- Home

- Asia: Market access and barriers to trade

Asia: Market access and barriers to trade

When it comes to trade, tariff levels, understandably, attract a fair amount of attention. Low or non-existent import tariffs in a country mean it is favourable to export there. High import tariffs discourage trade due to the cost to the exporter.

It is also important to be aware that international trade does not depend just on tariff rates. Market access also depends on meeting various conditions and criteria of the importing country. In order to export animal products, export health certificates (EHCs) are required by the importing nation, so an arrangement must be in place before products can be shipped.

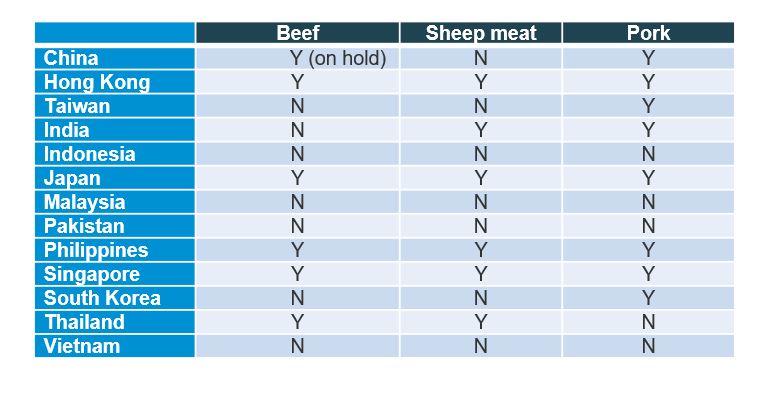

Table 1 shows whether the UK has EHC agreements in place allowing meat exports to various Asian countries.

Table 1. Selected Asian countries where the UK has an EHC for red meat

Source: Animal and Plant Health Agency, gov.uk/export-health-certificates

It is clear from the table above that the UK’s market access for pork in Asia is better than beef and sheep meat.

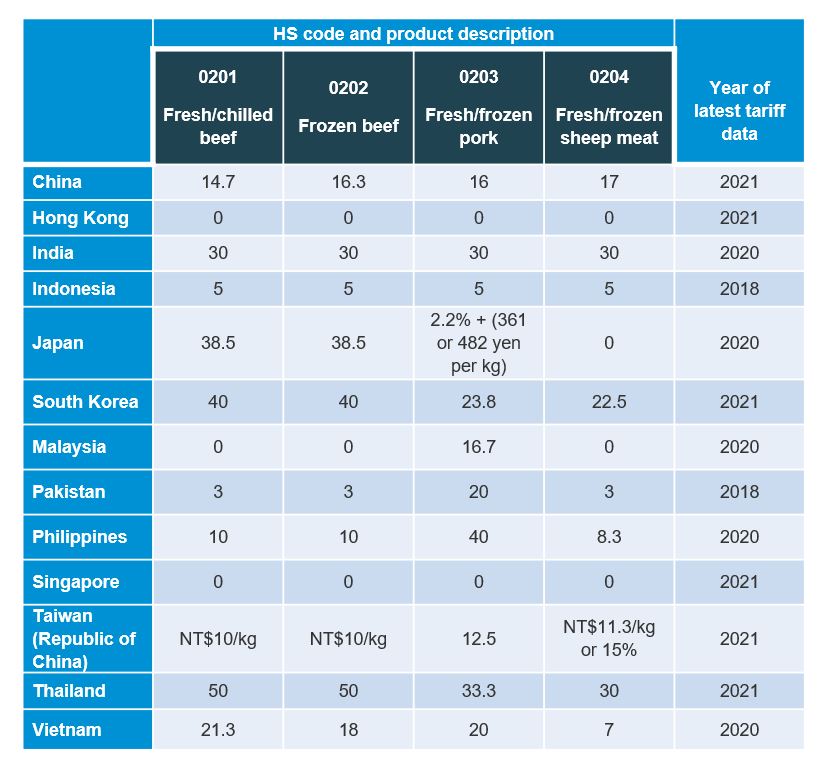

Table 2 shows the latest WTO tariff rates for beef, pork and sheep meat for various Asian countries. Out of the countries shown, tariff rates in Japan, South Korea and Thailand are the highest for red meat imports.

