Input cost inflation easing but remains historically high

Thursday, 4 May 2023

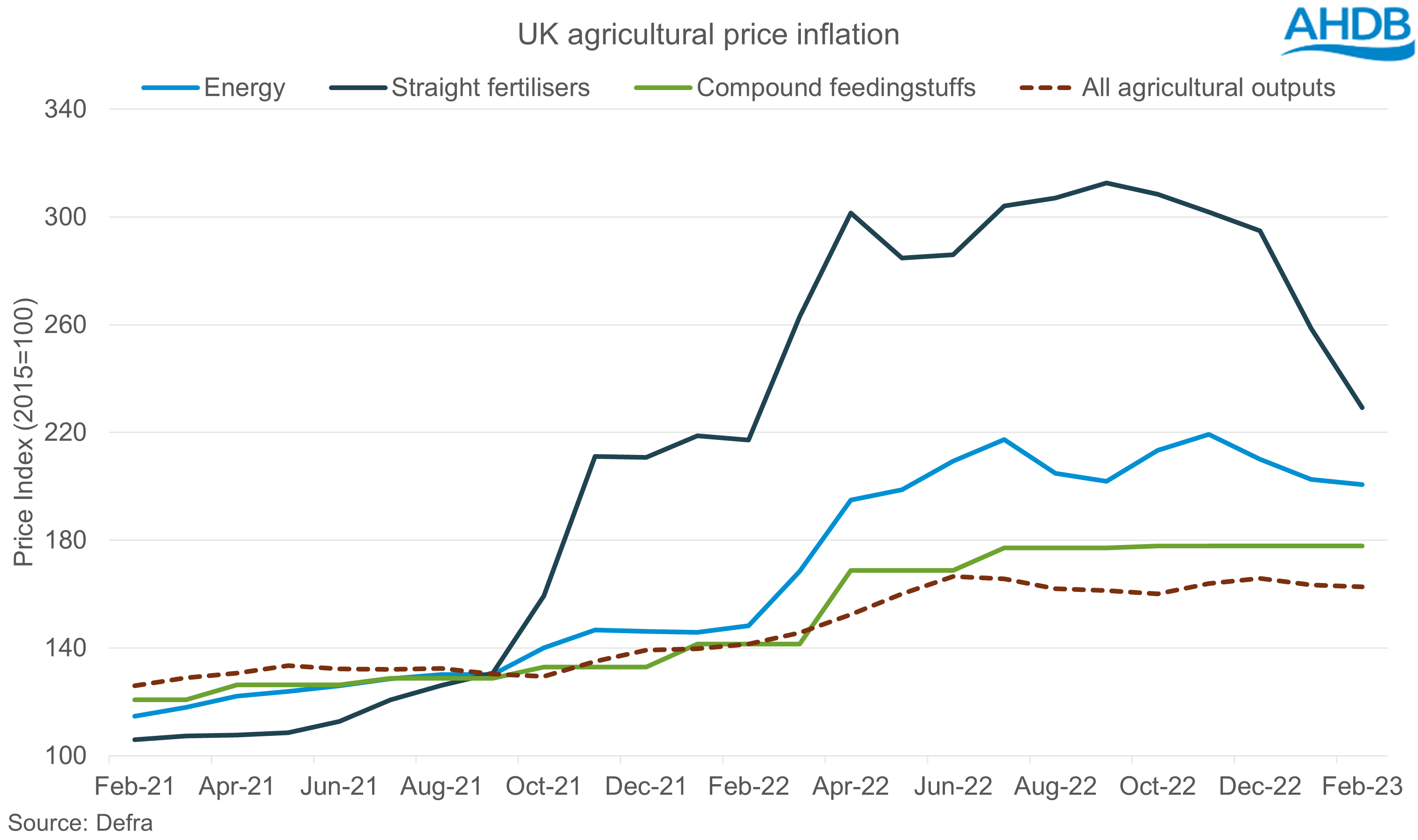

The latest Agricultural Price Index (API)[i] shows that the rate of inflation in prices paid for goods and services has eased since peaking in the Autumn. Although this will be welcome news to farmers, pressure on their margins still remains as price inflation continues to sit at historically high levels with the key inputs maintaining a higher rate of inflation than outputs. The extent to which inflationary pressure will impact individual farms will depend on their contracts and purchase requirements.

Fertiliser price inflation has seen the largest decline, falling 22% in the first 2 months of the year (Dec22 vs Feb23) and down 27% compared to the inflationary peak in September. Despite this, price inflation is up 6% on February last year and sits at a substantial 116% above the level from 2 years ago. We anticipate fertiliser price inflation to continue to ease in the short term as it follows the downwards movements seen in the natural gas market. In March average spot prices for UK produced ammonium nitrate declined by £166/t compared to the previous month, sitting below £500/t for the first time since summer 2021. For further insight into the fertiliser market read our cereals and oilseeds analysis.

Energy price inflation has eased but at a much slower rate, down 4% from the start of the year (Dec22 vs Feb23) and a 9% drop compared to November where inflation peaked as winter energy demand picked up. However, year on year there has been a 35% increase in energy price inflation. We would expect to see inflation to continue to ease as we leave the winter demand period, however with a cooler and wetter spring this year it is likely that energy demand has remained higher for longer. There is some government support with energy prices available to businesses with the Energy Bills Discount Scheme running until 31 March next year and a higher level of discount available to those who qualify as part of the Energy and Trade Intensive Industries (this includes dairy, meat, and fish processors).

Inflation for compound feeds has remained flat since peaking in the summer but sits 26% above the level from this time last year and is 47% higher than in 2021. Wheat futures markets are currently at a similar price point to February last year, before the Russian invasion of Ukraine. While short term volatility in grain markets is likely with the Black Sea Initiative nearing renewal, longer term fundamentals point to a less pressured price outlook, with ample global grain supply expected for next season. Find out more about the cereals and oilseeds outlooks in our recent Spring Grain Market Outlook.

[i] The Agricultural Price Index (API) reflects the change in the price farmers have paid for goods and services in relation to the base year of 2015.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: