- Home

- Dairy trade and production in Switzerland

Dairy trade and production in Switzerland

Switzerland’s dairy sector is characterised by high prices and high standards. The greatest proportion of processed product is cheese, which is important for Switzerland’s domestic production and trading relationships.

Overview

Dairy is the largest sector within Swiss agriculture, making up nearly one-quarter of its total output. In 2022, there were 543,000 dairy cows across 23,000 farms, split between lowland and mountainous areas. Nearly 8% of dairy produced in Switzerland in 2022 met organic standards.

In 2022, the average number of dairy cows per farm in Switzerland was 28.5, which has been steadily increasing from 21.4 since 2010.

The Swiss national dairy herd contains a range of breeds, with the greatest volume of milk production coming from Holsteins, followed by the Red Holstein, Montbéliarde and the native, dual-purpose breeds of Brown Cattle and Fleckviehs.

Switzerland’s geography is well suited to dairy production, with an abundance of meadowland that allows grass and fodder production. Nearly 85% of the feed for Swiss dairy cattle is made up of domestic roughage, with the remaining ration comprising concentrate feed and food production by-products.

Swiss milk prices are very high compared with the EU. This is likely a reflection of their high animal welfare standards, which result in a higher cost of production. Furthermore, the relative wealth of the country means that consumers are willing to pay a higher price.

Almost all dairy cattle in Switzerland are produced to the ‘swissmilk green’ industry production standard. Introduced in 2019 and mandatory from 2024, this standard aims to demonstrate the sustainability of Swiss production and processing of dairy products. The standard has ten holistic requirements, including responsible medicine use and environmental measures.

Alongside dairy production from cows, Switzerland produces sheep’s and goat’s milk, which is often processed into cheeses. In 2022, the Swiss Federal Statistical Office recorded populations of nearly 15,000 dairy sheep and just over 35,000 dairy goats.

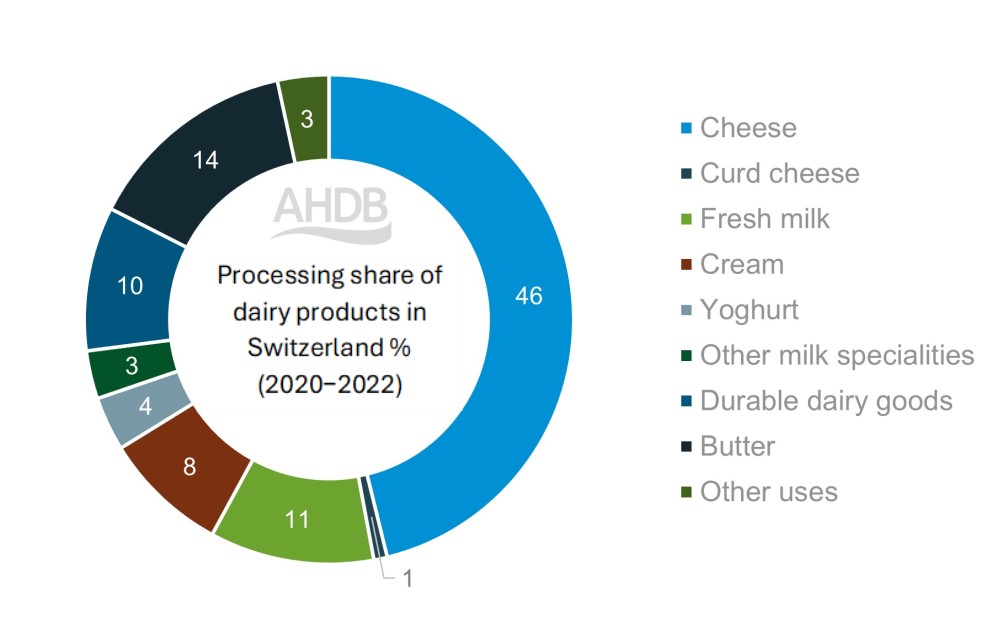

Cheese makes up almost half of processed Swiss dairy (46%) – the largest proportion by far of any dairy product. Fresh milk makes up just over one-tenth of domestic processing.

