- Home

- Asia: How much do they consume?

Asia: How much do they consume?

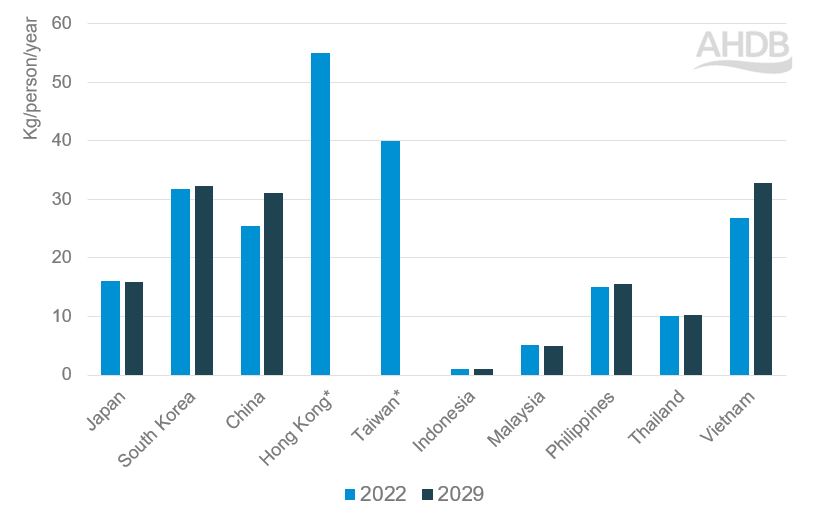

Pork

Pork is the most widely consumed red meat in Asia.

According to OECD data (Figure 1), South Korea, Vietnam and China have the highest consumption per capita in the region.

Hong Kong and Taiwan (Republic of China) have the highest consumption, estimated at 55 kg and 38 kg per person per year, respectively.

Per capita, pork consumption is forecast to increase in South Korea by 2% between 2022 and 2029 and by a substantial 22% in China and Vietnam.

Figure 1. Pork consumption per capita in selected Asian countries (kg/person/yr)

*Hong Kong and Taiwan figures are for 2020 (FAO) as 2022 figures and forecast not available from OECD

Source: OECD, FAO

China and Japan consume more pork than they produce; African swine fever (ASF) has exacerbated the gap in China. Canada, the EU and the USA are the main suppliers to the Asian market.

ASF has led to a surge in Chinese pig meat imports. Prior to 2020, China imported about 1.4 million tonnes (Mt) of pork (2015–19 average). However, imports in 2020 and 2021 averaged just under 4 Mt.

Although full trade data for 2022 is not available at the time of writing, monthly figures indicate a considerable year-on-year decline for imports, in line with China’s recovery from ASF.

China imports about 1.2 Mt of pork offal (2019–21 average), mainly from the USA, Spain and other EU countries. Chinese pig offal imports peaked at around 1.3 Mt in 2016 but then fell to 950 Kt in 2018 and 1 Mt in 2019.

Imports then rebounded to more than 1.2 Mt in 2020 and 2021, probably as a consequence of ASF. Monthly 2022 trade data indicated lower Chinese pig offal imports in 2022.

Hong Kong has imported an average of 300 Kt of pork offal over the same period, mainly from the USA and EU. The Philippines is another large offal importer (more than 180 Kt imported on average between 2019 and 2021).

