- Home

- Asia: Consumer insight

Asia: Consumer insight

Meat

Unlike consumers in the West, who tend to buy food infrequently and store it in refrigerators or freezers, consumers in many Asian countries buy fresh food on a daily basis. This may be out of necessity due to a lack of refrigeration and storage in the home. There are opportunities for exporters to focus on in-store opportunities. Shopping behaviour links back to production, and the in-store environment heavily pulls upon this message to create a feeling of freshness and inform the consumer how the product has been made. These behaviours are covered in more depth in AHDB’s Exploring Asia report.

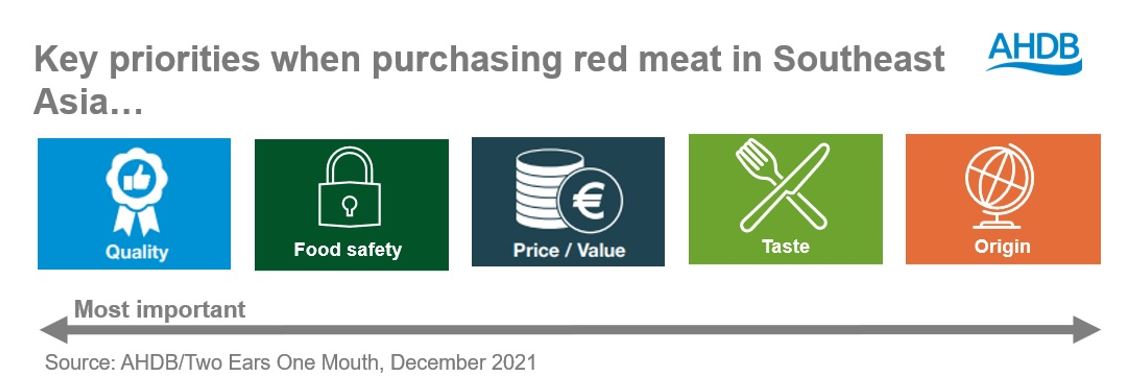

Consumer meat-buying behaviour in Southeast Asia (see list of countries in the next paragraph) is influenced by three overarching factors ‒ quality, food safety and price. Quality is the most influential; however, what a consumer considers as quality is unique to the individual and can include further factors such as product taste. Food safety is second, understandably so, as it has consistently been a top concern for consumers in many Asian countries, especially those without trusted food-safety systems.

Note: The Southeast Asian countries covered in this report are: China, Hong Kong (Special Administrative Region of China), Taiwan (Republic of China), Japan, Singapore, South Korea, the Philippines and Vietnam.

Broken down by country within Southeast Asia, we can see nuances in the priorities behind buying red meat. For example, Korean consumers consider taste more highly when purchasing red meat, while food safety sits much lower down the list. Chinese and Vietnamese consumers, however, are more likely to consider the health and nutritional credentials of red meat. Although British red meat remains niche in Southeast Asia, it performs well in comparison to Southeast Asian domestic product.

Southeast Asia provides a fantastic opportunity for UK exports. However, there are some barriers when it comes to consumer perception of British red meat. A key stumbling block in many Southeast Asian markets is price and value for money in comparison to domestic product. Exporters would need to ensure their communications justify a price premium while getting across messaging on the key purchase drivers within given regions, such as quality, taste, and food safety.

Read more: Understanding red meat buying behaviours in Southeast Asia

Dairy

As with other categories, food safety is a big concern in many parts of Asia, and there is an opportunity for exporters to deliver products with messages about the issue. Claims such as organic, pasture-raised or antibiotic/hormone-free could be used on-pack to appeal to Asian consumers.

Health claims such as reduced fat, lactose-free, probiotic, and fortified with calcium are popular in the region. Dairy products have been identified in Asia as good for growing children, delivering nutrients such as protein and calcium. Indeed, in China, young children and older consumers are the key age cohorts for dairy consumption.

Taste also varies by country, for instance, with cheese. More affluent markets like Korea and Japan, where cheese is more established, are open to trying stronger flavours such as blue cheese and stronger Cheddar. In markets less familiar with cheese flavours, such as China, creamier and milder cheese, such as mozzarella, mascarpone and other cream cheeses, are more common.

These topics are explored further in the dairy section of AHDB’s report Exploring Asia: Understanding consumer needs.

Continue reading about the Asian market

Where the opportunities lie, by country

Market access and barriers to trade