Spotlight on 2026 wheat prices: Grain market daily

Tuesday, 24 June 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £183.00/t yesterday, down £2.00/t (-1.1%) from Friday’s close. The May-26 contract fell £2.00/t (-1.0%) over the same period, to settle at £193.35/t.

- Domestic wheat prices tracked global market trends, with harvest pressure in the US weighing on prices. The USDA reported that the US winter wheat harvest was 19% complete as at 22 June, up from 10% the previous week. However, progress remains behind last year (38%) and the five-year average (28%) for the same date. Dec-25 Chicago wheat and Paris milling wheat futures lost 2.2% and 1.6%, respectively.

- Paris rapeseed futures (Nov-25) closed yesterday at €507.25/t, down €4.75/t from Friday’s close. The decline reflects a broader weakening across the oilseeds complex, driven by news of the potential easing of tensions in the Middle East. Nearby Brent crude oil futures dropped by 7.2%, while Nov-25 Chicago soyabean futures fell by 1.3%.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Spotlight on 2026 wheat prices

Wheat prices climbed to a one-month high last week, supported by short covering, weather concerns, and expectations of tighter ending stocks.

With 2026 cropping decisions underway, keeping up to date with market movements is key to making sound decisions. Following our recent update on oilseed rape prices, we are now turning our attention to wheat.

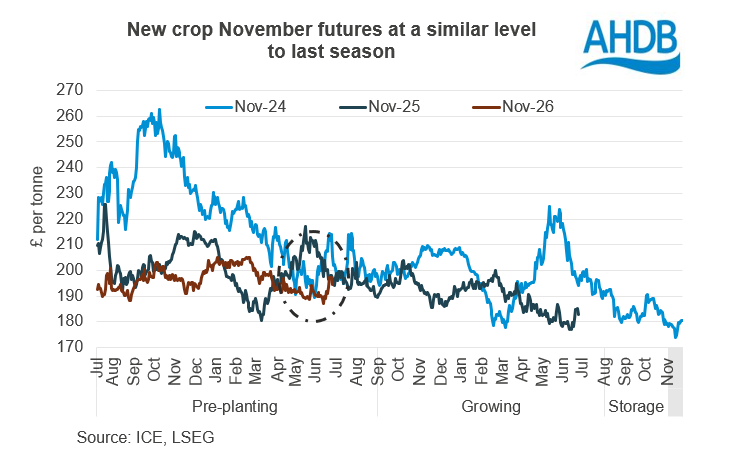

While most trading activity at this point in the season centres around the Nov-25 wheat futures contract, it is worth keeping an eye on Nov-26 futures as you finalise your new season drilling plans.

Nov-26 UK feed wheat futures update

Nov-26 UK feed wheat futures closed at £194.45/t yesterday, up £3.45/t on the previous week (16 June). However, this remains £10.75/t below the levels seen at the start of the year. Notably, the current price is just £0.55/t lower than where Nov-25 futures stood at the same point last year (24 June 2024).

At present, Nov-26 futures are trading £11.45/t above Nov-25, reflecting the expectations of a larger wheat area this year. Forecasts of increased global wheat production in 2025 (USDA) are also being factored into the market.

What could influence the 2026 price?

Prices for the 2026 wheat crop are likely to change over the coming months, with both global and domestic prospects playing their part.

Weather will be a major driver, particularly in key wheat-growing regions throughout the autumn drilling period in the northern hemisphere. Poor conditions or delays to autumn 2025 drilling could reduce supply expectations for the 2026 harvest, potentially supporting prices. Equally, larger than anticipated planted areas and ideal conditions could pressure prices longer term.

Energy and fertiliser prices are still high and remain a watchpoint due to ongoing tensions in the Middle East. With farm margins already under pressure, a further rise in input costs could also affect planting decisions.

Summary

As always, keeping a close eye on the market can help you make more informed decisions and manage risk effectively. We will continue to provide updates as Nov-26 wheat prices evolve.

In the meantime, AHDB offers a range of tools to support your planning. Farmbench is an online benchmarking tool that allows farms to compare themselves to similar businesses and identify areas where efficiency and profit can be improved within different crops. The Nitrogen Fertiliser Calculator and Nutrient Management Guide (RB209) are also available to support managing inputs effectively.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.