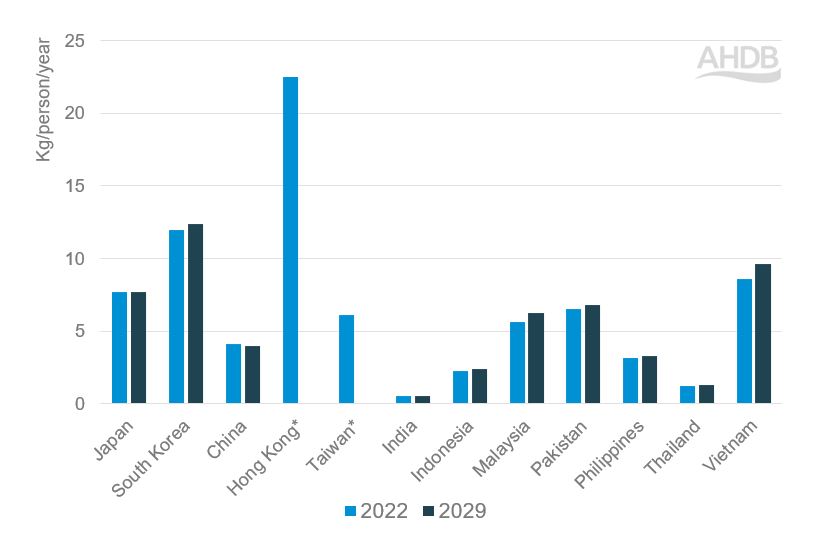

Beef

Beef is the second most widely consumed red meat in Asia, with per capita consumption highest in South Korea, followed by Vietnam (Figure 2), according to OECD data.

However, OECD figures do not differentiate between China, Hong Kong and Taiwan (Republic of China). The FAO estimates beef consumption per capita in Hong Kong in 2020 as 22.5 kg per person, which is considerably higher than in other Asian countries.

According to the same source, Taiwan’s beef consumption per capita in 2020 is reported as 6.1 kg per person per year, but as 6.8 kg per person per year based on information on the Meat and Livestock Australia website.

While the exact figures are not clear, it’s fair to say that beef consumption in Taiwan (Republic of China) is relatively high within Asia.

Figure 2. Beef consumption per capita in selected Asian countries (kg/person/yr)

*Hong Kong and Taiwan figures are for 2020 (FAO) as 2022 figures and forecast not available from OECD

Source: OECD, FAO

Between 2022 and 2029, per capita beef consumption is projected to increase by 4% in South Korea, 12% in Vietnam and 11% in Malaysia.

Taiwan (Republic of China) relies on imports as the domestic production of beef is small. Almost a third of the population are young, affluent adults who consume a variety of cuisines containing beef, and beef imports are expected to increase by 1.8% per year until 2024.

China, Japan and South Korea import the most beef in Asia, and with South Korea’s beef consumption per capita projected to rise, as shown in Figure 2, it is likely that imports will also increase to meet demand unless there is an increase in domestic production.

In recent years, China’s beef imports have mainly come from Brazil, Argentina, New Zealand and Australia. Demand for beef in China increased in recent years due to ASF and avian flu.

The USA and Australia are the main beef suppliers for Japan and South Korea.

The main cuts China imports are beef shank and brisket. Beef shank is predominantly used in foodservice and home cooking, while brisket is used mainly in hotpots and fast-food restaurants.

Beef shoulder cuts are also a popular product for Chinese imports, used in foodservice and for further processing. Beef trimmings also feature highly and are processed further or used in hotpots (broths traditionally served in large metal pots).

Hong Kong is the main bovine offal importer in Asia (321 Kt based on the 2019–21 average), supplied mostly by Brazil. Japan is another important importer of bovine offal (more than 55 Kt) and beef tongues (more than 22 Kt).

