What might Brexit mean for Europe’s sheep meat importers?

Tuesday, 9 July 2019

By Rebecca Wright

We have already considered how Brexit might affect the UK’s trade of sheep meat and how the UK largely exports carcases and imports leg cuts. But what about the other side of this trade, what might Brexit mean for Europe’s sheep meat importers?

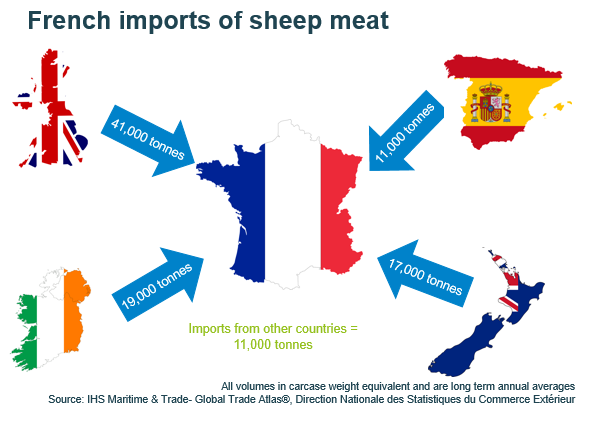

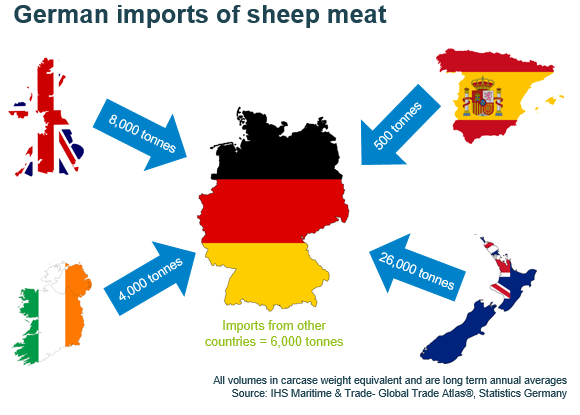

Other than the UK itself, France and Germany are the largest importers of sheep meat in the EU, importing significant amounts of sheep meat from both the UK and elsewhere. For the purposes of this analysis from here, we’ll use “EU” to mean the EU not including the UK.

The UK and New Zealand both supply significant quantities of sheep meat to the EU. After a no-deal Brexit, New Zealand could potentially switch some supply currently destined for the UK into the EU instead, the expectation being that prices in Europe would be higher, and prices in the UK would be lower. However, this opportunity might be limited by the available tariff free quotas, and by the difference in the type of cuts demanded in the EU and UK.

It has long been documented that the level of EU tariffs on out of quota sheep meat stops Australia from sending more. Officials from New Zealand have also said that once the existing quota has been spilt between the UK and EU they would find the tariff levels restrictive. The reason New Zealand and Australia consider the proposed tariff split restrictive, is because it would limit their ability to switch between the two markets.

Overall, after Brexit the EU market is likely to be short of sheep meat unless additional volumes outside of quota are imported or production within the EU increases. The latter would take some time. So, in the short term, while it is probable that the UK price would fall, the European price could be expected to rise, such that between them the EU’s external tariff on UK exports would be covered. It is not clear that the UK market would necessarily accommodate the full amount of the tariff entirely by itself. When we talk about sharing the tariff, we mean market prices adjusting; in practical terms, it is the importer that actually pays the tariff.

If New Zealand did not divert any shipment towards the EU, then EU production would need to increase by just over 20% to offset a complete stoppage on UK exports. If New Zealand did divert product away from the UK towards the EU, the likely shortage would mean EU production would need to increase by around 15%. Domestic production of sheep meat in both France and Germany is low, so Ireland, Spain and Romania are the likely countries which together, might eventually increase production enough to offset UK shipments.

Some sheep meat exports from the UK may continue after a no-deal Brexit, but at what price? Tariffs would be payable by the importer, which could potentially be passed back to the exporter through a lower purchase price. For example carcases, a key export product for the UK, attract a tariff of around £2.70/kg based upon 2018 data.

However, competition for supply may mean European importers cannot pass the full tariff back to UK sellers. The global market for lamb is tight at the moment, with supplies constrained in both New Zealand and Australia, and China on the lookout for more imported protein in the wake of its African Swine Fever problems.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.