Prices supported by crude oil and weather worries: Grain market daily

Friday, 20 June 2025

Market commentary

- Nov-25 UK feed wheat futures closed unchanged at £184.75/t yesterday after reaching the highest level since 22 May on Wednesday. The May-26 contract gained £0.10/t from Wednesday to close at £195.10/t.

- European wheat and maize futures remained supported, though the US markets were closed for the Juneteenth holiday yesterday. Concerns over the Middle East, the impact of heavy rain in the US and dry weather in Russia and France were said to be factors.

- The situation in the Middle East is also supporting agricultural markets. Nearby Brent crude oil futures are at the highest level since 11 February, closing at $76.70/barrel yesterday.

- Nov-25 Paris rapeseed futures lifted further above the key threshold of €500.00/t yesterday, supported by ongoing strength in crude oil markets. The Nov-25 contract gained €6.50/t yesterday to close at €506.75/t, equating to just under £433.00/t.

Prices supported by crude oil and weather worries

Increases in crude oil prices, alongside crop concerns and short covering by speculative traders, have supported grain and oilseed prices this week.

So, what’s the situation for some of the top producers?

In the US, heavy rain has delayed the winter wheat harvest, while spring wheat crops have improved after a dry start. On Monday night the USDA showed the winter wheat harvest at 10% complete, behind the five-year average of 16% complete. But conditions continue to look generally positive for maize and soyabean crops with planting almost complete.

Limited rainfall is also a concern in Canada. Planting is complete in the top grain and canola (rapeseed) growing province, Saskatchewan, but the forecast rain is much needed to support crop development. The provincial government reported yesterday that 59% of cropland soils are short or very short of moisture.

In France, ongoing dry weather has meant declines in crop condition scores. This morning FranceAgriMer reported small drops in the amount of winter barley and common wheat in good or very good condition, as the winter barley harvest gets underway. However, for spring barley, the proportion in good or very good condition fell from 71% to 67% over the week to 16 June.

Russia remains in focus after a challenging growing season and drought across some of the main winter wheat growing areas. Earlier this month, private forecaster SovEcon pegged the crop at 82.8 Mt. However, the government currently forecasts the 2025 crop at 90.0 Mt, up from last year’s 82.6 Mt (LSEG).

Harvest is underway in southern Ukraine, which has also felt the effects of dry weather. The farm ministry expects a wheat crop of 20.0 – 22.0 Mt, compared to almost 23.0 Mt in 2024 (LSEG).

Risk of harvest pressure?

As harvests gather pace across the Northern Hemisphere, harvest pressure remains a risk. Seasonal dips in grain prices can often occur in late June and into July due to harvest pressure, unless crop issues or other concerns offer support.

This year the situation in the Middle East may help offset some of this pressure, though the situation is still evolving.

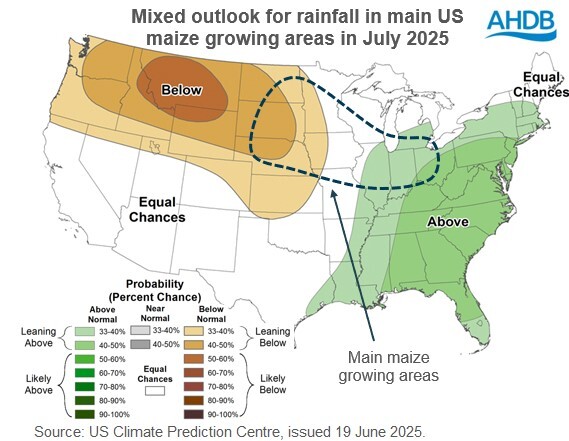

Harvest results and weather conditions for the developing US maize crop are also areas to watch. As the long-range weather outlook shows mixed conditions for US maize in the crucial month of July and with greater uncertainty over yields in the Black Sea, it’s important to keep monitoring markets.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.