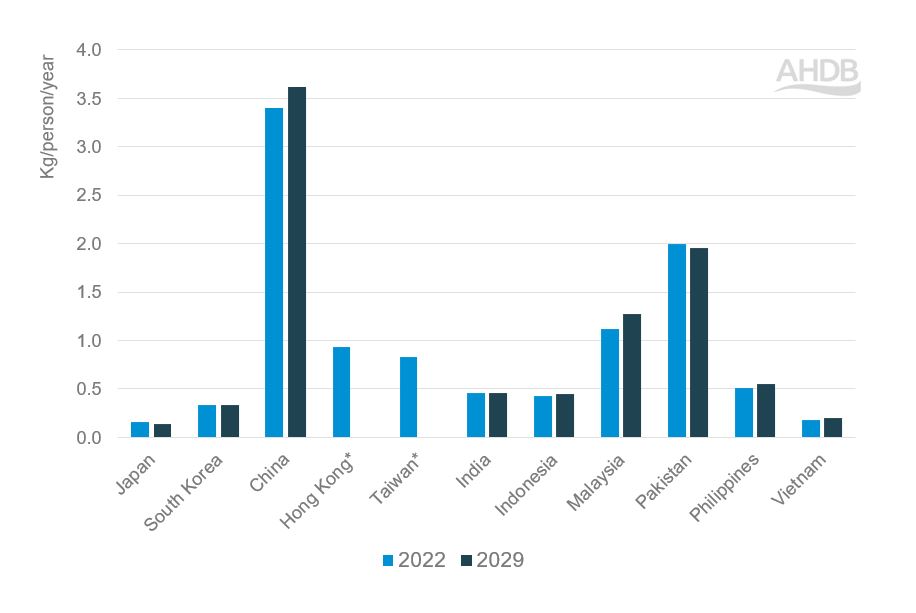

Sheep meat

Sheep meat consumption in Asia is markedly lower than pork and beef, with China having the highest per capita consumption in the region, which is expected to increase by 6% by 2029 (Figure 3).

Figure 3. Sheep meat consumption per capita in selected Asian countries (kg/person/yr)

*Hong Kong and Taiwan figures are for 2020 (FAO) as 2022 figures and forecast not available from OECD

Source: OECD, FAO

Although from a smaller base, per capita consumption of sheep meat in Malaysia and Vietnam is forecast to increase by 14% and 16%, respectively, by 2029.

China is by far the largest sheep meat importer in the region, accounting for almost two-thirds of the Asia-Pacific total in 2018.

The second-highest importer, Malaysia, accounted for 8% (based on quantity) in 2018. The main suppliers to the Asian market are Australia and New Zealand.

Sheep meat consumption is expected to continue to grow in Asia, particularly in China, where consumers consider it a high-quality and nutritious source of protein.

ASF and avian flu led to protein switching and increased demand for sheep meat in China over the past few years, and by 2028 China is expected to account for 40% of global growth.

Sheep meat imports into China are usually low-value cuts which are processed and used in hotpots.

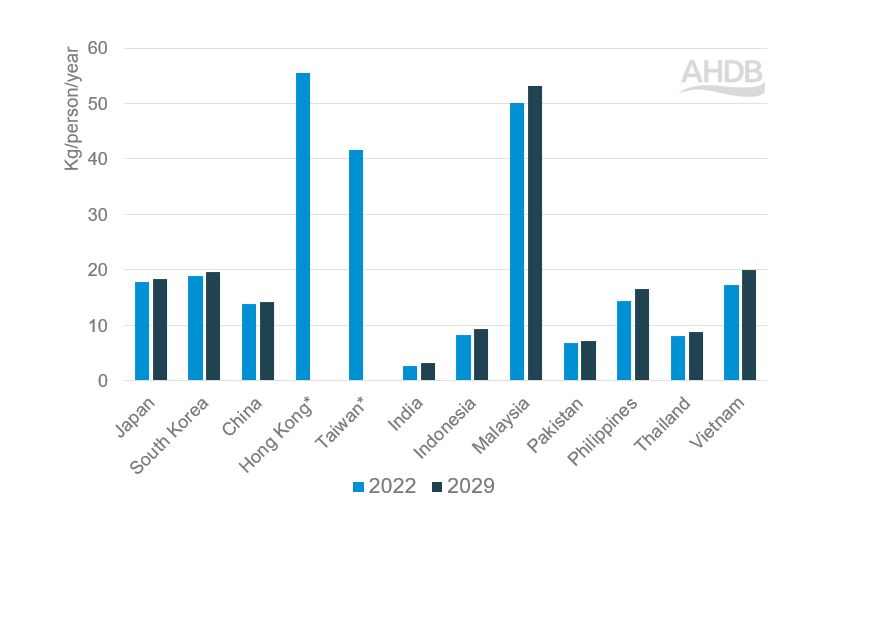

Poultry and fish

Demand for poultry meat and fish meat competes with red meat for market share in Asia.

Figure 4 shows Malaysia has a high poultry meat per capita consumption, with the potential to grow. On average, poultry meat consumption per capita in Asia is higher than beef and sheep meat.

