Why do Paris grain prices matter for UK feed wheat? Grain market daily

Thursday, 26 June 2025

Market commentary

- Nov-25 UK feed wheat futures fell £2.70/t (1.5%) yesterday to close at £177.85/t. The May-26 contract fell £1.80/t over the same period, to close at £189.50/t. Yesterday, sterling reached its highest level against the US dollar since January 2022, with £1 = $1.3636 (LSEG)

- Chicago wheat and Paris milling wheat futures (Dec-25) decreased by 1.4% and 0.8% respectively. Global wheat futures are under pressure due to the improving weather forecast in the US, harvesting progression in the Northern Hemisphere and a decrease in crude oil prices. The decrease in crude oil prices results from eased concerns in the Middle East. An additional factor putting pressure on Paris futures was the stronger euro against the US dollar for four trading days in a row

- Nov-25 Paris rapeseed futures fell €3.75/t to €490.25/t. Soyabean, soyabean oil and soyabean meal futures in Chicago were lower at yesterday’s close. However, Winnipeg canola futures for November 2025 increased by 1.2%

Why do Paris grain prices matter for UK feed wheat?

Due to increased wheat and maize imports in the current season, the domestic market is even more influenced by changing global trends.

Consequently, UK farmers should pay closer attention to global markets, particularly the Paris grain market. In addition, from July to April of this season, the UK imported 77% of its wheat and 48% of its maize from EU countries.

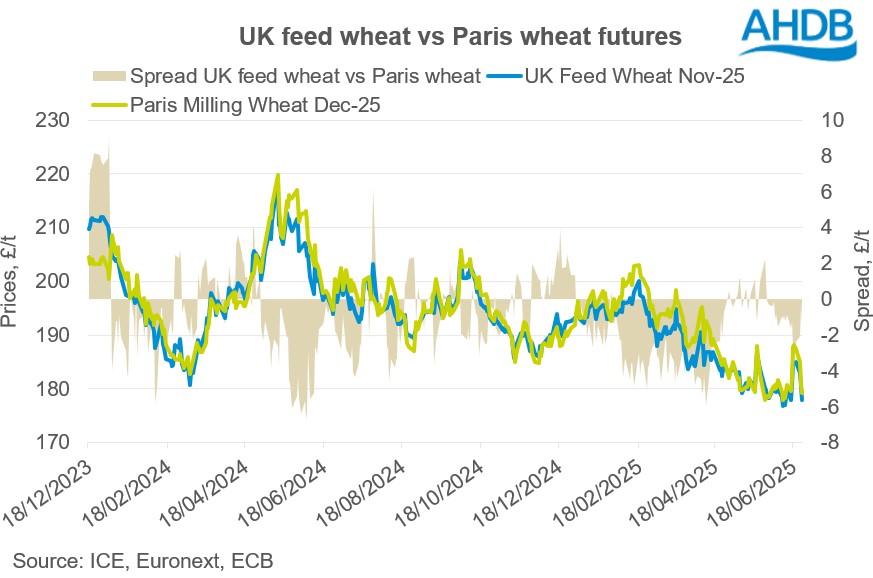

In general, the price of domestic feed wheat futures tends to follow those of Paris milling wheat, though the relationship does vary. From December 2023 till now, the price difference between Nov-25 UK feed wheat futures and Dec-25 Paris milling wheat was in a range of +£9.00/t to -£6.70/t.

Checking this information could be a useful additional tool for farmers when making decisions about selling wheat.

In periods when the UK has larger exports to Europe, UK feed wheat futures tend to be around £15/t or more below Paris milling wheat futures. However, when UK feed wheat futures are near the same level as, or even above, Paris milling wheat futures, it increases the attractiveness of imports into the UK.

Yesterday, Nov-25 UK feed wheat futures were £1.41/t below Dec-25 Paris milling wheat, reflecting uncertainty over UK yields this year due to the dry spring. A year ago, UK Nov-24 futures were £0.53/t above Dec-25 Paris wheat futures.

While a small improvement from a year ago, if the current price relationship persists, it could encourage import levels to remain above historical averages into the 2025/26 season.

However, import volumes will also be influenced by factors such as the size and quality of the crops in Europe and the UK, currency fluctuations, as well as other factors.

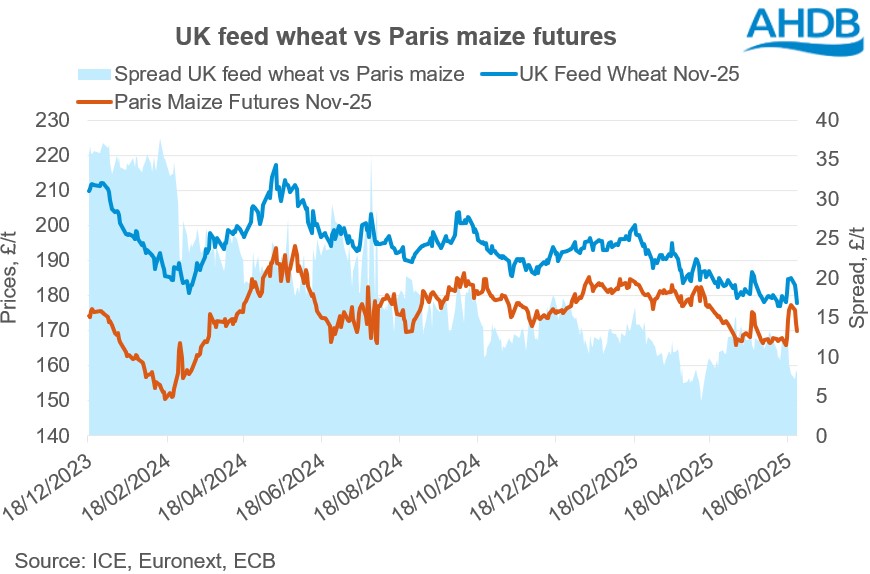

Meanwhile, since the start of 2024, the spread between UK feed wheat futures and Paris maize futures has been generally decreasing. It reached a low level of + £8/t earlier this week, the highest level was +£37/t at the end of 2023.

This makes UK feed wheat futures more competitive against Paris maize futures and could reduce the incentive to import French or potentially EU maize in 2025/26. However, with more maize coming form outside the EU, these relationships will also need to be monitored.

Looking ahead

The EU wheat balance for the 2025 crop and the weather forecast for Europe will soon become very important.

On Monday, the European crop monitor Mars increased its yield forecasts for wheat and barley in Europe by 1% and 2%, respectively, compared to the previous month, while leaving its maize estimates unchanged. This is putting pressure on the European wheat market and as a result on the UK domestic market.

In the case of UK feed wheat futures, the price difference against Paris milling wheat and maize futures will be influenced by currency movements and the size of the UK crops. AHDB’s final crop development of the growing season will be released tomorrow and will offer more insights into yield potential.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.