Table 2. Average import tariffs for red meat in selected Asian countries (%)

Averaged tariff rates are expressed as % of price except where stated

Source: World Trade Organisation

These tariff rates may be lowered or eliminated if a trade agreement is in place between the two countries or as part of a trade bloc or network. The UK has continuity deals with Japan, Singapore, South Korea and Vietnam, rolled over from its previous EU membership.

Beef

Out of the key markets shown in Table 2, Thailand, Korea and Japan have the highest tariffs on beef imports. Import tariffs for China and Vietnam, and to some extent, Taiwan (Republic of China), are broadly similar and are mid-range for the region. Import tariffs for Indonesia and Pakistan are relatively low. Hong Kong and Malaysia allow tariff-free beef imports, but it’s worth bearing in mind that for the large Muslim populations of Malaysia, Pakistan and Indonesia, halal beef is likely to be required.

Under the CEPA agreement with Japan, the UK can export beef to the country at a preferential tariff rate of 24.2% rather than the rate of 38.5% shown in Table 2. By 2033, the tariff rate will gradually be lowered to 9%.

However, there are currently other issues limiting British beef exports to Japan. In 2019, Japan lifted its ban on British beef imports put in place during the BSE crisis, but this only allows beef carcase meat and offal from animals under 30 months old. Products such as minced beef and prepared or cooked beef are still not accepted.

A ban on British beef imports has also been in place in South Korea since 2001 due to BSE. Work to regain market access is in progress.

Tariffs on UK beef exports to Vietnam will be removed by August 2023 following an agreement between the two countries. However, at the time of writing, there is no EHC in place to export UK beef to Vietnam.

Market access for beef is challenging at the moment due to the suspension of beef imports from the UK into China.

Pork

The Philippines and Thailand have the highest pork import tariffs in Asia. India’s tariff on pork is also relatively high, but as consumption levels are much lower, it is less of an opportunity for UK exporters. Hong Kong does not have any import tariffs on pork, while Indonesia’s tariff rate is relatively low at 5%.

Under the UK‒Vietnam continuity agreement, tariffs on frozen pork will be eliminated by August 2027, while tariffs for fresh pork, offal and hams will be removed by August 2029. This is promising news because pork consumption in Vietnam is relatively high within Asia and is forecast to grow (see consumption section). Taiwan, China and South Korea are also in the mid-range of pork tariffs (shown in Table 2) but have high per capita consumption of pork. Under the continuity agreement between the two countries, UK pork can enter the South Korean market tariff-free.

Sheep meat

Of the Asian markets in Table 2, India and Thailand have the highest WTO import tariffs on sheep meat. Although market access has opened for UK lamb exports to India, further work to improve it is ongoing as India’s requirements exceed international standards set by the World Organisation of Animal Health (formally OEI) for certain diseases. It is worth noting that in addition to relatively high import tariffs, Thailand has lengthy application and authorisation procedures for animal products which may lead to delays.

China, South Korea and Taiwan’s tariffs on sheep meat imports are mid-range for countries in Table 2. The UK does not have market access to export lamb/sheep meat to China. The UK Government made an application in 2019, and this remains under review. Similarly, the UK submitted an application for market access for UK lamb into South Korea in 2019, and the process has been delayed due to the COVID-19 pandemic. Under the UK‒South Korea continuity agreement, sheep meat from the UK would be eligible to enter South Korea tariff-free.

Malaysia and Pakistan have either no or small import tariffs on sheep meat, and in Asia, they are the highest consumers of it after China. In Asia as a whole though, sheep meat consumption is much lower than other meats.

Dairy

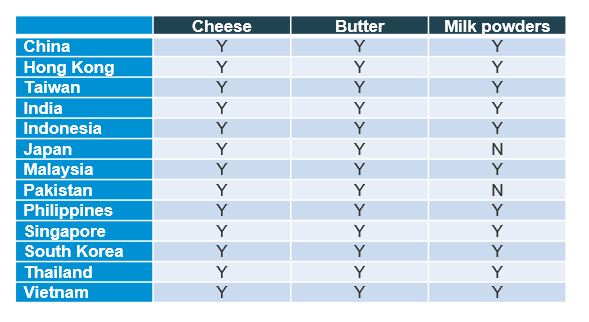

UK market access for dairy products in Asia is considerably better than red meat. Access is granted for cheese and butter in all the countries shown in Table 3. For milk powders, the UK also has access to all except Japan and Pakistan.