Figure 4. Poultry meat consumption per capita in selected Asian countries (kg/person/yr)

Source: OECD, FAO

Fish is an important component of the Asian diet. Global fish consumption is expected to increase at a faster rate (1.4% per year compared with 1% per year) than meat consumption for the next decade (OECD).

Asian demand for fish consumption in food is expected to account for almost three-quarters of the total consumption of fish meat by 2031.

Dairy

Globally, Asia has the highest consumption of fresh dairy products, such as milk, but consumption of processed dairy products, such as cheese, yoghurt and butter, lags behind Europe and the USA.

Pakistan and India are the largest dairy-consuming countries in Asia, especially for fresh produce. India is self-sufficient in milk production and is a net exporter of most dairy products.

While Pakistan is a net exporter of fresh milk, it is mainly a net importer of processed dairy products, particularly cheese, albeit in relatively small quantities (around 2 Kt, based on 2019–20 average).

China is the key dairy importer in Asia (as well as the world), particularly for milk powders. Its main supplier is New Zealand, accounting for 40% of imports.

Milk powder imports in Asia are around 40‒50% of the global share (2016‒18 average), and this is forecast to increase to over 60% for skimmed milk powder (SMP) by 2028 (OECD).

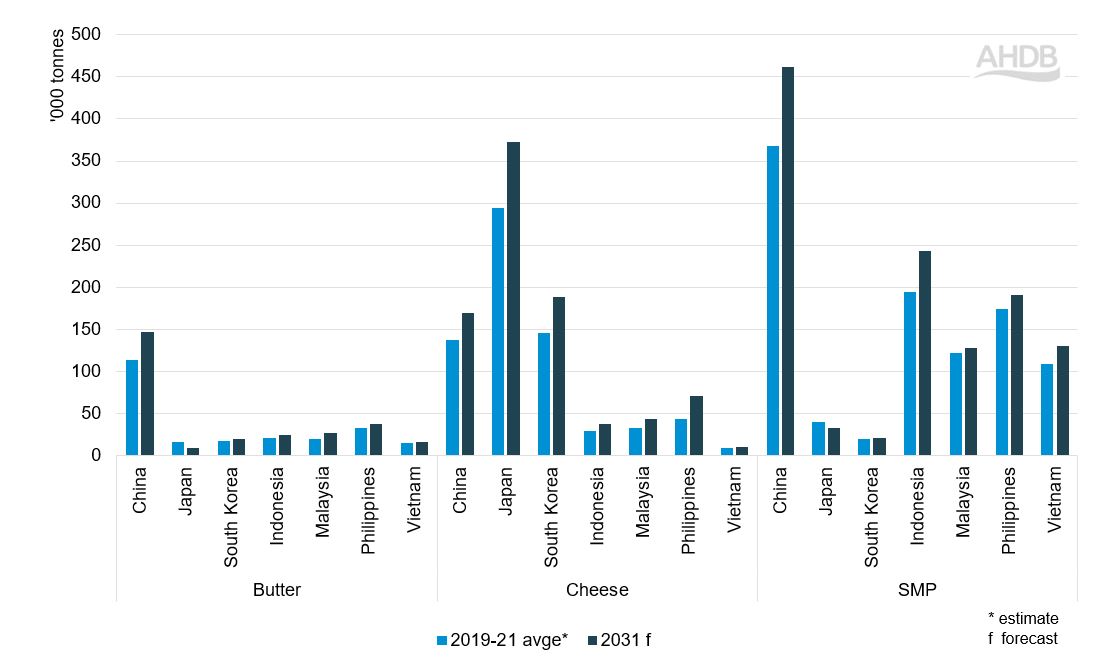

Figure 5 shows current dairy product imports in a selection of Asian markets as well as projected import levels in 2031.

China is by far the largest importer of SMP, with imports forecast to increase by 25% by 2031. Indonesia, the Philippines, Vietnam and Malaysia are also expected to increase SMP imports over the next decade.

Vietnam’s per capita milk consumption is relatively low compared with other Asian countries (26‒27 kg per person per year, compared with an average of 38 kg per person per year). However, it’s the young population with increasing income levels that is seen as a driver for rising demand in the coming years.

Vietnam is already highly dependent on dairy imports as its production cannot satisfy domestic consumption. With the expectation that demand for dairy will grow, we can expect import levels to increase.

