trade Data Monitor, FAO Stat 2021

Imports and exports

Of the beef produced in Switzerland, less than 1% is exported. The destination is predominantly neighbouring countries, especially Germany and Italy.

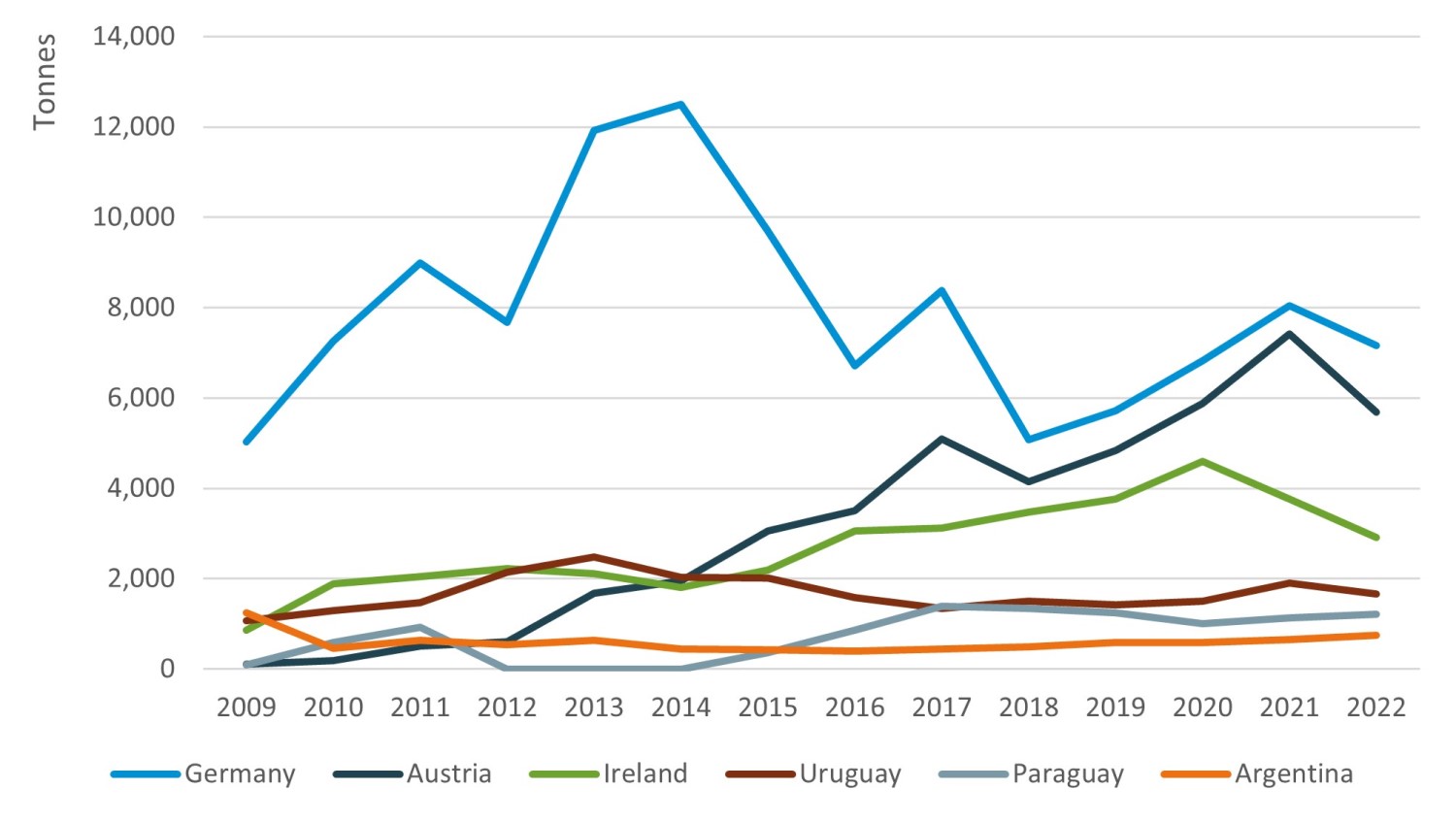

Imports generally consist of fresh boneless cuts or carcases. While neighbouring countries supply a large proportion of imports, an annual average of 15% of beef imports (by volume) came from Ireland between 2020 and 2022.

Figure 2. Swiss imports of beef from six key trading countries

Source: Trade Data Monitor 2022

UK beef imported into Switzerland fell by 70% in 2020–2021 (TDM), and in 2023 represented just 0.51% of the market. This loss of share coincided with the Covid pandemic, during which time the only category that didn’t experience a fall was processed meat.

Prior to the 2020s, beef imports from the UK mostly covered hospitality markets, with high-value product. When the market reopened, major beef exporters Australia and the USA gained market share in 2022, but the UK did not (TDM).

Table 1. Annual trade and production, comparison between Switzerland and the UK (2019–2021 average)

| Switzerland | UK | |

|---|---|---|

| Production (t) | 180,612 | 1,000,000 |

| Exports (t) | 71 | 118,143 |

| Imports (t) | 23,875 | 237,953 |

Source: Trade Data Monitor and FAO Stat

Back to

Hubpage: The impact of a UK–Switzerland Free Trade Agreement on UK agriculture

Continue reading about the UK–Switzerland FTA

- Introduction

- Trade between the UK and Switzerland at a glance

- Switzerland trade and production

- Consumer demand: Is there a market to export more UK red meat and dairy to Switzerland?

- Agricultural policy in Switzerland

- Switzerland's Free Trade Agreements

- Economic modelling of the beef, sheep, dairy and pork sectors