- Home

- Pork trade and production in Switzerland

Pork trade and production in Switzerland

Pork production in Switzerland accounts for about 8% of total agricultural output. The majority of production is for domestic consumption, with only limited amounts imported or exported.

Overview

For 2021, the Swiss pig sector accounted for 8.1% of total agricultural output – the third greatest output for animal production and fourth largest agricultural output overall.

As at 2020, there were 110,097 breeding sows and 2.8 million piglets in Switzerland. This is less than half the size of the sector in the UK, where there were 295,000 pigs in the female breeding herd and 3.7 million fattening pigs in 2021.

From 2021 to 2022, pork production in Switzerland increased by 1.2% to 177,769 tonnes (fresh meat sales weight).

Switzerland has much more organic production than the EU, and organic is more common on smaller holdings. During 2019, the organic farming area in Switzerland was 16.3%, almost double the average organic farming area for EU-27 (as at 2019) of 8.5%. For comparison, 0.7% of the UK pig herd were produced using organic farming practices during 2022.

There are four pork production assurance schemes in Switzerland. Approximately 69% of Swiss pig farms are assured under a conventional production method, which acts as a baseline assurance scheme. Almost one-third (31%) of pig farms are assured to production standards which are higher than conventional methods, such as organic production or improved animal welfare.

Although Switzerland is outside the EU, its agricultural systems are vulnerable to pressures faced in Europe. Towards the end of 2022, for example, the Swiss pork market was in a state of crisis due to an oversupply of pigs and declining pig prices, along with the EU and the UK. Funding from Switzerland’s federal government helped to support the sector and mitigate the crisis.

