Arable Market Report - 30 June 2025

Monday, 30 June 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

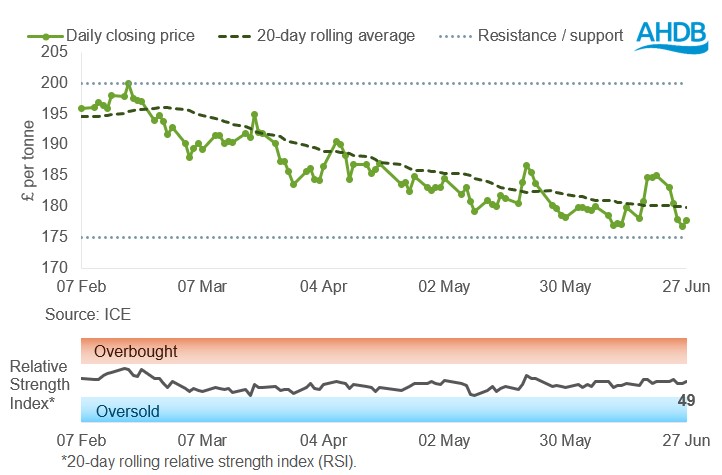

UK feed wheat futures (Nov-25)

UK feed wheat futures fell last week (Friday to Friday), crossing below the 20-day moving average and approaching the strong support level of £175/t once again.

Find out more about the graphs in this report and how to use them here.

Market drivers

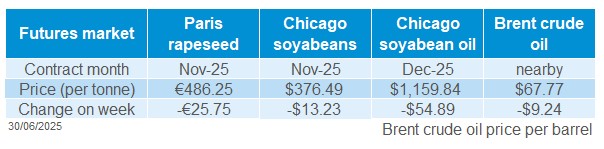

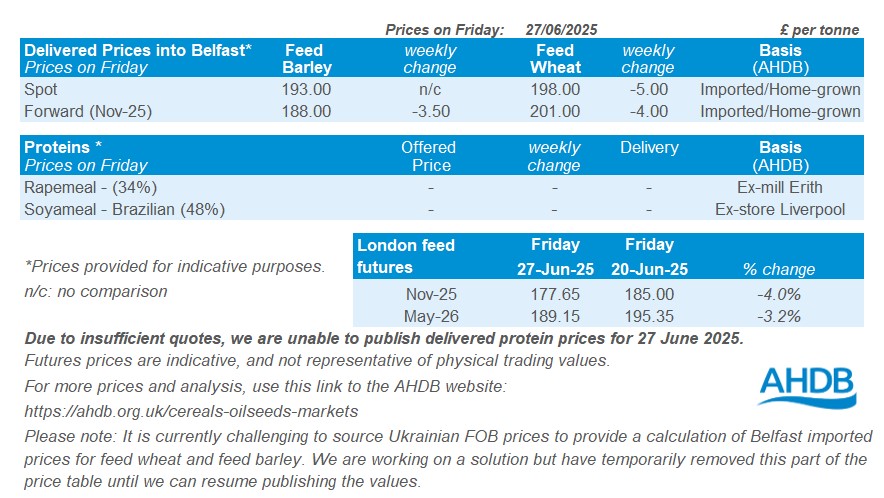

UK feed wheat futures (Nov-25) decreased last week (20–27 June), falling by £7.35/t (4.0%), to close at £177.65/t on Friday. Chicago wheat and Paris milling wheat futures (Dec-25) fell by 7.1% and 5.2% respectively.

Global wheat futures are under pressure due to the harvesting progression in the Northern Hemisphere and low export activity, particularly in the US. Also, speculative traders in Chicago wheat futures reduced their net short positions in the week ending 24 June, helping reduce the pressure on Chicago prices. An additional factor putting pressure on Paris futures was the stronger euro against the US dollar.

In a monthly update, the International Grains Council increased the global wheat production forecast by 2.3 Mt to 807.9 Mt. Conversely, maize production was decreased by 1.1 Mt. The increase in wheat production largely reflects higher production in India and Romania, while the forecast for maize production fell due to lower estimates for production in Ukraine.

Last Monday, the European crop monitor MARS increased its yield forecasts for wheat and barley in the EU by 1% and 2%, respectively, compared to the previous month, while leaving its maize estimates unchanged. This is putting pressure on the European wheat market, which is also weighing on the UK domestic market.

Last week, there was a lot of information about wheat crop prospects for the Black Sea region in 2025. A production estimate for Ukraine was decreased due to unfavourable weather conditions, while the production forecasts in Romania, Bulgaria and Russia improved.

According to StatsCan, the area of Canadian wheat in 2025 is 1.0% higher than the 2024 figures, while the area of barley fell by 4.2%. However, the area of wheat in 2025 is less than farmers had intended in March.

Brazil has approved increases in the percentages of ethanol and biodiesel blended into gasoline and diesel, from 27% to 30% and from 14% to 15% respectively. This is significant for maize, given the growing trend of using this crop to produce ethanol in Brazil.

