US winter wheat crop struggles while spring plantings progress: Grain market daily

Wednesday, 19 April 2023

Market commentary

- UK feed wheat futures (May-23) gained £1.70/t over yesterday’s session, closing at £203.25/t. The Nov-23 contract closed at £216.80/t, up £0.80/t over the same period.

- UK prices followed European wheat markets as they continued to be supported by the ongoing doubt over the future of the Ukrainian export deal. According to Refinitv, vessel inspections were halted on Monday, while Kyiv and Moscow made opposing statements about whether inspections had resumed yesterday. This morning Ukraine confirmed that inspections had resumed.

- Paris milling wheat (May-23) gained €4.75/t yesterday, closing at €260.75/t.

- Concerns over Ukrainian exports also drove up European rapeseed prices yesterday. Paris rapeseed (May-23) gained €16.50/t since Monday’s close, ending the session at €477.00/t yesterday.

US winter wheat crop struggles while spring plantings progress

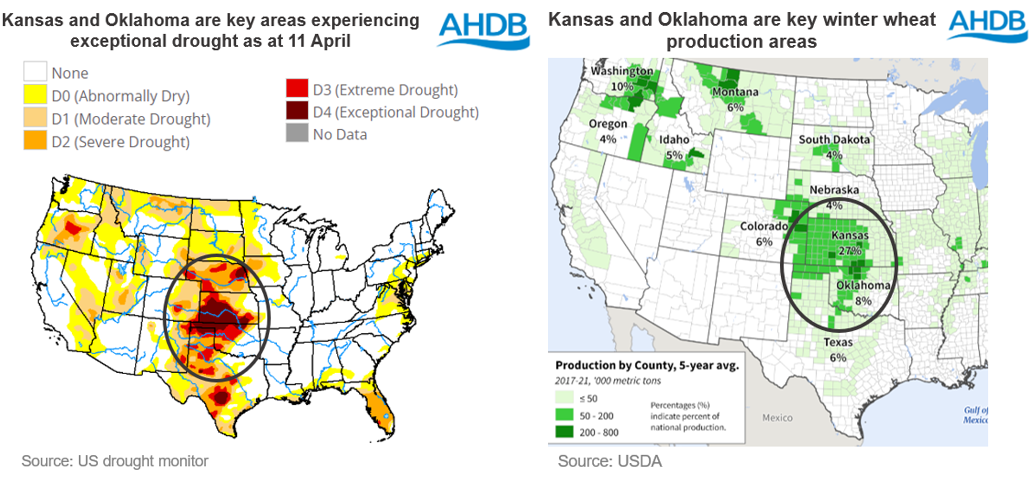

On top of concerns regarding the future of the export corridor deal in Ukraine, a key driver of global wheat markets this week has been reports of poor US winter crop conditions, with an ongoing drought in some key producing regions. Spring maize and soyabean plantings in the US are also in focus this week, as farmers take advantage of the milder weather.

So, what’s the picture in the US at the moment? And what might this mean for global markets moving forward?

Winter wheat conditions

In its weekly crop progress report released on Monday, the USDA reported 18% of the US winter wheat crop was in very poor condition, and 21% was in poor condition as at 16 April. At the same point last year, 19% of the crop was in very poor condition, while 18% was in poor condition.

As could be expected, certain areas are feeling a greater impact of the drought. Kansas and Oklahoma, two of the largest winter wheat growing states in the US, are seeing 60% and 53% respectively of the crop in either poor or very poor condition.

While market reactions suggest there is cause for concern, it’s important to remember the estimated area planted to wheat in the US for harvest 2023. In a prospective plantings report released at the end of March, the USDA estimated the total wheat area for harvest 2023 at 20.2Mha, up 9% on the year and up 8% on the five-year average. The significant increase in planted area means that even if yields are affected slightly by drought, it’s likely output will remain high. That said, if the current conditions persist, the quality of the crop may be impacted.

It’s also important to point out that wheat in the US is currently in its vegetative stage, meaning it isn’t currently highly sensitive to moisture or temperature stresses. However, over the next few weeks as the crop moves into its heading phase, it will become more sensitive, and we could see a greater impact on yield potential. For this reason, US weather will remain an important watchpoint moving forward.

While in the short-term, US markets in particular, will likely react to updates on the winter wheat crop, it is still early in the development of the crop. Looking longer term, with an increased planted area, the outlook for US wheat production remains relatively high. As it stands currently, the drought hasn’t resulted in majorly different crop conditions to previous years. The next USDA World Agricultural Supply and Demand Estimates (WASDE) due to be released in May, will be another important watchpoint in wheat markets as we gain a better idea of expected production for 2023/24.

Spring plantings progressing well

The majority of maize in the US is grown in northern parts of the country (including Iowa, Nebraska and Illinois), meaning the drought is less prevalent, with conditions mild and favourable for plantings to progress. In Monday’s crop progression report, as at 16 April, 8% of US maize plantings were complete, compared to 4% at the same point last season and up from the five-year average of 5%.

Soyabeans are largely grown in the northern parts of the US plains, though plantings in certain regions such as Kansas and Nebraska could be impacted by the extremely dry conditions. It is still early though for soyabean plantings, as on average over the past 5 years just 1% of plantings were complete at this point in the season. In Monday’s report, 4% of plantings were complete, also ahead of 1% completion at the same time last year.

Up to four inches of rain is forecast in northern parts of the US over the next week, which could delay both maize and soyabean plantings slightly, something to watch out for over the next few days. Much like wheat, the upcoming WASDE will also give us a first look at the US maize and soyabean picture for next season, and we could see some market movement as a result.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.