Imports and exports

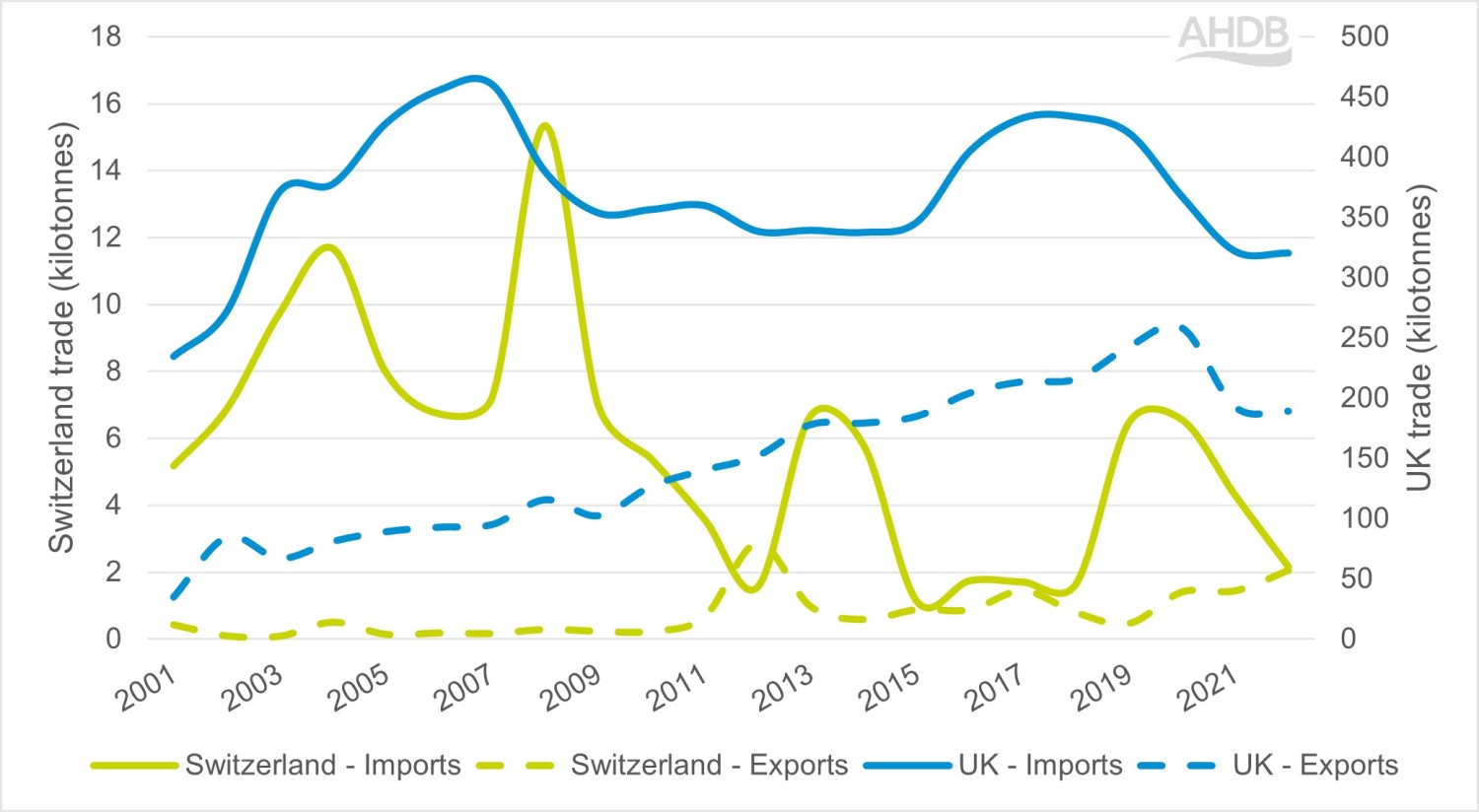

Like the UK, Switzerland is a net importer of pig meat. Occasionally, Switzerland has exported more pork meat than it has imported.