China is the largest butter importer in Asia, but Japan is the main cheese-importing country: its imports are forecast to grow by 27% by 2031.

South Korea is the second-largest cheese importer in the region, and a growth of 30% is expected by 2031. Demand for cheese in South Korea has been growing rapidly, with per capita consumption more than doubling in the past decade.

Cheese, particularly the processed variety, is a popular snack, and demand has increased in both the consumer and food processing markets.

Hong Kong and Singapore are also important dairy markets in Asia. Milk powders are the key product, with over 100 Kt imported (2019‒2021 average). Both cheese and butter imports have averaged below 20 Kt in comparison.

Nevertheless, Hong Kong and Singapore can be considered gateways to the Asian market and, as advanced economies within the region, are promising markets for premium dairy products.

Likewise, Taiwan is also a market to consider. Annually it imports around 80 Kt, 30 Kt and 20 Kt of milk powders, cheese and butter, respectively (2019‒21 average).

The UK already exports some dairy products to Hong Kong, Singapore and Taiwan and is the second main supplier of cheese to Hong Kong after New Zealand.

There is, however, potential to improve the amounts of other dairy products exported, as well as maximise dairy exports to Singapore and Taiwan.

Figure 5. Dairy product imports in selected Asian countries ('000 tonnes)

Source: OECD

Barley

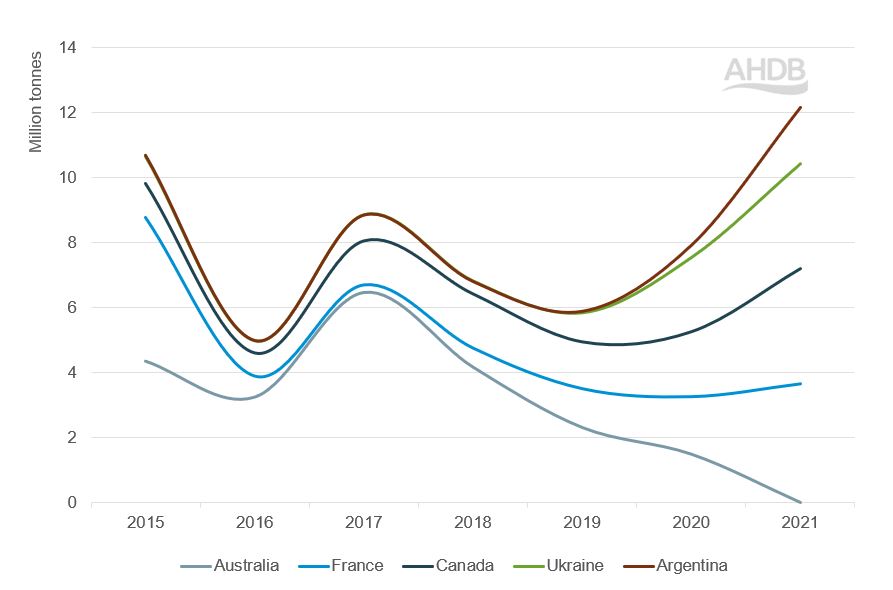

China is a big importer of barley, and since 2015, imports have been between 5 and 10 Mt.

However, in 2021, barley imports reached over 12 Mt, reportedly driven by increased demand for feed grains due to rising meat consumption.

Feed barley is the main grade of the crop imported by China with malting barley imports typically at 1‒2 Mt a year.

As shown in Figure 6, Australia has been the main supplier of barley to China, but has been subject to an inhibiting 80% tariff on barley imports since May 2020.

Other barley suppliers have benefitted from Australia’s inability to compete for the Chinese market.

Figure 6. Chinese barley imports (Mt)

Source: China Customs Statistics via Trade Data Monitor LLC

While the OECD and FAO do not provide import projections for barley separately, the OECD predicts China’s imports of coarse grains (barley, oats sorghum, rye, millet) will reach more than 19 Mt by 2031 ‒ an increase of 18% from current (2019‒21 average) levels.

Continue reading about the Asian market

Where the opportunities lie, by country

Market access and barriers to trade