What’s driving GB cow prices?

Thursday, 18 May 2023

GB cull cow prices (like prime cattle) have remained in a record high position since the start of the year. We explore the key market drivers behind this.

Price review

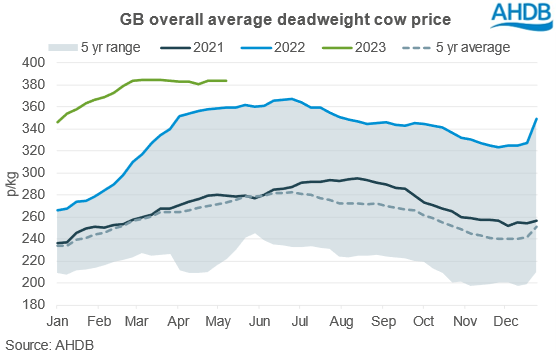

Average prices for cull cows have remained historically strong since the start of the year, with growth felt particularly in the first two months. The GB deadweight overall average cow price peaked at 384.3p/kg during the week ending 18 March, up 38p from the first reporting week of January.

However, since then average prices have stabilised, seeing little fluctuation with an average change of 3p/kg over 8 weeks. The week ending 22 April saw a dip to 380.9p, with prices bouncing back to 383.5p the following week. In the week ending 13 May, the measure averaged 384p/kg, up 24p year-on-year.

Slaughter

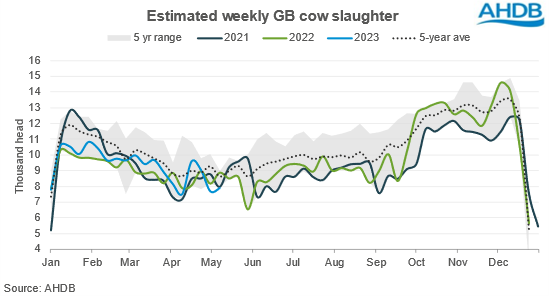

From a supply perspective, weekly estimated GB cow slaughter has largely run above year-ago levels for the year so far. Estimated kill stood at 177,300 head for the first 19 weeks of the year, up just over 3% from the same period in 2022. While cow kill remains elevated year-on-year, numbers have followed the seasonal trend, easing back compared to throughput seen pre-Christmas.

Where are these cows coming from?

What is particularly interesting is which herds these cows are coming from. BCMS data allows us to get an indication of cow slaughter by type (dairy/beef) by looking at slaughter of females over a certain age, for example thirty months (OTM) (although of course this will catch some older non-breeding animals). The annual split between OTM female slaughter of dairy and beef has remained relatively stable at around 58%/42% over the past few years, but in 2022 the proportion of beef females rose to 45%. This came as slaughter of beef females in 2022 rose by nearly 10% from 2021, while dairy kill remained relatively flat. For the year-to-date (January – March), this proportion adjusted further, with 57% of OTM females as dairy, and 43% as beef. However, some of this may be due to seasonality; typically in spring the proportion of cows culled as dairy does increase in comparison to the rest of the year.

Higher finished prices, plus maintained high input costs will likely be key aspects behind higher throughputs for the year to date. Continued cuts to milk prices may begin to pressure dairy systems, although it remains to be seen what impact that might have on production and cow numbers in the short term.

Domestic beef demand

Domestic retail demand for beef remained relatively firm in the 12 weeks ending 16 April (latest data period) compared to the same time period in 2022. Mince was a key driver, with volume sales up 1.5% year-on-year, according to our beef retail dashboards. This is due to increases in the frequency of shoppers purchasing mince compared to other beef products, as the average price per kg of beef has increased by 10.8% from the same period last year.

Of course, this data period falls short of the recent swathe of bank holidays and good weather, which should have supported demand for BBQ and processed beef items over recent weeks. Indeed, GB foodservice data for the 52 weeks to 19 March shows that burgers are a key driver of sales growth. Furthermore, more recent wholesale reports suggest that retail demand for VL items continues to be strong.

For more detailed retail price information, click here

Trade

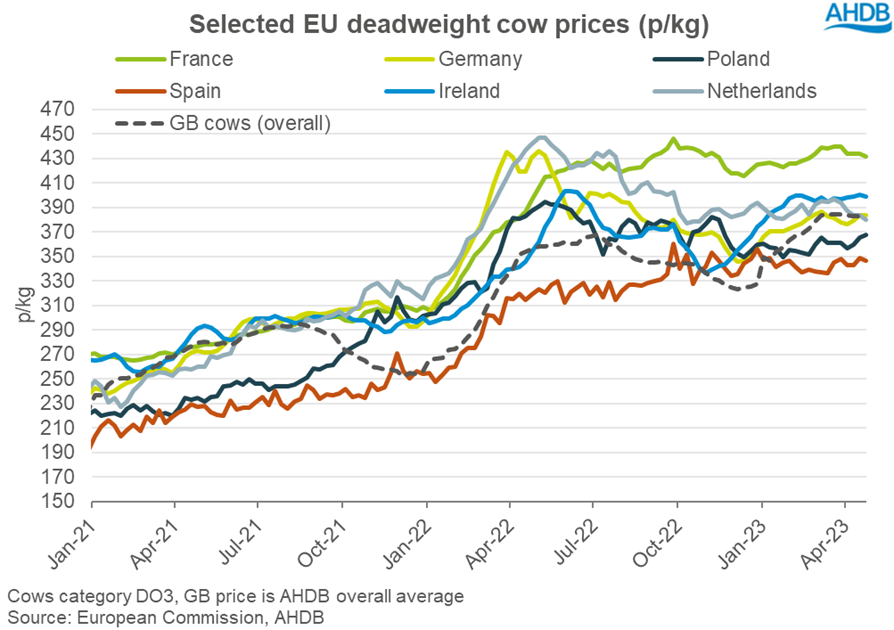

Across the EU, cow prices have generally remained firm since the start of the year. Tight cattle supplies stemming from contracting herds are likely offering support across key markets, with prices particularly strong in France and Ireland. UK beef exports to the EU have remained firm for the first three months of the year.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.