Cheese is an important product for Swiss dairy, both for domestic consumption and trading relationships. Swiss raw-milk cheeses – such as Gruyère AOP, Emmental AOP, Sbrinz AOP or Tête de Moine AOP – carry a protected designation of origin, as well as a prerequisite for silage-free milk in their production.

Figure 1. Breakdown of processing share of dairy products in Switzerland (2020–2022 average)

Source: Swiss Milk Statistics 2022

Imports and exports

Nearly 40% of Swiss dairy exports by value (£240m) go to Germany and 13% go to the USA (£85m) (see Table 1).

Italy, France and Germany hold the majority share of Swiss dairy imports, by value, with 36%, 24% and 19% shares respectively.

Table 1. Switzerland’s top five export and import destinations (millions of pounds)

| Top export destinations for Swiss dairy products | Top exporters of dairy products |

|---|---|

| Germany (£240m) | Italy (£174m) |

| USA (£85m) | France (£115m) |

| France (71m) | Germany (£92m) |

| Italy (£65m) | Netherlands (£27m) |

| Russia (£24m) | Belgium (£15m) |

Cheese accounts for 90% of Swiss imports and 95% of exports by value across the dairy category.

Skimmed milk powder (SMP) exports make up just over 3% share of export value, with an export surplus of nearly £20m versus imports.

Imports of butter, valued at £27m, make up a 5.5% share by value. The Swiss import deficit for butter is over £25m in value – a potential opportunity for the UK as a butter exporter.

Table 2. Annual production and trade of dairy, comparison between Switzerland and the UK (2020–2022 average)

| Switzerland | UK | |

|---|---|---|

| Production |

Liquid milk: 454,000 tonnes Butter: 40,000 tonnes Cheese: 204,000 tonnes |

Liquid milk: 6.2bn tonnes Butter: 207,000 tonnes Cheese: 500,000 tonnes |

| Total exports |

£641m Top exports:

|

£1.6bn Top exports:

|

| Total imports |

£488m Top imports:

|

£2.7bn Top imports:

|

Sources: Defra, Swiss Federal Statistical Office and TDM

Consumption

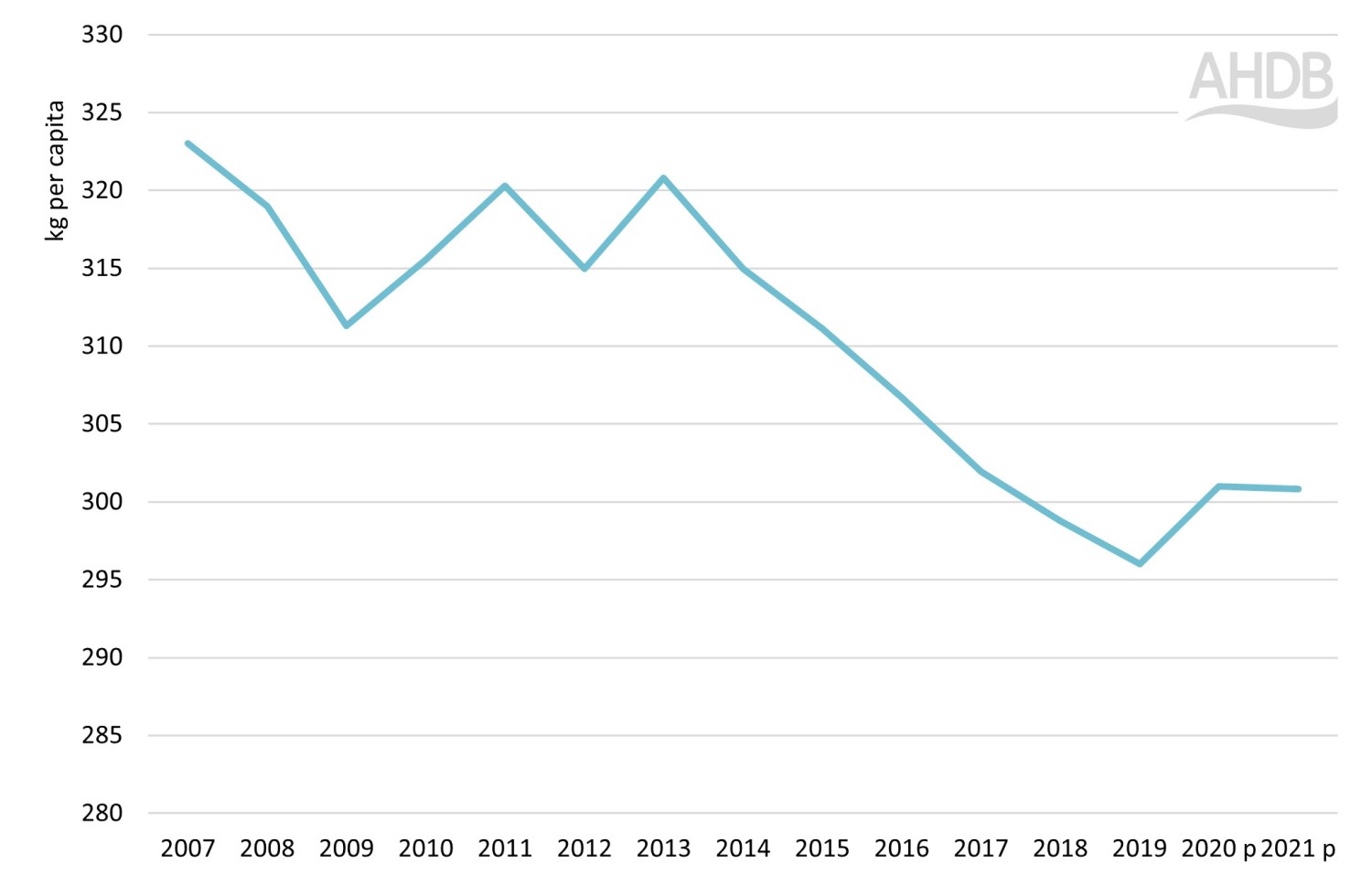

It is estimated that the Swiss consume 23.4 kg of Swiss cheese per capita each year (see Figure 2), over 10% more than the EU average of 20 kg. Milk and butter consumption in Switzerland are both also above the EU average at 51.3 kg and 5.3 kg, respectively, per person per year (2021 data). These figures may reflect the relative wealth of the country.

Over the past 10 years, individual consumption of dairy products has decreased. This is against a backdrop of increasing population in Switzerland, however, so overall demand has remained steady. In the next few years, changes in demand and increasing consumer concern about the environment and animal welfare will be key watchpoints.

Figure 2. Average consumption of milk and dairy products per person

Source: Swiss Federal Statistical Office

Sustainability is important to the Swiss consumer. The 2021 survey ‘Sustainable food: What Swiss consumers expect from companies and policymakers’ reported that for 79% of Swiss consumers sustainability has some degree of influence over eating habits; this is significantly higher than the EU average of 59%.

Animal welfare measures are strict in Switzerland. The country has two widely adopted government programmes that detail measures for farmers to improve cow comfort and quality of life:

- RAUS (regular open-air grazing)

- BTS (animal-friendly livestock housing)

Back to

Hubpage: The impact of a UK–Switzerland Free Trade Agreement on UK agriculture

Continue reading about the UK–Switzerland FTA

- Introduction

- Trade between the UK and Switzerland at a glance

- Switzerland trade and production

- Consumer demand: Is there a market to export more UK red meat and dairy to Switzerland?

- Agricultural policy in Switzerland

- Switzerland's Free Trade Agreements

- Economic modelling of the beef, sheep, dairy and pork sectors