Will the USDA forecast heavy supplies in 2023-24? Grain market daily

Friday, 12 May 2023

Market commentary

- Nov-23 UK feed wheat futures fell £1.00/t yesterday to close at £194.75/t. Grain futures globally slipped a bit lower, after Algeria bought mostly Black Sea wheat in a tender and the US again reported slow grain export sales.

- Negotiations continue to try to extend the Ukraine grain export corridor and this uncertainty limited price falls. The current deal expires in less than a week and there’s no answer yet about an extension. Turkey’s Defence Minister says a deal is getting closer but Russia states there is nothing new to report (Refinitiv).

- Brazil’s soyabean crop totals 154.8Mt said Conab (gov’t agency) yesterday, a new record and up 1.2Mt from the April estimate. Conab also added 0.7Mt to its maize forecast, now 125.5Mt.

- Nov-23 Paris rapeseed futures lost €10.75/t yesterday. The contract closed at €431.50/t, down €22.50/t since last Friday and its lowest price since July 2021. Falls in crude oil and Malaysian palm oil prices weighed on rapeseed prices.

Will the USDA forecast heavy supplies in 2023-24?

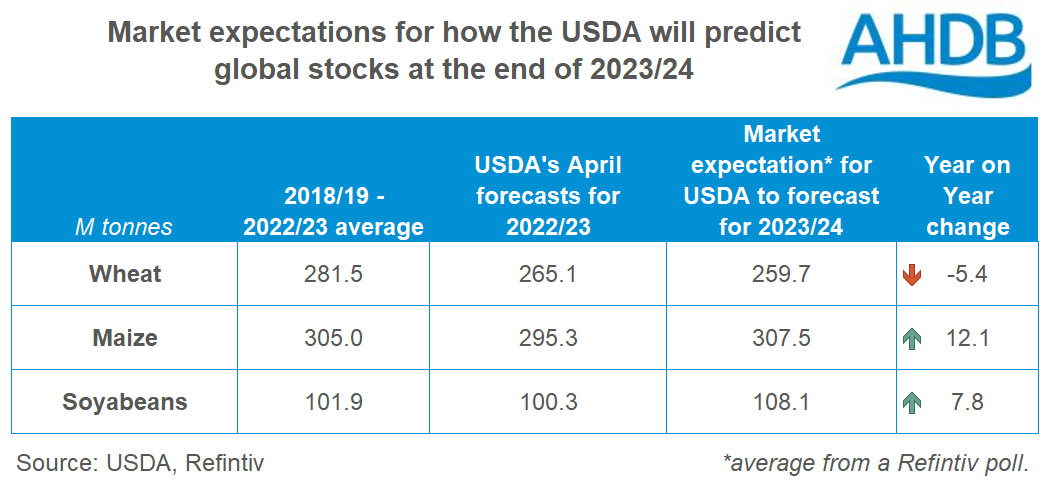

Tonight (at 5pm) the USDA releases its first forecasts for global supply and demand in 2023-24 (next season). The market expects the USDA to forecast high global supplies of both maize and soybeans, with further stock build up in 2023-24. This is according to a poll of expectations by Refinitiv.

For wheat, market sentiment has been bearish as we head towards the new season. This reflects the ample availability of Black Sea supplies, feed demand being curtailed and building stocks on the continent and domestically. The Refinitiv poll shows the market expects global stocks to fall over 2023-24, though there’s a wide range of views. The key to sentiment for wheat will be in the detail of the report, not just the total stock level but where are they? And how accessible are they?

Heavy global supplies of both maize and soyabeans could pull the whole market, including prices for wheat (and rapeseed) lower.

The USDA’s May report helps set the tone for how developments are viewed in the season ahead. If the USDA confirms market expectations for heavy supplies, the recent bearish tone is likely to continue. As always, things do change, and serious weather issues or further supply disruption could shift sentiment. But an established bearish tone means it can take a lot more bullish news to change market sentiment and push prices higher again.

For example, if the Ukrainian export corridor (Black Sea Initiative) isn’t extended, it could mean some support for prices as it makes the supply in Ukraine so much harder to access. But, if a deal is reached, it could add to confidence about availability and contribute to a bearish view continuing.

These are some things to watch for in tonight’s report:

2023/24 forecasts

- What will the USDA’s assessment of the damage from dry weather on the US winter wheat crop be? The market is still expecting bigger crops than last year because of the larger planted area. Harvest is now only a few weeks away in the southern states.

- In May, the USDA uses the long-term trend to forecast US maize, spring wheat and soyabean yields in the coming harvest. But it’s still interesting to see what yields the USDA uses.

- Australian crops are likely to be smaller next season but where will the USDA peg them? The La Niña weather event, which brought high rainfall, has ended so yields are likely to drop back. Plus, an El Niño weather event could be brewing, and these can mean below normal rainfall and yields.

- Similarly, the USDA is likely to show a rebound in Argentina’s maize and soyabean crops, after this season’s drought. But how high will that rebound be?

- Ukraine’s crops are forecast to be smaller in 2023/24 by its government. Will the USDA match these numbers?

- From 2017/18 – 2021/22 total global demand for wheat, maize and barley grew by 2% per season on average. This season, the USDA predicts it to fall 1%. So, with prices lower than they were, could feed demand and so total global grain demand grow again in 2023/24?

2022/23 forecasts

There can also be changes to the old season supply and demand numbers. But the most likely changes seem unlikely to help prices.

- US ending stocks of wheat, maize and soyabeans are likely be raised from April’s forecasts following the sluggish export pace in recent weeks.

- Will the USDA match the latest South American crop numbers? The USDA’s estimates of the Argentinian soyabean crops are 4.5Mt above the latest numbers from the Buenos Aries Grain Exchange, with maize 1.0Mt above. Conversely, the USDA’s April estimates of the Brazilian soyabean and maize crops are 0.8Mt and 0.5Mt below the latest numbers from Conab.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.