What could El Niño mean for oilseeds? Grain market daily

Friday, 21 April 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £195.70/t, down £4.15/t on Wednesday’s close. New crop futures (Nov-23) closed at £208.60/t, down £4.25/t over the same period.

- The domestic market followed both the Chicago and Paris market down yesterday. Pressuring the market was the resumption of vessel inspections out of the Black Sea under the UN-brokered deal.

- Further to that, the EU plans to permit Ukrainian grain to continue being transported across five countries within the EU for onward export, read more information on this in yesterday’s Grain Market Daily.

- Paris rapeseed futures (May-23) closed at €456.75/t, down €12.50/t on Wednesday’s close. Rapeseed followed the pressure in soyabean markets which were weaker as U.S. plantings are expected to proceed under favourable weather and U.S. soyabean exports came in under market expectations.

What could El Niño mean for oilseeds?

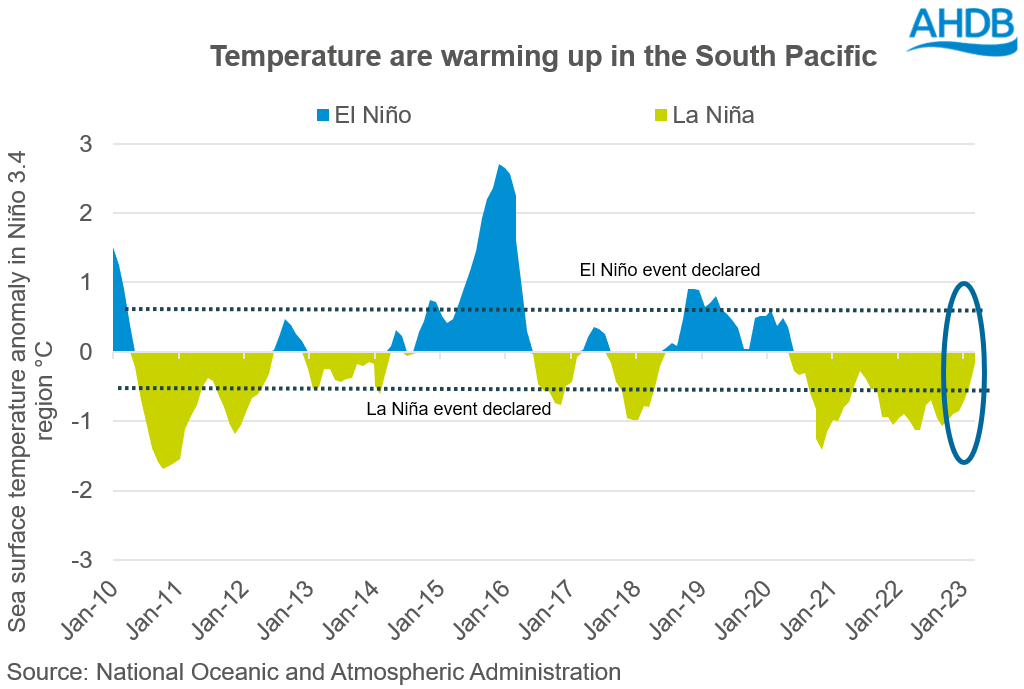

For the last three years we have constantly been writing about the La Niña weather event in the South Pacific, and notably how this impacts South America and Australia.

From this event, Australia has benefitted from excessive rains and South American crops (in parts) have suffered from drought.

However, that’s all currently in a motion of change as the National Oceanic and Atmospheric Administration (NOAA) are pointing to an increased probability (62%) of an El Niño weather event developing during May to June and intensifying between August to September this year.

There is a lot of information that this weather event in the South Pacific has the ability to control the changing weather patterns in multiple parts of the globe. However, what are the main watch points of this event if it comes into fruition?

Key watch points

- Australia is going to produce less canola – ABARES have already forecast in their statistics that grain and oilseeds are all going to take a hit from this El Niño weather event – currently putting the 2023/24 canola crop at 5.4Mt, down from a record 8.3Mt this year. To some extent, this will have been factored into the market already, as it could tighten the global supply and demand picture of rapeseed/canola. However, if these revisions are further, we could actually see rapeseed gain a premium, but ultimately soyabeans will drive the sentiment of oilseeds.

- South American crops are going to benefit – El Niño will bring favourable rains to South America, and with trend yields and area of soyabeans consistently increasing, this will mean a larger output. Which one could argue will put a bearish sentiment on the market going into January 2024 when harvest starts – but between now and then a lot can change, and demand from places like China will drive sentiment too.

- Palm oil output reduced – Due to the nature of this event palm oil producing countries like Indonesia and Malaysia will receive less rain, which will have a delayed impact on their output – but this won’t be felt until 2024, due to the nature of the harvest. This is a potential bullish factor, palm oil recently has been at a premium to other vegetable oils, which historically is unheard of.

The development of this El Niño weather event will be monitored as it could impact ex-farm rapeseed prices. Prices will ultimately be driven by the potential bearish sentiment of soyabeans going into 2024, if large South American crops are realised. However, rapeseed prices could be underpinned with a premium if Australia’s canola crop is significantly revised down from current estimates. However, sizable soyabean crops have the potential to overshadow (potential) revisions to Australia’s canola crop, especially if the EU and Canada do not face any significant weather events.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.