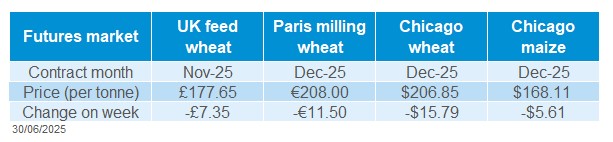

UK delivered cereal prices

Domestic delivered wheat prices moved down following declines in futures prices Thursday to Thursday. Bread wheat delivered into Northamptonshire in July 2025 was quoted at £198.00/t, down £5.00/t. Feed wheat for delivery to Yorkshire in November 2025 was quoted at £188.50/t, down £5.50/t.

Information about the 2026 crop feed wheat futures price can be found here.

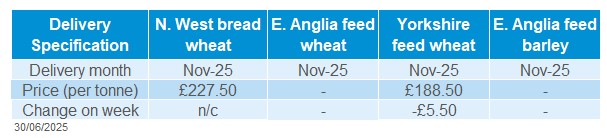

Rapeseed

Paris rapeseed futures in £/t (Nov-25)

Nov-25 Paris oilseed futures (in £/t) fell back last week and ended the week below the 20-day rolling average after holding above it for much of June. The relative strength index (RSI) level also dropped from 70 to 58.

Find out more about the graphs in this report and how to use them here.

Market drivers

Oilseeds markets fell back last week after a level of volatility midweek. The easing of geopolitical tensions reduced concerns over energy supply disruptions, prompted a parallel pullback in vegetable oil-linked commodities

Currency movements added another layer of pressure. The euro strengthened to $1.1719, its highest level since September 2021 (LSEG), reducing the competitiveness of euro-denominated oilseed exports and contributing to a correction in Paris rapeseed futures.

After reaching their highest level since July 2023 of €512.00/t on Friday 20 June, Paris rapeseed futures (Nov-25) prices retreated last week. Paris rapeseed futures (Nov-25) fell back €25.75/t (-5.0%) Friday – Friday, to close at €486.25/t. Chicago soybean oil futures (Dec-25) fell 4.5% over the same period, with Winnipeg canola (Nov-25) decreasing 6.7%. Nearby Brent crude oil futures fell 12.0% last week to $67.77/barrel.

In the US, warm, consistent rainfall and moderate temperatures across key US Midwest states have supported crop emergence. This is bolstering expectations for soyabean and maize yields.

In Canada, StatsCan estimated the 2025 canola (rapeseed) planted area at 8.7 Mha, a 2.5% decline from last year. The soyabean area has risen to 2.3 Mha, up 0.5% year-on-year. While the areas came as traders expected, an upwards revision in last year’s canola production number was unexpected. Indicating healthier stocks, production for 2024 was revised to 19.2 Mt, an increase of 7.9% on the previous figure.

Ukraine’s rapeseed production is forecast at 2.9 Mt by private analysts, down from 3.7 Mt in 2024, while soybean output is expected to fall 0.4 Mt year-on-year to 6.1 Mt.

Policy developments in Brazil and the US look set to underpin demand for soybean oil. Brazil’s National Energy Policy Council (CNPE) approved an increase in the biodiesel blending mandate from B14 to B15, starting August 2025. The US announced higher biodiesel blending targets earlier in June.

Attention now turns to today’s USDA reports on the US crop conditions, crop areas and stocks, which will influence the market in the week ahead.

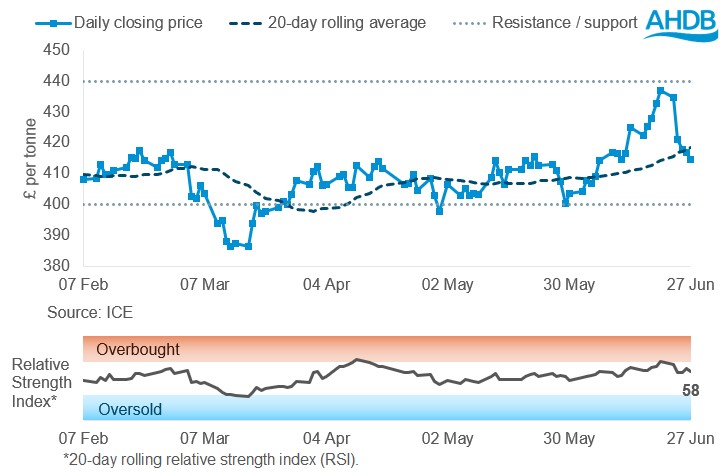

UK delivered rapeseed prices

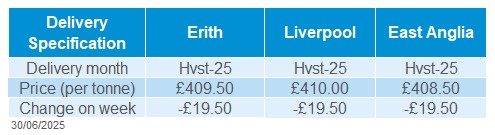

Rapeseed to be delivered into Erith at harvest was quoted at £409.50/t down £19.50/t from the previous week. Liverpool at harvest was quoted at £410.00/t also down £19.50/t on the previous week. Domestic rapeseed followed Paris rapeseed prices lower.

Extra information

AHDB’s Harvest Toolkit includes a wealth of information such as on pre-harvest glyphosate use, the decision to incorporate or sell straw, good sampling practice, grain storage and much more.

Cereal usage data is to be released this week (3 July) covering UK human and industrial usage as well as GB animal feed production.

AHDB released analysis on UK Total Income from Farming (TIFF) in 2024, which increased by 26% year on year, but it was a mixed picture across the sectors.

Norhtern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.