Table 3. Selected Asian countries where the UK has an EHC for dairy products

Source: Animal and Plant Health Agency, gov.uk/export-health-certificates

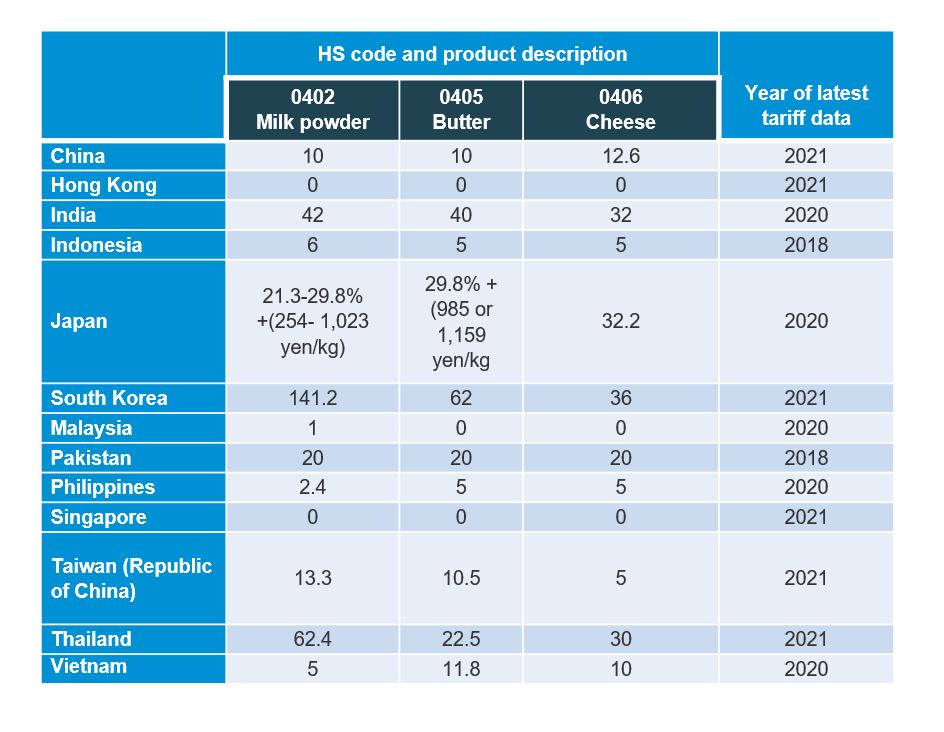

South Korea, Thailand, Japan and India have the highest tariffs on dairy imports within Asia. Powdered milk tariffs in South Korea and Thailand, in particular, are higher than other dairy products.

Although there are no tariffs for UK dairy imports into Hong Kong, complex regulations (mainly for milk and cream) have been affecting UK exports and leading to delays and loss of shelf life.

Vietnam’s import tariffs on dairy products are broadly similar to China’s. Furthermore, under the UK‒Vietnam FTA, import tariffs on cheeses with Geographical Indications will be removed by August 2023 and duty on other dairy products lifted by August 2025.

Table 4. Average import tariffs for dairy products in selected Asian countries (%)

Average tariff rates are expressed as % of price except where stated

Source: World Trade Organisation

Barley

China’s WTO tariff rates for barley imports are fairly low (maximum 3%), but as we have seen already, tariffs are usually only a small part of market access. In 2015, AHDB negotiated a protocol allowing UK barley exports to China. However, discussions are continuing around the presence and control of sterile brome and ongoing trade.

Developments in trade negotiations

At the time of writing:

- The UK is in FTA negotiations with India

- The UK applied to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes Japan, Malaysia, Singapore and Vietnam as members. Fruition of these talks may see improved tariffs and/or trading terms for UK agri-food

- The UK has a continuity agreement with South Korea but is taking steps towards setting up an FTA. In December 2022, it opened a consultation to inform starting negotiations

Continue reading about the Asian market

Where the opportunities lie, by country