Figure 1. Imports and exports of pork in Switzerland and the UK, 2001–2022

Table 1. Annual production and trade, 2020–2022 average

| Switzerland | UK | |

|---|---|---|

| Production (t) | 228,663 | 980,845 |

| Total exports (t) | 1,634 | 213,517 |

| Total imports (t) | 4,331 | 336,580 |

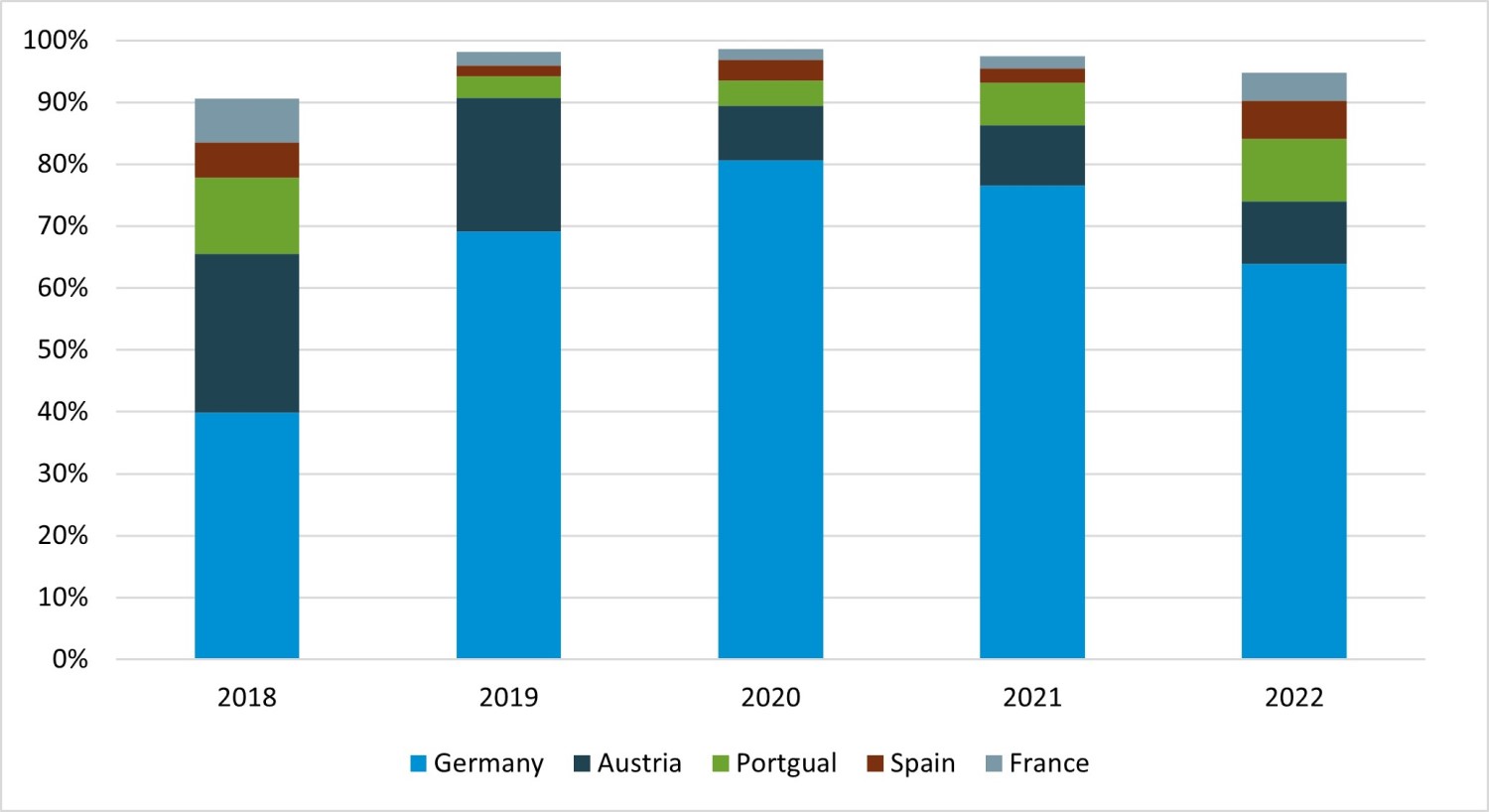

All of Switzerland’s imported pork originates from within Europe, with Germany being the largest supplier by far (see Figure 2). Since 2002, Switzerland has had a free trade deal with the EU, in which no customs duty is payable on pig meat imports from EU countries.

Figure 2. Where does Switzerland imported pig meat come from?

Opportunities for UK exports to Switzerland are likely to depend on the quality and reputation of UK pork. For example, the UK’s welfare standards chime with the strong consumer demand in Switzerland for high standards of animal-friendly husbandry.

Consumption

While pork meat is the most popular livestock product in Switzerland, one challenge the UK may face is consumer preferences for certain product types. Sausages and fresh meat dominate the Swiss pork meat sector. The UK, however, mostly exports offal, fresh and frozen pork meat. There may be an opportunity to increase UK exports of fresh and frozen pork to Switzerland; however, demand for offal is likely to be low.

Pork consumption in Switzerland has been in decline since 2014. This is likely due to a trend towards meat-free diets and awareness of climate change. For 2022, pork consumption declined by 1.2% and per capita consumption fell by 2.5% to 20.7 kg.

In addition to the weakening demand for pork, a 2022 survey found that 99% of participants agreed that the origin “Switzerland” was important when buying meat. This was supported by recent meat consumption data; this highlighted that, for 2022, 96.4% of pig meat produced in Switzerland was consumed domestically – up 2.4 percentage points from 2021.

Back to

Hubpage: The impact of a UK–Switzerland Free Trade Agreement on UK agriculture

Continue reading about the UK–Switzerland FTA

- Introduction

- Trade between the UK and Switzerland at a glance

- Switzerland trade and production

- Consumer demand: Is there a market to export more UK red meat and dairy to Switzerland?

- Agricultural policy in Switzerland

- Switzerland's Free Trade Agreements

- Economic modelling of the beef, sheep, dairy and pork sectors